A report of the Bank of America raised warnings to the government of Javier Milei in a recent report titled “Argentina in Focus” signed by analyst Sebastián Rondeau. There, he highlighted the possibility of reaching the fiscal pact with the governors even with accusations from public opinion regarding the adjustment.

What Bank of America said about the dollar and the exchange rate

“The Central Bank does not seem to be in a hurry to accelerate the exchange rate (maintaining a 2% monthly adjustment so far) despite concerns about the currency’s overvaluation. The BCRA continues to accumulate international reserves, in part due to the gradual allocation of imports,” the analysis states.

The Government highlights the end, “Nor is he in a hurry to lift capital controls, expecting a cleaner BCRA balance sheet (including a greater accumulation of reserves). In our opinion, the mega debt swap in pesos completed this week paves the way for lifting capital controls (as it eliminates refinancing risks).”

And closes: “The completion of the relative price correction for June (public services), could also open space for a recalibration of foreign exchange policy. We wait for a acceleration of peso devaluation no later than the end of April and the beginning of lifting of capital controls by June”.

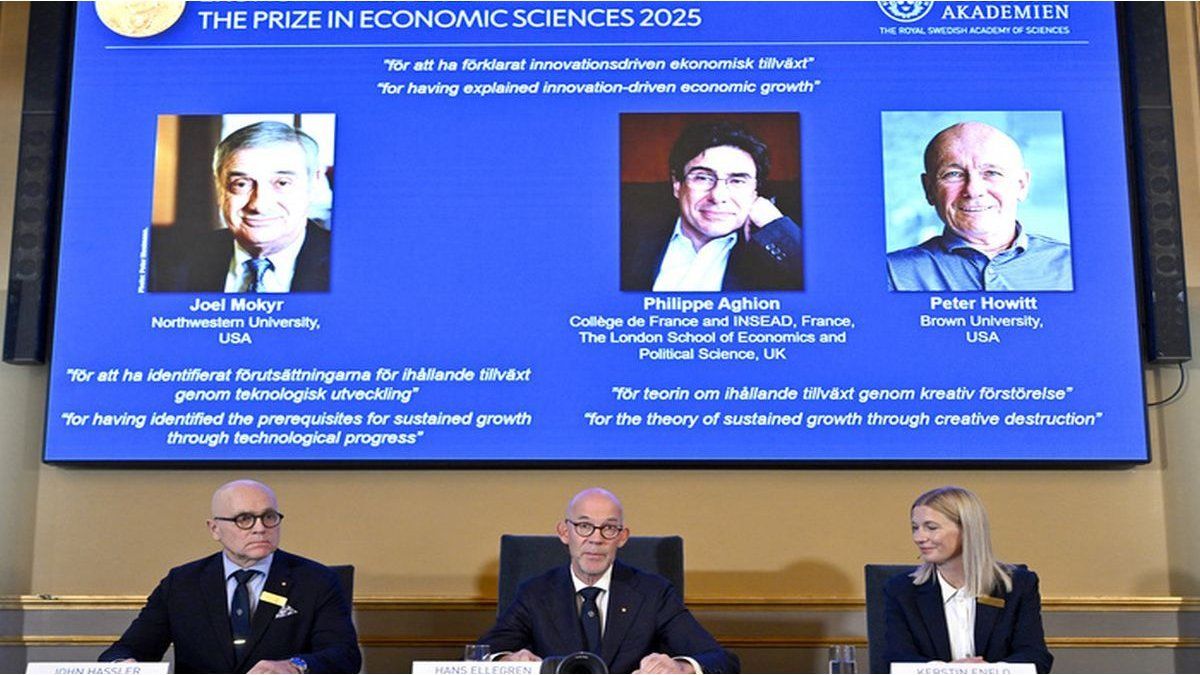

Bank of america.PNG

According to Rondeau, the experts they spoke with during their visit to Buenos Aires “are less optimistic about the possibilities of privatization proposals and delegation of powers.”

Risks of Javier Milei’s economic plan

According to Rondeau, the experts they spoke with during their visit to Buenos Aires “are less optimistic about the chances of privatization proposals and delegation of powers.

“There are doubts about whether Milei would give up some proposals to reach the agreement (such as privatization). The division in Congress increases uncertainties about the approval of the pact, especially in the Senate”says the document.

“We are moderately optimistic about the possibilities of reaching a fiscal agreement between the Government and the governors short term. This should include a change in the pension formula, tax revenues, a promotion regime for large-scale investment projects and the deregulation of hydrocarbons.”

“The incentives for this agreement are strong given the need to consolidate fiscal adjustment and increase income for the provinces. Execution risks remain great amid a divided Congress and risks for the mega-deregulation decree”says the document.

“The Government proposes reinstate income taxes eliminated last year (0.4% of GDP revenue for the central government and 0.5% of GDP for the provinces). However, a group of governors rejects the idea in principle, including the patagonian provinces who have high salaries related to the energy sector.”

For Bank of America, “this tax is crucial to replace the transitory income obtained through the import tax (PAIS tax).”

Dollar: what Javier Milei said about the exchange rate trap

Javier Milei confirmed that it could negotiate the disbursement of US$15 billion to lift restrictions on the exchange market. “If they gave me 15 billion dollars today, I would open the trap now,” he asserted.

Regarding the consultation on whether the Argentine government would be willing to present this request in the debt negotiations, the president responded: “Absolutely. And it can be part of a negotiation that includes the International Monetary Fund, other countries and common investment funds from abroad.”

During the interview in Radio Miterthe president did not give a date, but stated: “We are working on that. The faster we get it, the faster we lift the trap. If not, we have to continue in this Central Bank process. In fact, the fund considers that, by mid-year, we could open the stocks. There are even economists who believe that we could open it today.”

However, he acknowledged that the opening will not take place now. “because it is not 100% safe.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.