According to a study prepared by the Fintech Chamber and the Technological Institute of Buenos Aires (ITBA), fintech credit represents 15% of total loans in the financial system.

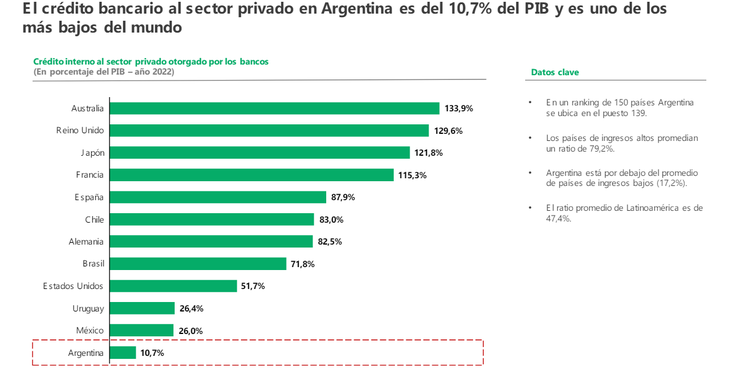

The lowering of Central Bank rates and the reduction in inflation made it possible for Argentina to talk again about access to credit. But we start from a quite complex panorama: bank credit to the private sector in Argentina represents 10.7% of GDP and it is one of the lowest in the world, according to data from the World Bank.

The content you want to access is exclusive to subscribers.

Unlike other countries in the region where credit has mostly expanded in recent decades, in Argentina there has been stagnation. There was only a greater expansion in two moments: in the 90’s when it reached 24% of GDP and in 2018. Two opportunities whose common thread is inflation at controlled levels.

fintech1.png

In this complex scenario, the Fintech plays a leading role. Currently, 6 out of every 10 adults in Argentina have a payment account and nearly 7 out of every 10 money transfers are made from or to a Fintech account. The AAccess to credit is one of the tools of financial inclusion where currently, More than 30 member companies of the Fintech Chamber grant loans as their main or accessory activity.

In seeking to provide more information about a potential sector, the Buenos Aires Technological Institute (ITBA) together with the Argentine Fintech Chamber prepared its first research study within the framework of the Industry Data project, which seeks to develop quantitative information on the ecosystem. .

“One of our objectives as a Chamber is to generate clear and accurate information about the state of the Fintech industry. The rapid evolution of the sector makes it essential to have this input to understand the place that fintechs occupy in the Argentine economy and their work in the inclusion of millions of people. This alliance with ITBA is part of that work and we aim for this to be the first of many joint projects,” said Ignacio Plaza, vice president of the Argentine Fintech Chamber.

Fintech credit: what key data did the report reveal

- Of the 5.3 million Fintech clients, 2.2 million (42%) are exclusive clients – they do not have credit with any bank or non-financial entity – while 3.1 million (58%) are shared – they also have current credits with other financial entities or other Non-Financial Credit Providers –

- More than 1 in 3 Fintech clients (36.2%) are between 18 and 29 years old against less than 1 in 5 (17.1%) that this age group represents in the loans granted by banks. One fact to keep in mind is that not only are these loans accessed by a young percentage of the population, but, in most cases, it may have been their first access to the financial system.

- 56.7% of adults have joint ownership of a bank and payment account and, 44.6% of the population still does not have active credit instruments.

- Total credits: In December 2023, the total amount of current credits in the financial system stood at 37.2 million, 15% (5.6 million) were granted by Fintech companies.

- The average balance of a Fintech loan is $89 million in December 2023. This value is lower than that observed by financial entities (1.3 million).

- Fintech companies show a higher percentage of female clients with 54.1%. While, in financial institutions the percentage is 50%-50%.

- 75.6% of the loans were in a normal situation, while 12.8% had arrears in cancellations and 11.8% in a situation of bad debt with a stable trend.

A view forward

The Fintech industry recognizes and assumes the challenge of this poorly inspected vertical that motivated the development of the study. As mentioned above, a better macroeconomic environment favors the industry in the possibility of attracting a greater number of clients of different age groups in the search to increase volume. A challenge is also incorporating companies: Today there are only 3,600 legal entities with valid Fintech credits.

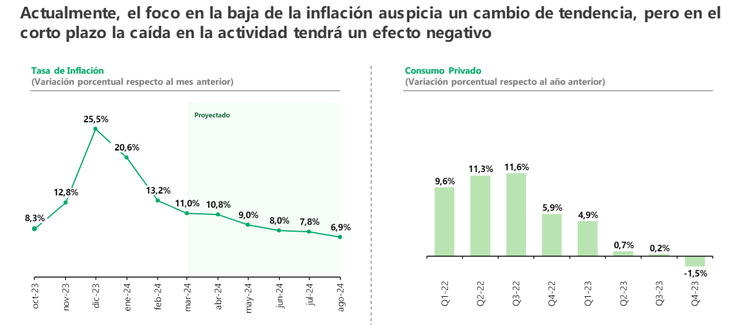

“The decrease in inflation from 25.5% monthly last December to 11% in March was accompanied by a sharp drop in personal loan rates, which fell from a maximum of 142% in January to 90% in April, which would boost credit in the future“, highlights the report.

According to the analysis, in the short term the fall in activity “will have a negative effect” But they maintain the belief that, with a stable macroeconomy, the Fintech sector will be able to expand credit to new clients and compete for existing ones.

fintech2.png

But beyond the potential, although the rate is usually higher than a loan obtained through a financial institution due to the funding capacity of each fintech, They do not consider it to be an “entry barrier” for access. That is why the sector is preparing to look for opportunities in a more favorable scenario.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.