The disturbing trend of loss of competitiveness of the official dollarwhich was consolidated last December after a significant devaluation, continues to generate concern in financial circles. The persistent monthly inflation rate, remaining above 20%, emerges as the key factor that could propel the currency to take a new leap to avoid being left behind.

Thus, market sources indicated Ambit that the exchange rate anchor could last longer than initially believed. In that sense, “the projected positive scenario does not imply a new jump in the exchange rate, but simply an acceleration of the crawling peg”. This acceleration does not seem to be abrupt either, but gradual, and finally they maintain that they do not see a scenario of “elimination of the gap by the end of the year” possible even in the most positive scenario, but rather a low gap (20%).

Thus, the most recent international survey, which consulted both local and foreign economists, revealed the most negative forecasts that suggest that the exchange rate could quadruple before the end of the year.

The outlook, more gloomy than positive, of the 40 analysts surveyed by FocusEconomics indicate that the official wholesale dollar could reach $3,635 by the end of Decemberthus representing a devaluation of 350% throughout 2024, starting from the current price close to $835.

This forecast would even exceed the inflation projected by the economists surveyed, who estimate an increase in the consumer price index (CPI) of 296.9% throughout the year.

Does the city believe Caputo?

Despite the statements of the Minister of Economy, Luis Caputowhich denies a new devaluation on the horizon, city analysts maintain that the price of the wholesale dollar has prospects of increasing, in line with other economic variables.

Thus, the most pessimistic projections are from the consulting firm Labor Capital & Growth (LCG) which anticipates a value of $3,635 by the end of the year, attributing this to an inflationary inertia that could last until March.

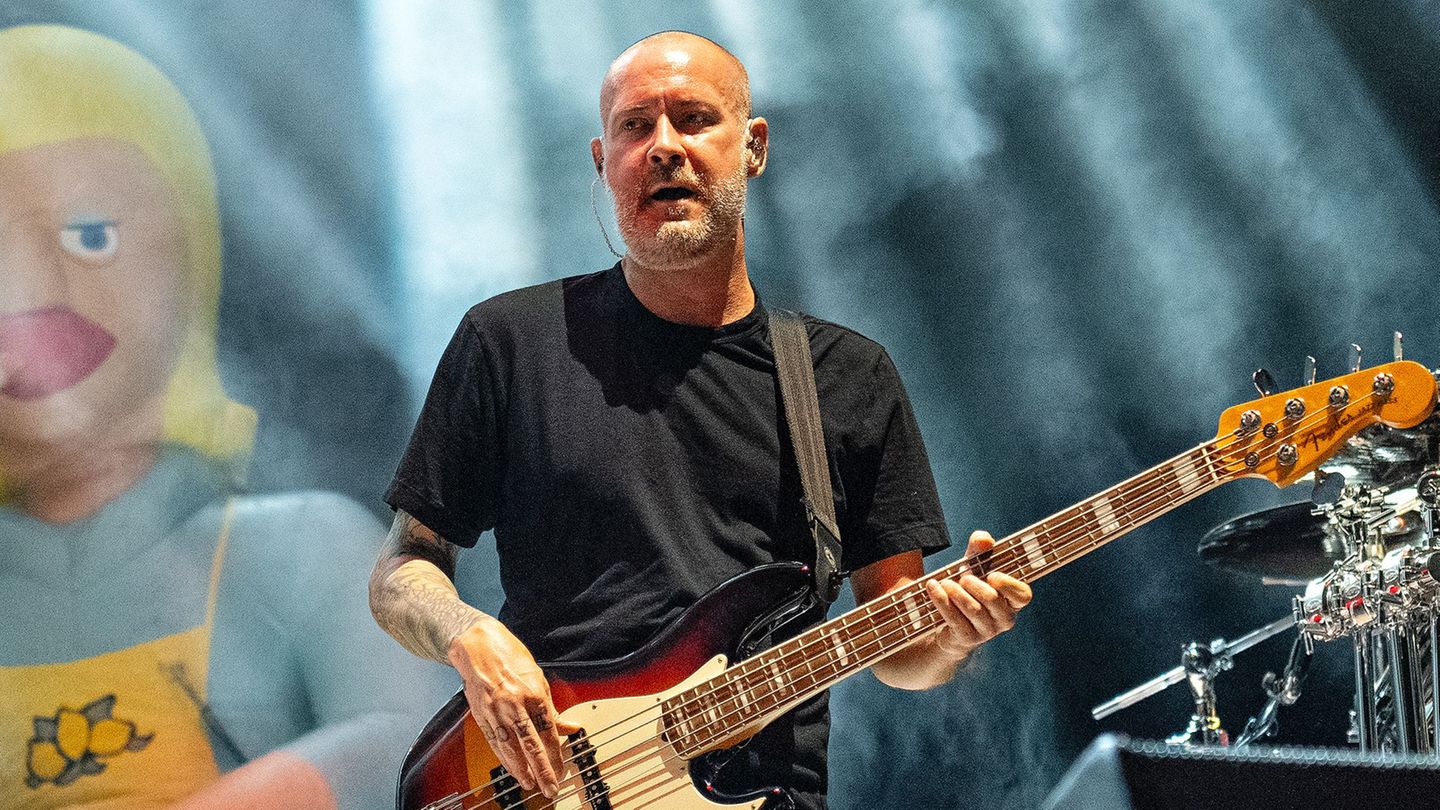

dollar-markets-dollar-finance-investments

City analysts maintain that the price of the wholesale dollar has prospects of increasing.

Depositphotos

Other negative projections come from consulting firms such as Balance ($3,000), Econviews ($2,803) and Analytica Consulting ($2,388); Fitch and Ratings ($2,375); Orlando J. Ferreres & Associates ($2,255); VDC Consultora ($2,235) and S&P Global Ratings ($2,100).

Analysts’ attention remains focused on the high inflation since December, with the concern that this price increase could impact the price of the official dollar. According to LCG, the real exchange rate is still a 40% above last December’s valueand a continuity in the inflationary escalation could affect exchange competitiveness in a short time.

What do dollar futures say?

In the futures market Matba-Rofex a wholesale dollar is negotiated $846 by the end of February, 1.4% higher than today. For March, it is projected a value of $881, indicating a devaluation of 4.2%. The most optimistic projections suggest an official wholesale dollar of $1,750 by the end of December, half of the most alarmist projections.

In this way, it could be interpreted that the market dynamics support a certain increase in the rate of devaluation, exceeding the current 2% monthly. However, An abrupt jump in the exchange rate of the same magnitude as that which occurred in December 2023 is not anticipated.

This diagnosis gains strength when taking into account the president’s words Javier Milei, who revealed the possibility of eliminating the dollar stocks in June of this year, marking a preliminary step towards dollarization. “Estimates from the International Monetary Fund suggest that we can lift the restrictions in the middle of the year,” he said.

Despite these predictions, more negative forecasts highlight the possibility of a less favorable scenario, such as the lack of control of inflation within the period stipulated by the Government. Consequently, the market remains alert to possible changes in economic variables that could influence the price of the dollar.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.