The financial dollars and the Dolar blue They fell sharply during February: the CCL fell 15.5%, the MEP 12.2% and the blue 13.2%. Thus the exchange gap fell to 23%. But how much room is there for it to continue falling? What do analysts expect?

The two pieces of information that must be taken into account and that are key areThe devaluation rate remains at 2% and inflation is around 15%.

The three main reasons that keep them without movement are:

- He dollar blend 80% MULC- 20% CCL for the liquidation of exports that helped the Central Bank to continue accumulating reserves.

- Weight reduction through the issuance of US$2,904 million of Bopreal.

- Liquefaction of peso stocks limiting the amount available to make the dollar fly.

But the biggest question is how long this dollar level can be sustained without affecting agricultural settlements.

According to the consulting firm Equilibra, “the real effective exchange rate for both exporters and importers is already at around equilibrium levels estimated by the IMF and would arrive at the end of April below the pre-pass levels if the crawling peg of 2% and the gap at current levels are maintained.”

Dollar: what to expect going forward

According to analysts, it is the exporters who hold the key to what will happen to the dollar: If export liquidations collapse, the CCL offer “could lose more than US$1,000 million per month.” This would also cause Bopreal to lose its appeal.

According to him Econviews, The greater income of dollars will depend on the real exchange rate “don’t appreciate it much.”

“The importance of a The high dollar does not come only from the side of encouraging export liquidations. It also lies in discouraging imports. That is, growing above what is necessary just because the RER is low does not help and can cause problems later. Something like this is what happened in 2017 and 2018,” they added.

“He risk is that it becomes unsustainable and the adjustment of the exchange rate will end up being decided by the market in a more disorderly way,” they explained from Econviews.

The consulting firm Fernando Marull and Associates (FMyA) He also states that ifThe CCL remains “very low” (minimum 4 years), “there could be some rebound in March.” “It is low” to pay “Cash Imports”, or “Old Debts”. “Buying dollars at $1000 only “loses” if there is an exchange rate jump, “unification” and full lifting of the stocks. Today it is unlikely because there are still pesos and reserves will remain low,” they say.

The market expectation is the acceleration of the crawling peg and that there is a migration towards hedging instruments.

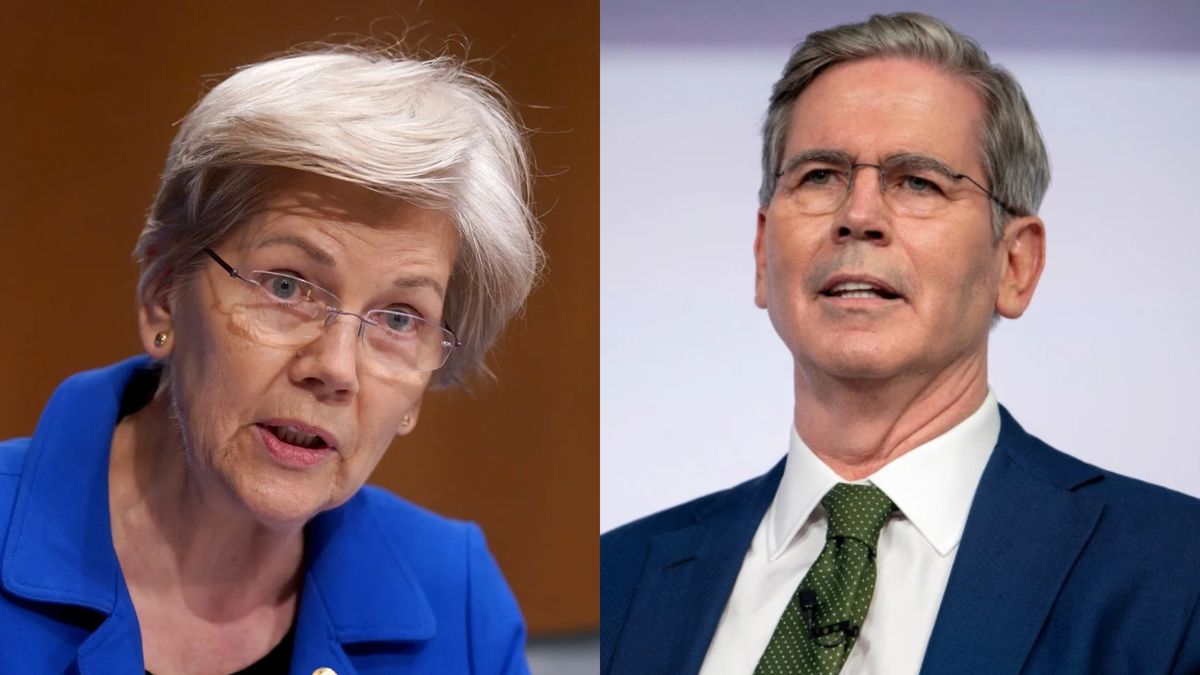

For Caputo, the “balance” dollar could be below $1,200, since that was a dollar in the middle of a “panic” situation without fiscal balance or reforms.

Caputo tries to convince the market that orderly fiscal accounts will achieve a equilibrium dollar at a lower price.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.