In other precious metals, spot silver fell 0.6% to $26.79 an ounce, having reached its highest level since June 2021 the previous day.

The gold prices They continue their upward trend during the day on Friday, thus marking their third consecutive week of gains. This impulse is supported due to the anticipation of the US non-farm payrolls report. The precious metal has been favored by strong safe-haven capital inflows and expectations that interest rates will remain at lower levels throughout the year.

The content you want to access is exclusive to subscribers.

Spot gold rose a modest 0.1% to $2,291.79 per ounce, after reaching an all-time high of $2,305.04 the previous day. So far this week, gold has registered an increase of 2.6%. For its part, gold futures in the United States showed a slight improvement of 0.1%, reaching $2,311.

Gold: what data the market analyzes

Ricardo Evangelistaan analyst at ActivTrades, attributes the recent upward trajectory in gold prices to growing geopolitical instability and expectations that the Federal Reserve continue cutting interest rates during the first half of the year. The future direction of interest rates will largely depend on U.S. employment data due around midday Friday, which could confirm or alter the Fed’s stance on interest rates.

gold

Depositphotos

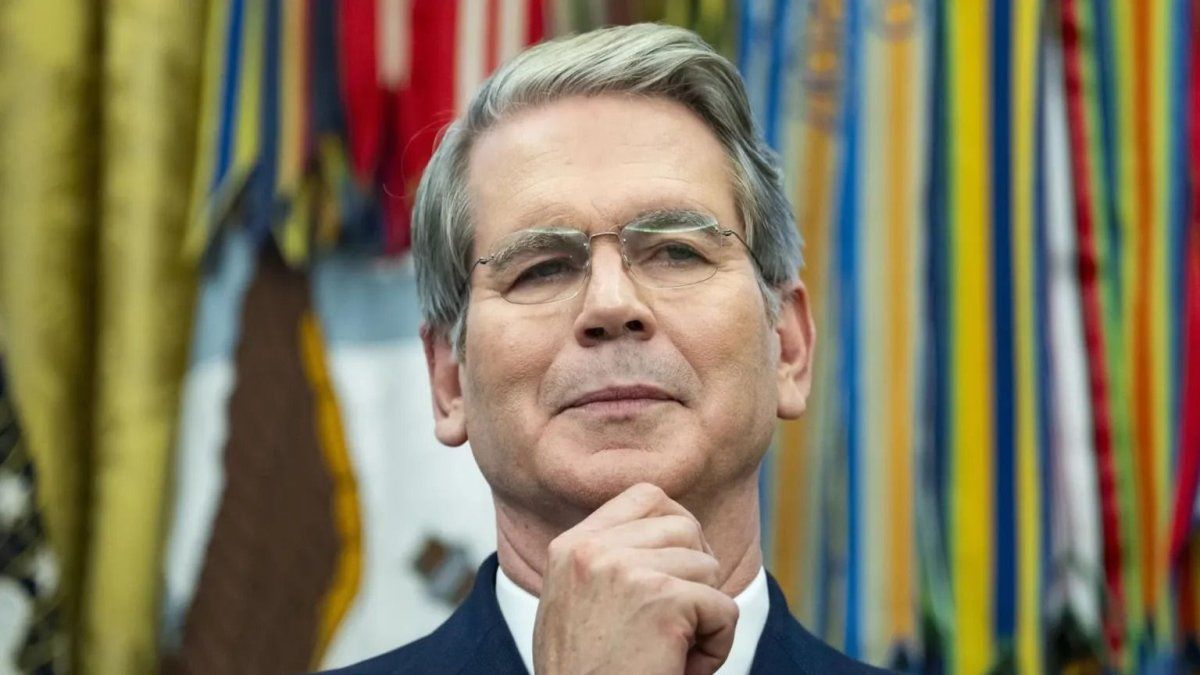

Jerome Powell Fed Chairman, pointed out that the US central bank has room to consider its first rate cut, considering the strength of the economy and recent signs of high inflation.

As for other precious metals, spot silver fell 0.6% to $26.79 an ounce, after having reached its highest level since June 2021 the day before. Meanwhile, platinum and palladium also show drops of 0.5% and 0.8% respectively, standing at $920.47 and $1,012.50. However, both silver and platinum are on track to close the week higher.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.