President Javier Milei He has defined/self-perceives himself as anarcho-capitalist, minarchist, paleo-libertarian, monetarist and other herbs. In our era of political correctness, it is under these lights that our own and opponents tend to analyze and judge their actions and those of the government, which is fine.

The problem is that, If we stay tied to declarations, ideologies, marketing and political correctness, We are going to lose money… and that’s not good at all.

Some theory

In 1973 two economists from Stanford University, Edward Shaw (a little more theoretically in Financial Deepening in Economic Development) and Ronald I McKinnon (with a better empirical basis in Money and Capital in Economic Development) introduced the concept of “financial repression” (RF)as a criticism of certain policies of emerging governments that restricted their development.

This idea referred to government policies that resulted in savers would receive returns below inflationallowing banks to provide and channel money at low (even negative) costs, subject to the discretion of the government, to groups within the private sector and to the government itself, which thus reduced their debt burden.

Since the crisis of 2008faced with the unpopular measure of adopting austerity policies, The main economies of the world turned towards the adoption of Quanitative Easing and other repressive police forces, inducing negative interest rates in the economy.

As demonstrated by Carmen M. Reinhart, Jacob F. Kirkegaard and María Belén Sbrancia, in “Financial Repression Redux” (2011), Financial repression began to be seen as an effective policy to liquidate state debt in local currency, giving politicians an alternative with which to face the difficulties of reducing government spending or implementing structural reforms that boost the economy.

What’s more, Anusha Chari and Peter B. Henry found in “Is the Invisible Hand Discerning or Indiscriminate? Investment and Stock Prices in the Aftermath of Capital Account Liberalizationsuna” (2004), A “well-managed” RF improved the credibility of governmentsby reducing the cost/removing the chances of a “formal default” and allowing new voluntary debt to be placed on the market (even though it was a bad deal, the alternative for local banks was to decapitalize more quickly).

Characteristics of repression

Reinhard et.al identify five basic elements behind financial repression policies

- Control of interest rates

- Government control of financial and banking institutions

- Creation and control of a domestic market for state debt

- Restrictions on entry into the Financial Industry

- Directing credit to certain industries.

Despite the words of “dynamiting the central bank” when he took office, all these phenomena occur between us and Today the control power of the BCRA and the CNV over the private sector is as much or greater than before.

Martínez de Hoz y Cavallo, also

The reality is that – and although some may be “offended” – this is not the first time that our economy has found itself under a scheme of financial repression, hidden under a cloak of liberalization.

This We already experienced it under the ministry of José Alfredo Martínez de Hoz and Domingo Cavallo.

I’m not going to go into details, but despite the deregulation of large economic areas and all the propaganda, the truth is that in both cases, thanks to the direction of the State, we saw a important boost to the financial system while continuing to protect the “great national industry”, which was the great beneficiary -perhaps I should say that the large industrialists were- along with the service sector, to the detriment of small and medium-sized industry.

Martinez de Hoz.jpg

José Alfredo Martínez de Hoz, the first major attempt at financial repression in Argentina. lasted five years

Cavallo.jpg

Felipe Domingo Cavallo, the second great test of financial repression. It lasted five years and four months

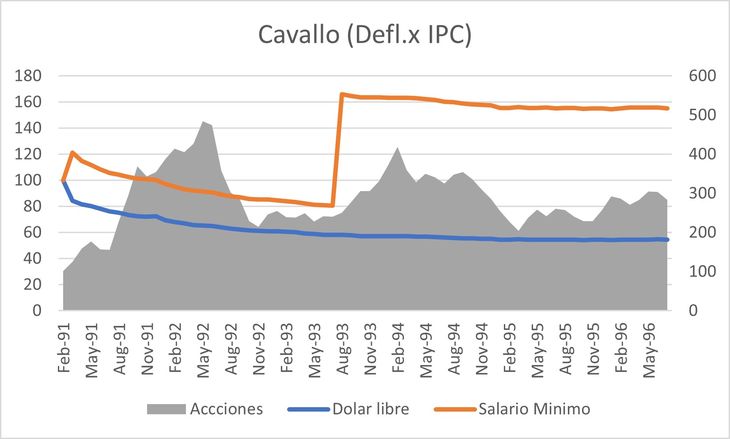

Even with their many differences, in both cases we had a significant local inflation in dollarsshooting a stock bubble within the first year of taking office the governments and a very strong recovery of property values. With “El Joe”, the average price of properties jumped from around US$320 per square meter to US$1,300 when he left in 1981 and with “El Mingo” from around US$660 to US$1,075 (unfortunately The data available is at the end of the year).

Nothing says that things should be repeated, but if something has a lion’s tail, a lion’s jaws, and stinks like a lion…

How to earn money in the coming years

We already know this story and so does the world, although then there was no talk of “Financial Repression”. So I’m not saying anything new. The best thing, in any case, is to present the theoretical framework and put in white on black what “the guys” are advising their clients as if it were the fruit of their great wisdom.

As long as the government continues with the current scheme, and Until we have a true expansion process, we must understand that “cash is the enemy.” Having any form of “cash” means facing a high probability of losing money.

And as time goes by, even if inflation decreases to less than single digitsthings will be worse -the government will continue to negative bank rates-, to the point that even considering the risk that other investment alternatives entail, the return of “cash” in any form would tend to be negative.

The only exception here are UVA deposits, which will be eliminated as soon as possible and the operations of “carry trade”, that could continue to give “air” to the big players in the market (with an external view), while the gain in dollars implies a loss in pesos.

What then remains for the small investor?

If history is of any use to us, the good thing – and unfortunately for the country – is that making money under a scheme of financial repression is incredibly easy.

You still have to take some precautions:

- Extend the investment horizon

- Minimize your exposure to any asset whose return in constant terms is negative

- Focus on real assets, including stocks and real estate

- Ignore short-term fluctuations and political noise, but be alert to the possibility of a bubble.

This is enough. A shame.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.