On the opposite path to that of variable income, are the dollar-nominated bonds, which gained up to 16% in February and pushed the country’s risk down, close to 1,700 units. All this, despite some doubts at the end of the month due to the political crisis between the Government of Javier Milei and some provinces.

The conflict with the governors put a brief pause on the sovereign debt rally. However, it should be noted that the market remains excited about Milei’s adjustment plan. The fiscal surplus of January, accompanied by the surplus of the exchange market and the absorption of pesos that the Central Bank (BCRA) has been doingfuel the optimism of investors, who reward with a reduction in the exchange gap and a notable improvement in sovereign bonds.

However, there are some drivers derived from the current plan that worry the City: a considerable reduction in expenses, a increase in floating debt and a marked decrease in payments for imports that will have to be faced in the coming months, as well as the pronounced drop in the level of activity, together with a notable deterioration in social indicators and the adoption of a policy of constant confrontation with the entire political spectrum.they do not contribute positively.

However, for the investor’s peace of mind, since Invest in the Stock Market (IEB), They maintain that the situation “of a particular province should not have an impact on sovereign debt“, given that the Government is determined not to take responsibility for the fiscal imbalances of the provinces.

The debt rally under the magnifying glass of experts

The ambition to achieve an economic order is hampered by an unstable political situation as a result of the ruling party deteriorating supportive relations with governors and Congress. “This factor will add volatility and risk in the coming months, so we recommend taking a cautious stance on positions.“he points out Martin Polo, by Cohen Financial Allies.

In that same line it is expressed Pablo ReppetoHead of Research Aurum Valuesin statements to Ambitwho slips that, it would seem that there is a certain rearrangement of the variables “after several weeks that have been very positive“.

dollar bonds.jpg

The analyst adds that, probably, in these previous weeks, “a complacent and optimistic look that everything would flow naturally”, but the market realized that there are many challenges ahead. For Reppeto, the political conditions, added to the imbalances that could accumulate if some economic policies are not modified to generate greater confidence (such as an acceleration of the crawling peg, ending the use of the blender to improve the fiscal front and correct the postponement of expenses to sustain the program), could lead the Government into a vicious circle regarding the deficit.

In a similar vein, he points out Juan Pedro MazzaCohen strategist, who recommends reducing the most aggressive positions in bonds that come from a strong rally such as: GD30, GD29 and GD35 preventively, in favor of more defensive options such as GD38 or the Bopreal Series 1.

Sovereign bonds: what the market expects for the future

From the Research team IOL Invertironline They warn that, although there was news that generated an impact on the price of the bonds, in reference to the Government’s bid with the provinces, “we understand that the subsequent increase” responds to certain support for the Government’s adjustment measures that seek to “try to order the macroeconomic imbalances that still affect the Argentine economy“.

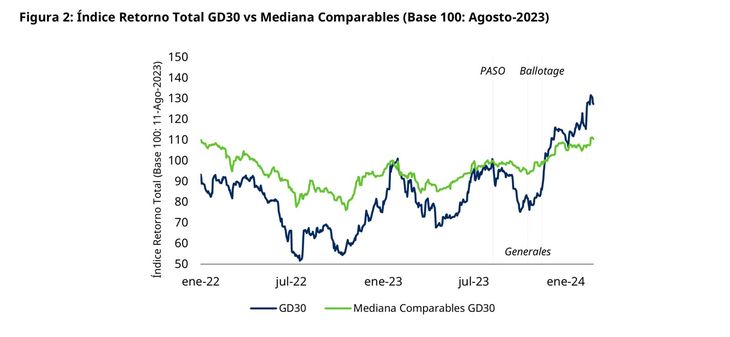

In that sense, since Schroders They maintain that, “Sovereign Bonds in Argentine dollars have been showing outstanding performance in recent months“. Thus, so far in 2024, they are generating a total return in dollars of between 4% and 14%, with the shortest ones (2029 and 2030) leading the increases.

“If we expand the analysis window, both the Globals (Argentine Sovereign Bonds Hard dollar Law New York) and the Bonares (Argentine Sovereign Bonds Hard USD Local Law) have generated, on average, a total return in dollars of 25% from PASO to today and almost 50% since the 2023 general elections“, confirms the broker.

The international investment manager maintains that the first part of the rise could be explained, in large part, by the improvement in expectations resulting from the change of regime after the 2023 presidential elections. Subsequently, various positive macroeconomic results, such as the financial surplus of January or the accumulation of international reserves by the BCRA, They are beginning to support these expectations and the rise in prices.

WhatsApp Image 2024-03-01 at 09.12.45.jpeg

In essence, the accumulation of reserves or the surplus fiscal balance gives the sovereign debt greater sustainability and, with it, a perception of a lower probability of default. Given the movement evident, the question arises as to whether there is still room for the rally to continue or, more importantly, whether the risk/return ratio remains attractive or not.

“We continue to see an attractive Risk/Return relationship in Argentine hard dollar sovereign bonds. With a substantial upside in a scenario of convergence towards comparables and a limited downside in a restructuring scenario. As time goes by, we approach the definition zone, where it will be necessary to see if Argentina manages to return to the international debt markets,” he responds. Schroders to the question posed.

Meanwhile, since IEB, indicate that in relation to bonds in pesos, “there continues to be an opportunity in the CERs tendered by the Treasury, given that they have the central bid and allow a very attractive rate to be earned, with the curve running at 20% monthly.” On the other hand, the synthetic fixed rate for April with TV24 also stands out, which consists of the purchase of the linked dollar bond and the sale of the April future dollar contract, which yields an effective monthly rate above 9% per month.

That said, the market is confident that the president concretize his “chainsaw plan” to the letter and be able to carry out his policies to clean up public accounts. This optimism is reflected in the market reading, which bets heavily for a variable income that promises and exposes the doubts of a more affected equity due to the “lack of legal security” and more vulnerable to the political crisis.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.