Therefore, doubt arises among investors about whether this trend will continue in 2024, in which case, it would be a good option to maintain the current strategy, or if it is advisable is to turn towards “small caps” or explore new alternatives. The second option would be to not be so exposed and taking into account that important players, such as Warren Buffett, Bill Gates, and Jeff Bezos, They are selling papers of the seven magnificentwhich, at least, should be a sign.

In a historic milestone, the S&P 500 reached 5,000 points for the first time thanks to the boost provided by some notable companies within the composite of the 500 largest companies in the US. Specifically, Nvidia and Meta led this riseregistering higher increases at 30% each one so far this year.

Panorama for Big tech: some clues and doubts

In a report sent to clients over the weekend, the financial advisor, Gaston Lentinistates that in 2024, there is an environment of economic uncertainty, with some expectations of lower growth and “concerns about the possibility of a resurgence of inflation”, similar to the 1970s in the US or even compared to the Great Depression from 1928-1929.

“A significant correlation of 0.94 is noted between the current situation of the S&P500 and the aforementioned historical crisis“, says the document. Of course It cannot be said that the outcome will be identical.so Lentini reiterates the importance of being alert to sudden falls, “especially in companies that are at or near their peaks“, as happened with teslawhich experienced a 33% loss in less than a month.

markets-wall-street-shares-stock-markets-investments-finance

Reuters

The document highlights the greedy market trend in the US which contrasts with the massive sale of shares by large investors, suggesting some caution. Sales of Bezos and Gates in shares of their respective companies and, of Buffet, tooSo he sold shares of Manzanaa company that has been an integral part of their portfolio for decades.

“Just as companies buy back their own shares when they consider that the price is low, at least I, if I were the owner of a listed company and I think the shares are expensive, I would sell some“, Lentini slides.

Is it worth continuing buying the magnificent seven?

“Although large technology companies have notably surpassed other companies in the market, this trend goes hand in hand with better performance in your profits”, he explains in statements to Scope Martin PrzybylskiPortfolio Manager Consultatio Financial Services.

And he adds that this increase in earnings per share (EPS) has prevented a decline in the index in the last year. These companies not only exhibit net margins that are double those of others in the S&P 500“but they are also expected to experience revenue growth in 2024, which is four times greater than the average of the rest of the companies in the index,” says Przybylski.

The analyst adds that, in addition, these Big Techs are immersed “in a sector that is experiencing the greatest technological disruptions of the last decade”, such as the growth of the cloud and artificial intelligencewhose first stages are barely being glimpsed, so it may be a sector that still has a lot of potential to give and profits ahead.

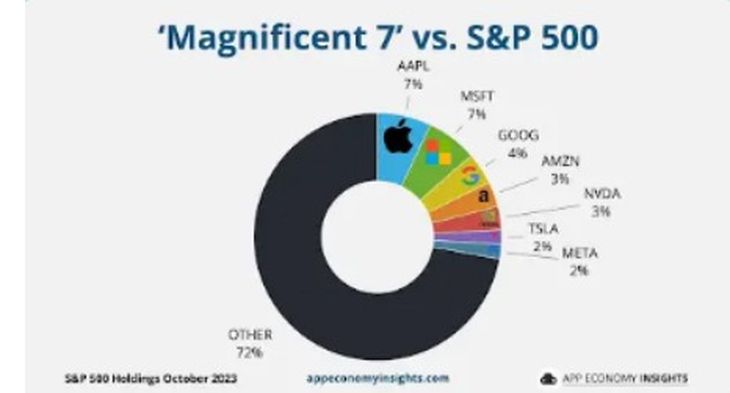

For its part, Federico Victorioco-founder of Andean Investments (IA), explains to this medium that by 2024, the suggestion is to be “somewhat more cautious in terms of adding exposure to Big Tech”. This is because “many of his valuations remained high.” In fact, in 2023, The tech sector was responsible for pushing up the American indicessince they represent almost 30% of the total marketcap of the S&P500.

“In this context of high valuations, We prioritize prudence to add exposure to this sector”Warns Victorio. In a long-term perspective, the AI analyst recommends investing in big names like Microsoft, Google, Meta or Mercado Libreyes indeed, “maintaining a prudent percentage in the portfolio”.

However, in a current tactical analysis, from Andean Investments strategically weigh sectors “value”, “small caps” and, for more daring profiles, sectors “emerging“. “In these assets, we observe attractive valuations and a relationship risk/benefit interesting for our 2024 portfolios,” says Victorio.

Big tech, a bubble in sight?

Let us remember that the “dotcom” bubble refers to the period from 1997 to 2000., characterized by a notable increase in the economic values of companies linked to the Internet. This excessive growth led to an economic bubble that resulted in the bankruptcy of numerous firms.

When asked about it, Przybylski from Consultatio maintains that the situation “It only seems that there is a very high concentration in a few companies (the magnificent 7) that make up about 30% of the S&P 500 index, as was also the case in the 2000s.

However, he explains that the valuations at that time were not only much higher, but also today “Sales growth is expected to be much higher than what occurred in those years among the largest companies.”, so when one adjusts those multiples for the expected earnings growth, “the difference with the time of dotcom It is even greater.”

WhatsApp Image 2024-02-19 at 10.58.47 (1).jpeg

Graphic courtesy of Inversiones Andinas (IA).

Victorio concludes that, in relation to similarities with the dotcom bubble, “if we look at it strictly by valuation, You could say that we see some similar ratios”. However, he warns that It is not that they project a panorama of a “catastrophic” crisis in this regard.. But it indicates that we must be cautious and, in that sense, leans more toward fixed income, progressively adding some risk to portfolios. This is because the broker maintains a criterion of prudence with the equity in generalat least until the second semester, where there is more certainty about interest rates.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.