This phenomenon served as a reminder of the constant risk that chipmakers face in earthquake-prone areas of Asia, as well as Taiwan’s preparedness for such disasters. However, it caused some concern among investors, since Immediately at Apple and Nvidia there were fears of disruption in the supply chain, which could directly impact their actions and therefore, the Argentine Deposit Certificates (Cedears).

Wednesday’s earthquake hit the coast of the Taiwanese city of Hualien, but also sent shock waves through the western part of the island, Home to major technology hubs Taoyuan, Hsinchu, Taichung and Tainan. It should be remembered that it was the largest earthquake on the island since the deadly earthquake of September 21, 1999, according to the Taiwanese government.

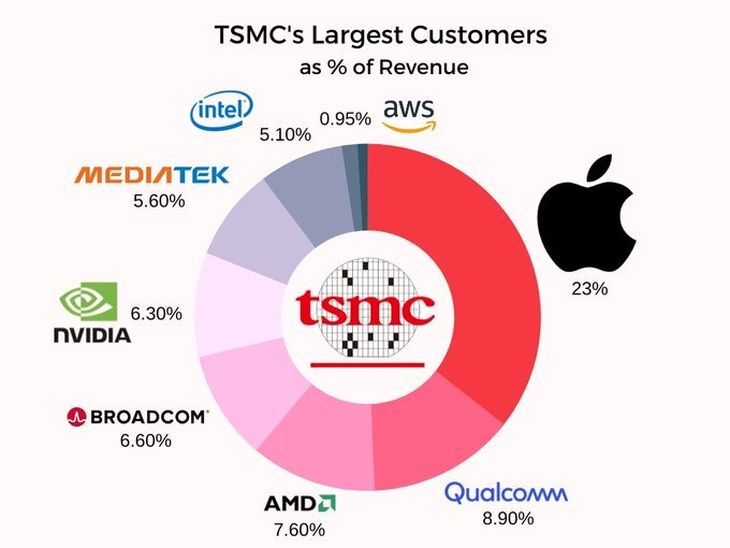

As he explains to Ámbito Martina Del Giudiceindependent financial advisor, although the tragedy had potential repercussions for global markets, due to the fundamental role that Taiwan plays in the manufacture of advanced chips, “Shares of TSMC and some of its main clients such as Apple and Nvidia fell slightly in pre-market operations“, then normalizing its price during the day. The analyst recommends, in those cases and for a better analysis, we always recommend looking at the asset’s price in dollars because “The Cedear may be altered by the exchange rate.”.

The importance of Taiwan in the sector

Taiwan accounts for a large portion of the industry’s critical components technological, including semiconductors, chip substrates and printed circuit boards, all of which require machines to run 24 hours a day. Any suspension is equivalent to a million-dollar loss, especially for chips, whose extremely delicate and sophisticated manufacturing processes are highly susceptible to earthquakes, so the response given TSMC to the emergency highlights what the chip industry has learned in recent years.

Del Giudice recalls that “TSMC is one of the leading semiconductor manufacturing companies in the world, so any of its actions can have a significant impact on the market.” And he exemplifies, that If TSMC did not act quickly in certain situations, several problems could arise for both the company and the market as a whole.: “production disruption, supply shortages, loss of revenue and market share.”

Nvidia.jpg

The Taiwanese firm noted after a few hours “The total recovery of tools in its factories in the Taiwanese city of Tainan reached more than 80%, and that there was no damage” in its extreme ultraviolet (EUV) lithography machines, according to the Japanese newspaper Nikkei. This equipment is essential for making five-nanometer and three-nanometer chips used for Nvidia’s AI products and Apple’s iPhone processors.

From Nvidia quickly came out to bring peace of mind to its investors and they assured that they do not expect any impact on their supplies due to the earthquake, since they know in advance that chip manufacturers in Taiwan have developed procedures to prepare for and respond to natural disasters“like having seismographs installed in all their factories,” quotes the Japanese newspaper.

Not only natural disasters threaten the market

As explained to Ambit the investor advisor, Gaston Lentini, “more than half of all the chips used in the world for any electronic circuit come from Taiwan.” The strategist suggests that, in an extreme, but not absurd, case, “If China starts to invade Taiwan, we are going to have a mess all over the world“.

And many of the Western companies, such as IntelFor example, they are creating entire new plants in the United States or Mexico, precisely to reduce this dependence on Taiwan. However, as Lentini maintains, Intel began construction of the plant in 2021-2022 and it will not be ready until 2025-2026. “That is where the problems are that keep the market in suspense and this latest earthquake raised that concern again.“adds the analyst.

WhatsApp Image 2024-04-04 at 2.15.15 PM.jpeg

Courtesy of Gastón Lentini to Ámbito.

Courtesy of Gastón Lentini to Ámbito.

If something were to happen in Taiwan, “everyone will fall,” says Lentini.from Apple, to NVIDIA, through NIO“In short, a disaster on the island would cause a domino effect of such magnitude that it would weigh down all the markets. “All the technology companies that are at their peak would be hit,” adds the analyst. On the one hand, due to expectations, because they will not have more inputs. On the other hand, because of how it will affect the entire industry worldwide. And here, indirectly, it affects everything that has to do with artificial intelligence, to everything that has to do with cryptocurrencies, to everything that has to do with car development.

In this regard, the strategy that Lentini recommends to his clients is be an analyst of the international panorama to be able to intuit or at least try to predict what could happen. “Considering the general market context, I am more of a friend of, at this moment, reducing, I am not saying desperately selling everything, but reducing the proportion we have in our variable income portfolio, particularly speaking of technology, and perhaps take refuge or become a little more conservative by going to some companies that are further away from that situation, such as mass consumption, commodities, companies that keep us away from that type of risk,” concludes Lentini.

For his part, Del Giudice concludes that the lack of quick action by one of the big winners on Wall Street in the first quarter of the year (TSMC), “could have had significant consequences for both the company and the technology industry as a whole“, very much in tune with his colleague, Lentini.

However, he highlights that this is where TSMC’s capacity is realized, “is to anticipate and respond quickly to changes in the market and demand“, as well as with solid contingency plans and rapid response measures to minimize the adverse effects of natural events that usually frequent the area.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.