After the devaluation and inflation above 20%, the sale of dollars grew to make ends meet.

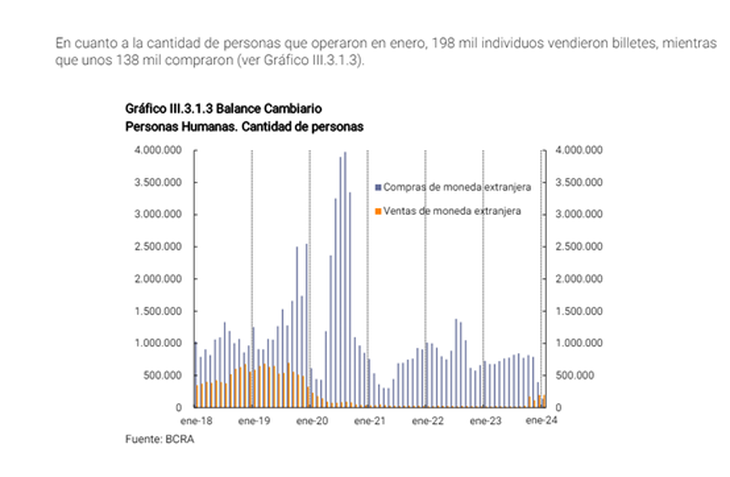

According to him Exchange Balance of the Central Bank, In the month of January they sold dollars 198,000 individualswhile 138,000 acquired them. Meanwhile, in the previous month, December, the number of people who got rid of them was 197,000 and bought 396,000.

The content you want to access is exclusive to subscribers.

Beyond the brutal drop in the purchase of dollar savings which could be reflected in the month of January, in terms of sales, although the difference between one month and the next seems not very relevant, the forward perspective indicates that the tendency to sell currency to make ends meet It increased in February due to the increase in the cost of living. And it is expected to rise in March as well, due to being a month that is seasonally of high expenses.

At the same time, for analysts it is beginning to be observed that it is beginning to be the sale of dollars through official channels or the so-called “caves” is indistinctdue to the fall of the exchange gap.

Capture.PNG

“This has to do with the strong reduction of the exchange gap. Today the loss from selling the official dollar against the parallel is clearly much lower and if you have the dollar bills in the bank and you don’t have any app to change it, you will save yourself from going to a cave,” said economist Aldo Abram.

According to economist Aldo Abram, “today, the dollar is much closer to what it is worth“, a more acceptable price for the market as reflected by the parallel prices.

For her part, the economist Elena Alonso He told Ámbito that the lower purchasing power liquefied by inflation and a lack of salary adequacy reduces the power to accumulate pesos. Thus, he pointed out that the growth in the sale of dollars will continue because it will be linked to a “less possibility of saving to be able to buy them.”

Although the trend set by the BCRA data in January is still incipientanalysts see it as the beginning of a path that could deepen forward until inflation remains at high levels.

As for February, they estimated that the dollar selling trend continued and they did not rule out that March could go along the same lines. While, In relation to the demand for foreign currency, Alonso estimates that she will “be calm” due to the current levels of the exchange gap around 30%.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.