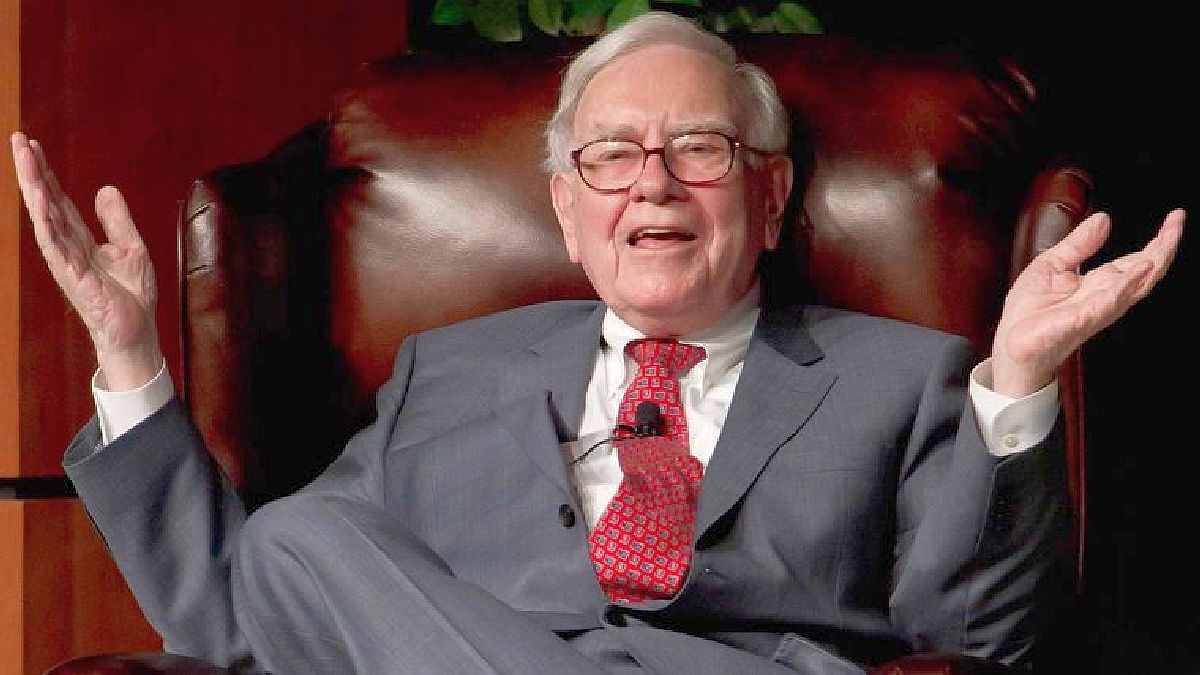

Warren Buffett does not normally invest in high growth stocks that develop cutting-edge technology. “Berkshire is not a fan of newcomers” he jokes in his most recent annual letter to shareholders.

However the oracle of omaha owns a large part of Berkshire Hathaway’s portfolio and two giants of artificial intelligence (AI), both members of the famous “Magnificent Seven“.

The Magnificent Seven (in Spanish) are a group of large-cap companies whose shares have largely driven the performance of the S&P 500 since the beginning of 2023. Primarily, they are technology leaders and do not represent the typical Buffett investment.

But if Buffett sees value in these two stocks, chances are they could generate solid returns for investors, whether they lean more toward Buffett’s investing style or toward growth stocks.

Apple ($155.3 billion)

Apple has become the largest position in stocks Berkshire Hathaway by a wide margin. Buffett initially started accumulating Apple shares between 2016 and 2018. And with the stock’s phenomenal growth since then, Berkshire’s position has risen to a value of roughly $155 billion today.

Although Buffett reduced his position in Apple a few times in the past, It seems to be mainly for tax reasons. In fact, Buffett expressed regret for selling stocks in the past given a tax opportunity, but appeared to repeat the same mistake late last year.

Apple (1).jpg

Reuters

Given the magnitude of Berkshire’s position in Apple, No one should question Buffett’s belief in the company and the stock to produce strong results in the future.. Buffett called Apple “a better business than any other we own” at Berkshire’s annual shareholder meeting last year.

So what does Buffett like so much about Apple? Although the apple firm develops several technologies, including artificial intelligence, Buffett sees it as an unparalleled consumer products company. There is no consumer product more ubiquitous than the smartphoneand Apple’s market share in the smartphone market, especially in the premium segment, is unmatched.

Amazon ($1.8 billion)

The other member of the Magnificent Seven found in Berkshire’s portfolio is amazon. The e-commerce company is far from a Buffett stock. He even said that the business is outside his circle of competence in an interview several years ago, so he does not consider it a mistake not to have invested in that paper. However, his company owns approximately $1.8 billion in Amazon shares.

This is likely because one of Buffett’s associate portfolio managers, Ted Weschler or Todd Combs, initiated a position in 2019.

There’s a lot to like Buffett about Amazon. “Your behavior has changed, everyone’s“Buffett said of the company in 2017. In fact, the Amazon Prime network has become a significant defense for the business, driving shoppers and merchants to be more loyal to Amazon. That creates a virtuous cycle by which Amazon can invest more in Prime benefits and faster shipping, attracting more shoppers and more merchants.

amazon (1).png

Buffett is also impressed by Amazon’s cloud computing business, which represents the majority of Amazon’s operating income. That could grow rapidly with the growth of artificial intelligence, and Amazon is investing heavily to keep up with competitors in the space. That includes a $4 billion investment in Anthropic and the design of its own AI training and inference chips for its servers to support new large language models and AI-powered applications.

The rapid growth of Amazon’s cloud computing business along with its growing advertising sales should support continued margin expansion for the company, producing strong free cash flow growth, the primary metric by which management judges its financial results.

Amazon trades at a price-to-sales ratio of just 3.29, which is below its five-year average despite increasingly promising prospects for margin expansion.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.