The Argentine country risk fell sharply in the week and this Friday, February 16, it was lows in almost 22 monthsdriven the bullish rally of the sovereign bonds in dollarsthat They extended their strong advances, and reached their highest prices since October 2020, shortly after these restructured securities were listed on the secondary market during the presidency of Alberto Fernández.

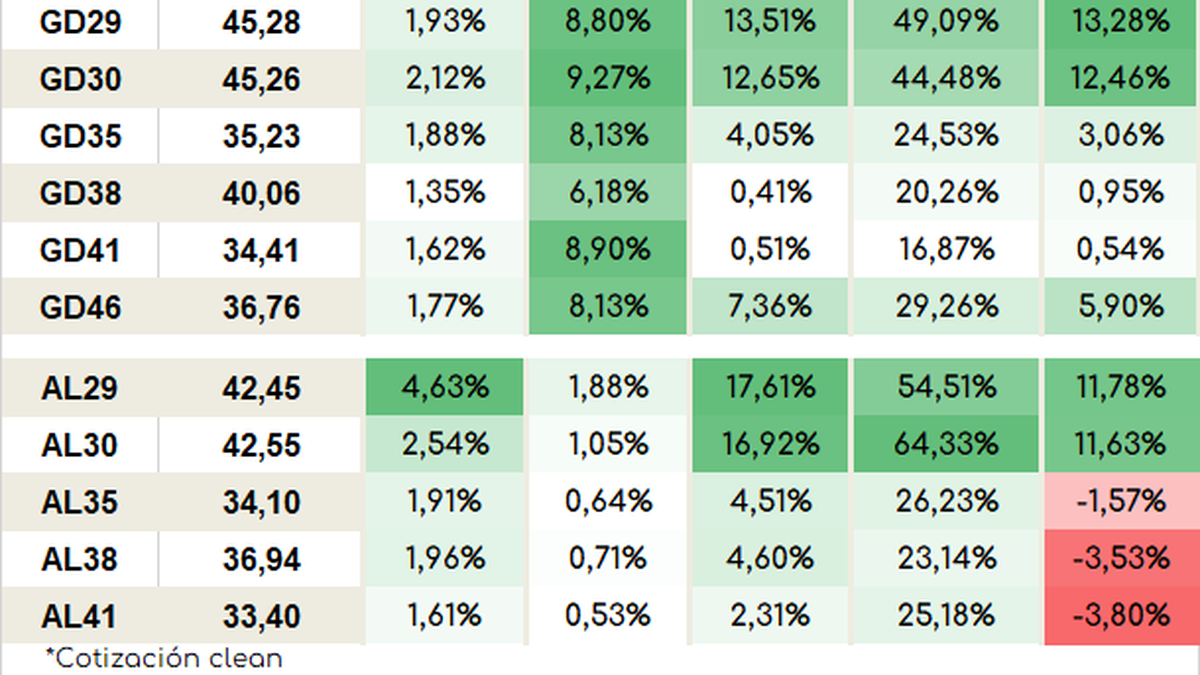

In this way, the bonds in hard currency recorded increases of up to 4.6% in New York, hand in hand of the Bonar 2029 or AL29 and the Bonar 2030 or AL30 (+2.5%). Throughout the week, they recorded increases of up to 9.3% (GD30) In U.S.A.

dollar bonds at 16-2.png

Source: Aurúm Valores

Consequently, the risk country -which measures the differential in the return rates of US Treasury bonds with respect to their emerging peers- fell 2.7% this Fridayor 50 points, and drilled the 1,800 points, up to the 1,788, minimums from May 5, 2022 (1,783 points). But in the week, it accumulated a decline of 10.3%.

So, moved even further away from 2,000 pointskey limit that was about to reach in the last daysbehind the failure of the omnibus law in it Congress.

A report by GMA Capital described that “despite the legislative setback due to the Bases Law, there is a vote of confidence on the part of investors. To affirm this we base ourselves on the state of grace of the peso – the ‘counted with liquid’ – is the lowest in terms real in four years – and in the strength of dollar bonds, especially GD30, which reached its highest valuation since the restructuring”.

“Sovereign debt in dollars increased the solidity with which they started the week in the local market after the Carnival holidays. Once again the Globals remained on the rise throughout the last round, notably widening their prices,” The analysts from Portfolio Personal Inversiones pointed out.

“The international context improved as the days went by, although it does not fully explain the impressive rebound that Argentine dollar debt had. Although it is expected that the reactions in high beta assets such as Argentine securities will be more pronounced, we think which is not the only factor that drives the prices of Creole bonds”, evaluated from Personal Portfolio.

“Although the context was optimistic, the performance of the Globals stood out above the rest. Certain points at the local level we think favored the notable escalation of the debt in dollars. Beyond the legislative stumble that the reversal of the Omnibus Law meant, “We believe that the dollar debt segment incorporated the positive signals of recent days”detailed from GMA Capital.

And they added: “In this sense, the relatively low inflation in January, the good fiscal outlook in January, the accumulation of dollars by the Central Bank and the weekend rains in the core zone, which came at a critical time for corn and soybeans, “These are factors that could have positive influences on the prices of Argentine assets.”

“However, we understand that this market support is a necessary condition to avoid new nominal turbulence and oil the engine to stabilize, but never sufficient. The greatest merit of the management seems to have been to avoid with some success a spiralization process,” they maintained.

The keys to this small triumph? “The change in fiscal regime – objective of financial balance – monetary – zero Treasury financing and absorption of pesos via Bopreal) and exchange regime – discreet jump and accumulation of foreign currency with stocks – acted as a temporary anchor. In addition, the drop in activity (‘early’ indicators for January indicate collapses of between 20% and 30% in key sectors of industry and construction – and the fall in real wages collaborated to mitigate the pass through of the devaluation to prices,” they indicated.

Meanwhile, a report from the IEB Group (Investing in the Stock Market) provided that “among the drivers that explain the rise we can mention the inflation data that shows a slowdown, the recomposition of reserves and mainly the fiscal data for January which, according to the statements of the Minister of Economy and the first data from the Budget Office of the Congress, they look very encouraging.”

Bonds in pesos: how much they closed at this February 16

For their part, the CER titleswhich became attractive again after the January inflation dataoperated again with important advances, up to 8.8%headed by DIP0 (+8.8%), the PR13 (+4.9%), and the PAP0 (+23%).

On the contrary, the bonds dollar linked they collapsed until 5.8%with casualties led by T2V4. Meanwhile, the TV24 fell 1.6%.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.