The initiative has the support of more than 60 fintech companies in Argentina that operate as virtual wallets, both for fiat and crypto money, as well as stock exchange and digital credit companies.

The Cybersecurity Group of the Argentine Fintech Chamber launched this Thursday a Manual of advice and good practices to reinforce the security of financial Apps, avoid falling into scams and how to act in case of loss or theft of the devices on which they were downloaded.

The content you want to access is exclusive to subscribers.

The initiative has the support of more than 60 fintech companies from Argentina that operate as virtual wallets, both fiat and crypto money, as well as stock exchange and digital credit companies. Companies linked to the payment processing sector and the provision of infrastructure and financial technology also added their support.

These are: Action Fintech, Afluenta, Agropago, AL2, Allaria +, AquiCobro, AREX, ArgenBTC, Bamba, Banza, Belo, Bind Pagos, Bitso, Buenbit, Bull Market Brokers, Bullpay, Cardcred, Cencopay, Claro Pay, Cobro Immediato, Cocos, Credencial Payments, Credicuotas, CryptoMarket, Decrypto, ePagos, Fertil Finanzas, Fiserv, Front, Global Processing, Helipagos, InvertirOnline, Ixpandit, Khipu, Koibanx, Koywe, Lemon, Lyra, Max Capital, Mercado Pago, Miiii, Mins, Mobbex , MODO, Moni, Movil Cash, N1U, Naranja Team Quality, Totalcoin, Ualá and Via Pago.

“This work is a reflection that the fintech industry as a whole has as a priority lto the safety of its users, and aims to be of help to you when reinforce preventive measures on your devices and alert them to actions criminals use to steal money or sensitive data,” the report explained.

Financial apps: how to reduce the risks in accessing the app and safeguarding passwords

– Use security key or biometrics to block strangers from accessing the device

– Activate two-factor authentication. If possible, an option other than SMS and, if there is no option, do not share the key tokens received.

– Use password recovery options that do not depend on the phone number.

– Use strong passwords and change them periodically. Use a different password for each financial app (you can use a password manager, if there are many).

– If an authentication factor is used, keep the codes stored securely.

– Identify the financial applications installed on the device (very important and useful in case of loss or theft).

– Do not enter the app from third-party devices or public networks.

Financial apps: tips for phone maintenance and downloading apps

– To ensure that they are official, download financial applications only from official websites and stores: Apple Store (iOS) or Play Store (Android).

– Keep the application and operating system updated to the latest version available on all devices (PC, cell phones, tablets, etc.).

– Protect the SIM card using security options offered by the telephone provider: activate the PIN or security word to prevent unauthorized changes.

Financial apps: acomplementary actions in emails and web pages

– Verify the origin of emails and messages received before clicking on the links they contain.

– Do not access web portals through links that reach your email. Always do it by entering the address in your browser.

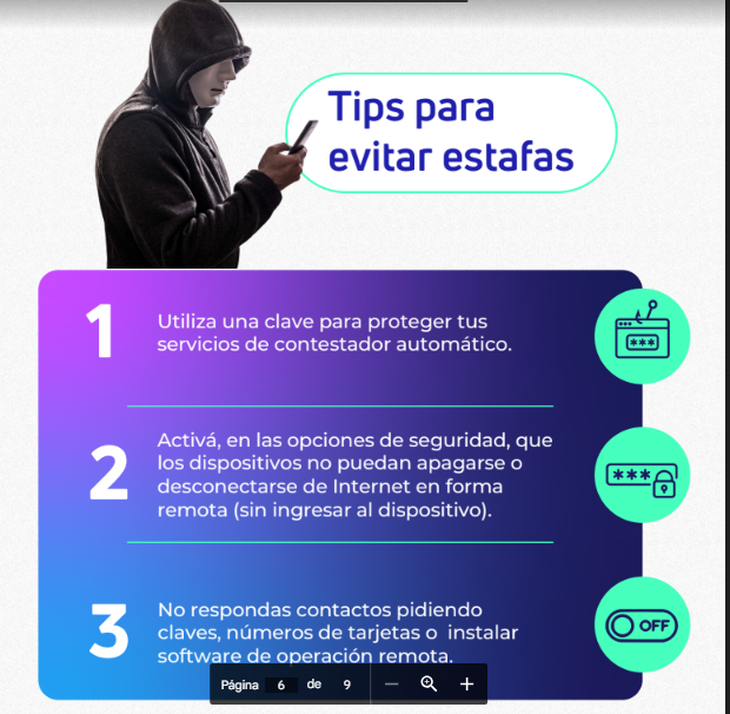

Financial apps: tips to avoid scams

– Use a password to protect answering services.

– Activate, in the security options, that devices cannot be turned off or disconnected from the Internet remotely (without entering the device).

– Do not respond to messages or emails that ask for passwords, card numbers or to install remote operation software.

– Activate alerts by email or App (if your provider allows it) to detect consumption not made with credit cards.

– If a person asks for money or for an emergency, contact another means (or with a direct family member) to validate the situation.

– Stay informed about phishing strategies and scam attempts on specialized sites.

camarafintech.PNG

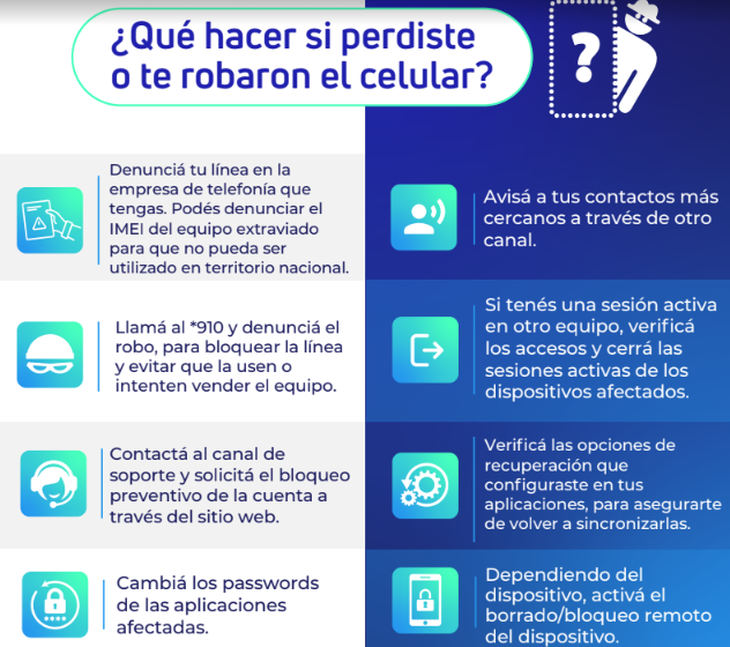

Financial apps: What to do if your cell phone is lost or stolen?

– Report the line to the telephone company. The IMEI of the lost device can be reported so that it cannot be used in the national territory

– Contact the support channel and request the preventive blocking of the app account through the website.

– Call *910 and report the theft, to block the line and prevent them from using it or trying to sell the equipment.

– Change the passwords of the affected applications.

– If you have an active session on another computer, verify access and close active sessions on affected devices.

– Check the recovery options you configured in your applications, to make sure you synchronize them again.

– Notify your closest contacts through another channel.

– Depending on the device, activate remote wipe/lock.

robbed.PNG

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.