New setback for Apple. The tech giant was removed from the list of “best buys” from Goldman Sachs after disappointing stock performancewhich accumulate a drop of more than 6% in 2024. This is added to the penalty by the European Union with a historic antitrust fine: the company must pay more than US$1,950 million. It is the first time that the European Commission applies a penalty of this style.

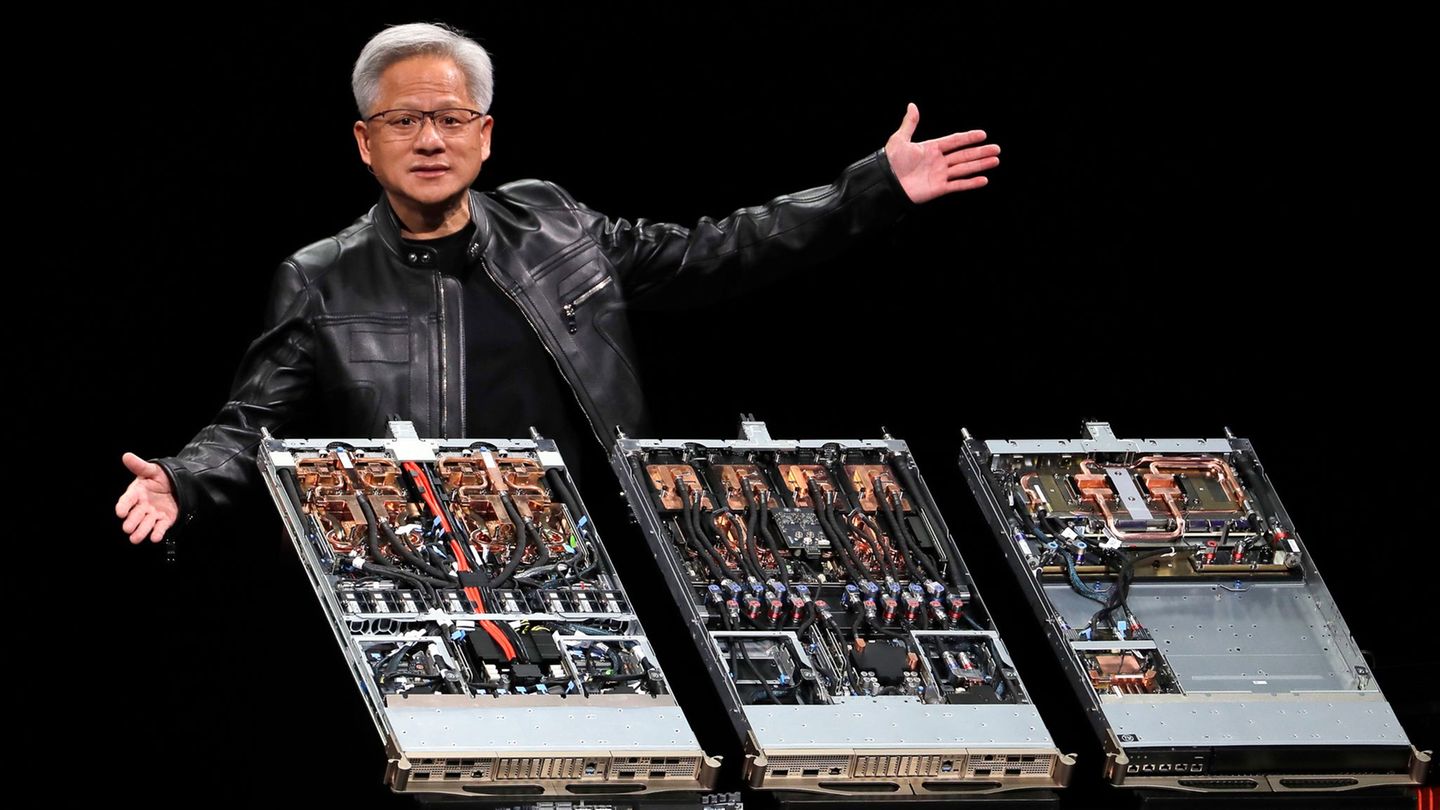

In this way, in the future of Wall Street The Manzanita company already lost almost 3%. Thus, the company’s shares have accumulated a drop of 5.6% in the last month and 7.6% in the last six. If this trend continues, Manzana could lose second place in the megacaps stock market ranking, since NVIDIA has been sweeping and is hot on its heels.

The iPhone maker had appeared in the “director’s cut” from this Goldman Sachs list, made up of just over twenty companies, since it was announced last June. In this period, The company’s share price has remained fairly stablewhile the S&P 500 index has risen more than 20%.

Goldman has indicated that its list of director cuts is reviewed monthly, with stocks being eliminated if they are “no longer a superior investment idea.”

The truth is that the company has not been able to keep up with most of the other members of the ‘Magnificent 7’ either. For example, Nvidia and Meta are leading the rally in this group of stocks after skyrocketing above 65% and 40% so far this year, respectively; In turn, Amazon has risen 17% in these two months and Microsoft has risen 10% since January 1.

On the negative side, Alphabet (Google) has barely fallen 1% since the beginning of the year, while Tesla is the only stock that worsens the Cupertino giant’s performance, as the electric vehicle manufacturer is falling more than 18% in 2024.

Not everything is so bad for Apple

Still, Goldman maintains its ‘buy’ rating on Apple, which it bases on “the market’s focus on slower product revenue growth, which masks the strength of Apple’s ecosystem and the durability and visibility of revenue.” associates”. The company changed its view on the stock a year ago and turned positive on the company for the first time in a decade.

However, there are heavyweight firms that remain optimistic about Apple. Bank of America analysts are in this select group, as they expect the company to benefit from the upcoming “iPhone refresh cycle.” In addition, they consider that the apple firm will experience “strong growth in services and an expansion of margins” in the coming years.

However, the majority thesis of analysts is that the apple company will not experience a good 2024. This is due, in large part, to the weak demand for its most iconic products, especially in key markets such as China. In fact, there are many experts who warn that local competitors like Huawei are eating Apple’s toast in the premium smartphone segment in the Asian giant.

In its latest results, Apple reported that its net profit in 2023 was $33,916 million, which represents an increase of 13% compared to the $29,998 million earned in the same period of 2022. However, analysts highlighted for the worse the decrease in turnover from China. In fact, the only market in which turnover worsened is the millennial country, where income fell from 23,905 million to 20,819 million dollars in the period.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.