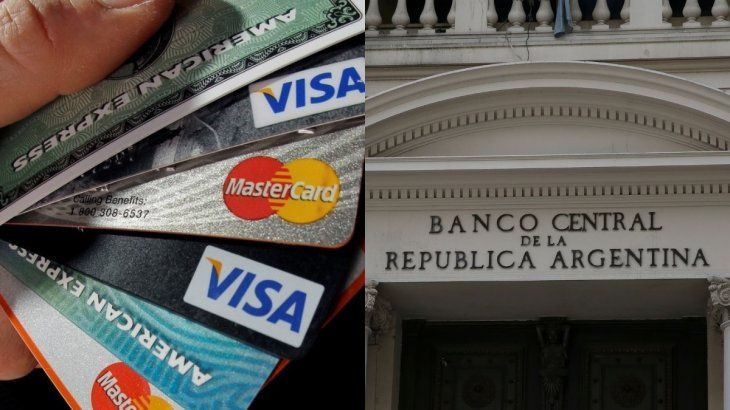

In the same month, consumption in pesos also fell but below inflation. How were the operations in March.

In March, the credit card purchases in pesos, amounted to $6,523,158 million, which means a nominal increase of 5.1% compared to the end of last month, and therefore below inflation values expected for this period. But in Dollarsthe fall of the exchange gap affected the use of plastic.

The content you want to access is exclusive to subscribers.

Credit card: how were operations in pesos for the month of March

A report of First Capital Group showed that year-on-year growth reached 166.9%, also being below the estimated inflation levels for the year, consequently showing a decrease in real terms in both analyses.

“It is a particular month, since the last days of the month have been holidays – Holy Week – and also coincide with a period during which plastic money is traditionally used more frequently and that can defer the calculation of operations to the following month, Therefore, the analysis of the variations can lead to less precise interpretations,” explained Guillermo Barbero, partner at FCG.

Credit Cards – BCRA.png

Credit card use registered a drop in real terms

Credit card: how much its use decreased in dollars

Purchases with dollar credit cards recorded an interannual increase of 52.4%, although with an irregular monthly behavior alternating increases and decreases. In March there was a decrease of 0.9% compared to the previous month. The balance amounts to US$346 million. “The fall of the “deregulated” exchange rates versus the exchange rate applied to card consumption causes users to limit operations,” concluded Barbero.

It is worth remembering that the price of card dollar or “tourist dollar”” is located at $1,410.40 while the blue dollar and the MEP dollar are cheaper at the rate of $1,000, which affects the use of the credit card for this type of consumption abroad.

So much so that it turns out to be more convenient to change pesos to physical dollars or MEP dollars You have to pay the card statement at the bank, also avoiding tax charges.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.