In the “serious” academic world, there is a long-standing discussion about whether or not they exist. “financial bubbles” (whatever type they are, rational, speculative… there is a whole rosary of names and variants). What happens with him Bitcoin renew that discussion. As the thing is quite arcane, in summary it should be said that no, they do not exist and that they are merely formations in the path of asset prices, which can only be defined in that way “expost” – after the events have happened. -, and that there is no definitive and universally accepted definition of how these bubbles are formed and what they are.

The most that can be said is that a bubble is something like a financial cycle characterized initially by a rapid increase in the price of one or several assets, which is followed by a rapid fall or contraction (the bubble “bursts”). ).

The problem is that, Like witches, bubbles also “exist”; They are there for those who want to believe in them. And there are examples: the American technology bubble that burst in 1999 and 2000 and closer and in these lands, “the macrista bubble”. Although some may not like this definition, the numbers are there.

the macrista bubble.jpg

The bubble of Macri and Caputo; that is not talked about

On January 20, 2016, the Merval closed at US$655.13; On January 25, 2018 it reached US$1,759.73 and by August 30 it returned to US$688.87. On the up path it climbed 168.6% and on the down path it fell 62%, with barely a 2% difference between the tips (the collapse after PASO 2019, although it had some previous exuberance, was “another bug” , a typical “crack”). During the bullish leg, the daily rise averaged 0.2% and during the bearish leg -0.61%, which is compared to a daily return of 0.08% since 1986. Thus, practically all the elements of a bubble are present.

The Bitcoin bubbles

Among all the definitions of bubbles, there is the idea that they are generated when the price – the price is what is paid in the market – of an asset moves away significantly from its “value” – there are some problems here, because Value is defined by each teacher with his little book.

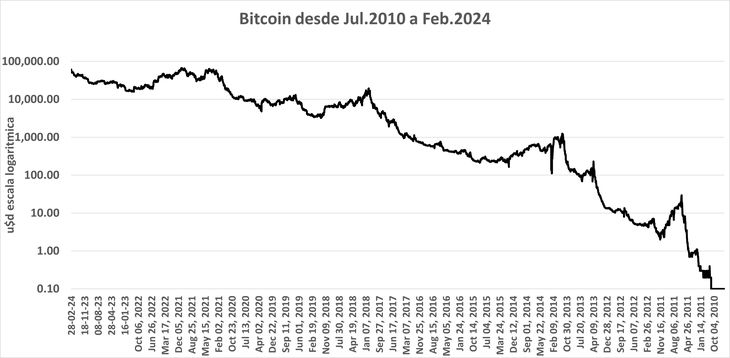

Bitcoin Jul 18, 201 to Feb 28, 2024 bitcoin.JPG

Bitcoin has a life full of bubbles

This was the case until cryptocurrencies and their queen, Bitcoin, appeared. What is the value of a Bitcoin? What does it represent? Does it represent something? Does it have any underlying meaning? The answer to these questions is basically a resounding no. This is why it should not be surprising that it is an instrument whose price is extremely volatile, and its history is full of… “bubbles”.

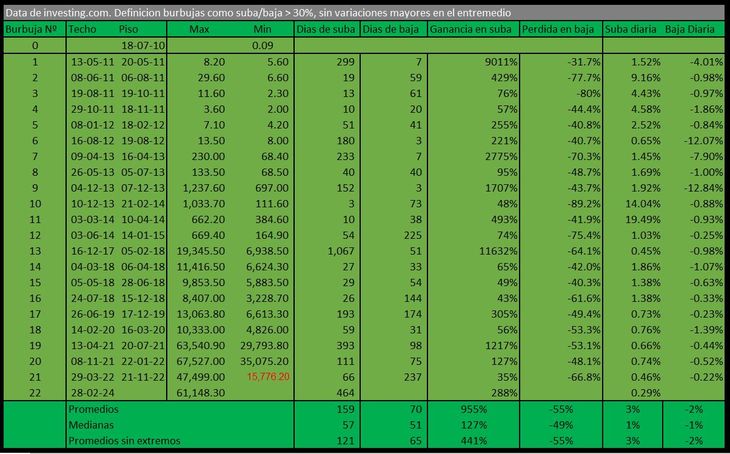

Bitcoin bubbles.JPG

The data in the table is not provided for making investment decisions

Since it began trading in July 2010 (BTC will soon be older than those who trade it), about 20 bubbles can be identified, if these are defined as processes in which the crypto rose more than 30%, falling by the same amount. a posteriori and without there being any intermediate movement of this magnitude. As can be seen in the table, the bullish legs lasted from 3 to 1067 days, with increases that were from 35% to 11.632% and daily increases between 0.29% and 19.49%. The bearish legs were from 3 to 237 days, in which the “currency” fell between 31.7% and 89.2% or daily declines between 0.22% and 12.84%.

Not that it means anything, but that BTC has reached US$64,000, catching almost everyone off guard (just look at the actual traded volumes in recent days), except the usual mythomaniacs, It should not be surprising. If one sticks to the historical average rise compared to the previous minimum, US$85,400 would not be off the radar. But as said, this means nothing.

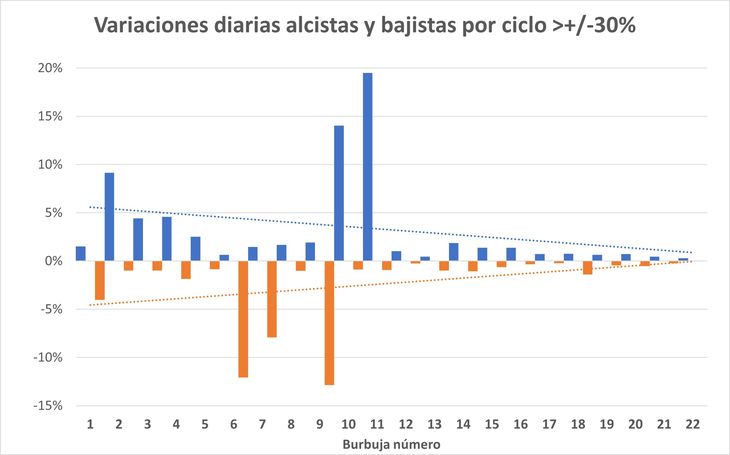

Variations.jpg

Bitcoin is increasingly becoming more “legal”

Before anyone wants to use the table to fuel delusional fantasies, an observation is worth it. Little by little – much slower than it seemed at times – Bitcoin has become an alternative “mainstream” investment, accepted by all but the most recalcitrant. This is not about using the word “maturity”, but this is being reflected in the behavior of their prices, which in each new bubble show lower volatility. Does this mean it’s still a good time to buy Bitcoin?

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.