Shortly after reaching $64,000, a sudden price drop saw Bitcoin drop to $58,700. This is likely attributed to a combination of selling pressure at the $64,000 level and the liquidation of leveraged long positions.

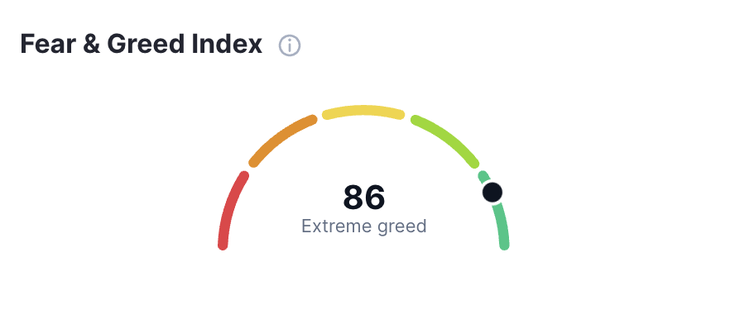

He Bitcoin (BTC) price experiences an increase of more than 10%, reaching a new annual maximum of US$64,000 for a few minutes, and then dropping to US$63,135. This impressive rise, which raised the price by 50% this month, is largely attributed to investor anticipation surrounding the upcoming supply halving eventhistorically followed by price increases, the halving. This led to the index fear and greed to trade at 2021 highs by marking 80 points, marking “extreme greed” for the crypto market.

The content you want to access is exclusive to subscribers.

Furthermore, the constant inflow of capital into the newly launched Bitcoin exchange-traded funds (ETFs) is believed to be fueling this bullish trend. Howeversome technical analysts warn against excessive optimism. They warn that the current market structure and high funding rates in general indicate extensive use of leverage, which could lead to a correction triggered by forced liquidations.

Shortly after reaching $64,000, a sudden price drop saw Bitcoin fall to $58,700. This is likely attributed to a combination of selling pressure at the $64,000 level. and the liquidation of long leveraged positions. However, at the time of writing this, Bitcoin has managed to regain almost 5% of its lost ground.

With Bitcoin currently sitting less than 13% below its all-time high, both retail and institutional investors maintain expectations that the record $68,900 will be broken before the supply halving event in approximately 52 days. However, the possibility of a correction due to excessive leverage and uncertainty in market dynamics necessitate cautious optimism in the near future.

Why measure fear and greed?

The behavior of the crypto market is very emotional. People tend to get greedy when the market is up, resulting in FOMO (fear of missing out). Furthermore, people often sell their coins in an irrational reaction to seeing red numbers. So the Fear and Greed Index attempts to save investors from their own emotional overreactions. There are two simple assumptions:

- Extreme fear may be a sign that investors are too worried. That could be a buying opportunity.

- When investors get too greedy, that means the market is ready for a correction.

GHfoeMWbIAAHCNS.png

Therefore, we analyze the current Bitcoin market sentiment and crunch the numbers on a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”. See below for more information about our data sources.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.