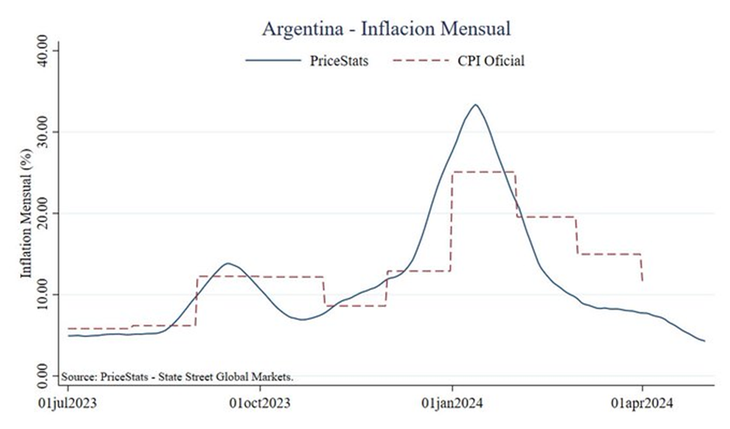

To top it off, the inflation was already out of control (even with strict price controls), especially affecting the most vulnerable sectors. Let us remember that inflation was running at a rate of 1% daily at the beginning of December (equivalent to 3680% annually). The exchange rate situation was also alarming, with an official dollar artificially tied and a market that anticipated a new devaluation.

Stabilizing the country and designing a reliable plan was a monumental task for the new government. Was it going to be painful? Of course, since shortcuts and magic do not exist. And getting things right, unfortunately, takes time, especially with the legacy mess.

Let’s look at some questions to put into perspective. In the first 5 months of government:

- Who predicted that there would be a fiscal surplus so quickly?

- Who thought that the dollar was going to be in the $1000 area?

- Who imagined that the BCRA was going to buy more than USD 15,000M of reserves?

- Who imagined consistent downward inflation?

- Who supposed that the Country Risk would reach 1200 points?

Fiscal Surplus

Milei announced, on its national network, a fiscal surplus of 0.2% of GDP in the first quarter of the year, for the first time since 2008. Given the seriousness of the inherited situation, they decided to advance a shock program, without gradualism.

A positive fiscal result is expected for this year, after years of deficit.

image.png

This surplus was achieved, mainly, through a considerable adjustment in primary spending, which has decreased in real terms by 35% compared to the same period of the previous year. This cut has been concentrated in several key sectors, including retirements (with an inherited formula), subsidies, salaries, transfers to provinces and public works, with a reduction in spending by 82.4% on these items.

On the other hand, although revenues have also seen a decline, they have not been as pronounced as the cuts in spending, and have been largely sustained by taxes related to foreign trade, such as export and import duties, and the COUNTRY tax.

Weight appreciation

After making a fiscal adjustment, the Central Bank no longer needs to resort to monetary issuance to finance public spending, which reduces a constant source of pressure on the currency. This reduces the need for the Central Bank to print more money to cover fiscal deficits.

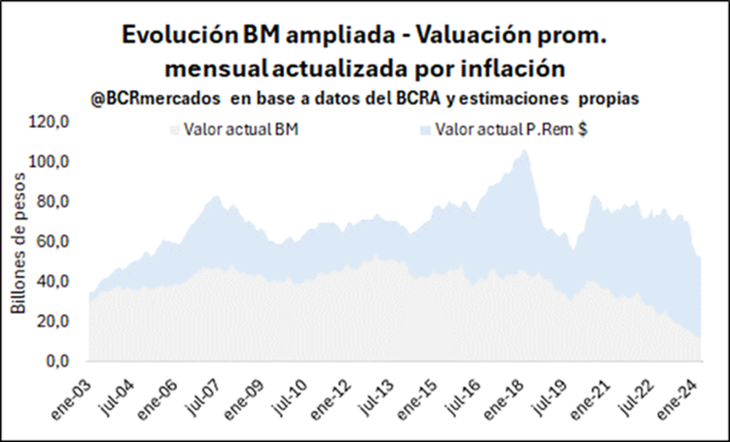

The expanded monetary base (Monetary Base + Remunerated Liabilities) is falling sharply in real terms, that is, adjusted for inflation.

image.png

Source: Rosario Stock Exchange

It is currently at its lowest levels since 2004. How is this explained? Basically because the money in circulation (monetary base) is liquefied by inflation and in addition the money placements that commercial banks remunerate in the Central Bank (Passive Passes) are also worth adjusted for inflation.

In addition, the Central Bank has reduced the interest rate 5 times, which is already at 50% TNA, which is equivalent to an effective rate of 64.8%:

image.png

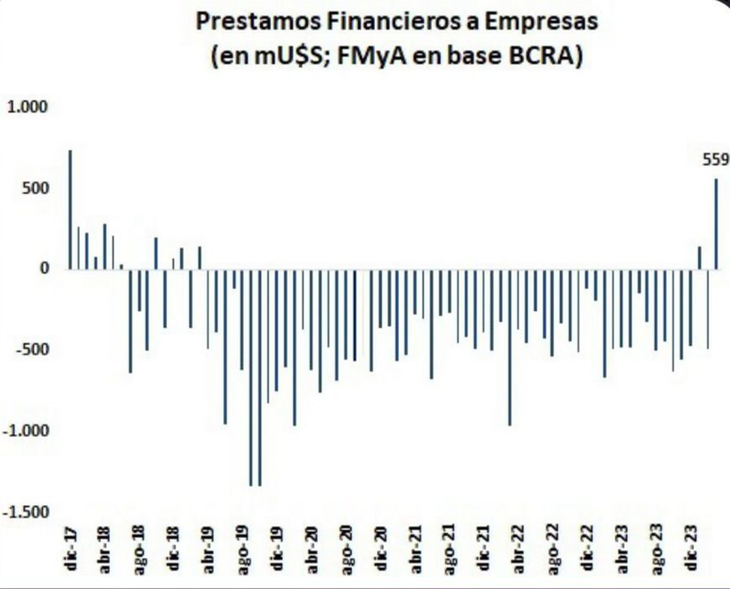

This rate clearly runs below inflation, which forces banks to lend their pesos to the private sector.

This explains how net financing for companies is positive after a long time:

image.png

Source: FMyA Consulting – Economy and Finance

And in addition, several banks have relaunched UVA loans, which means great news for credit in Argentina.

BCRA reserves

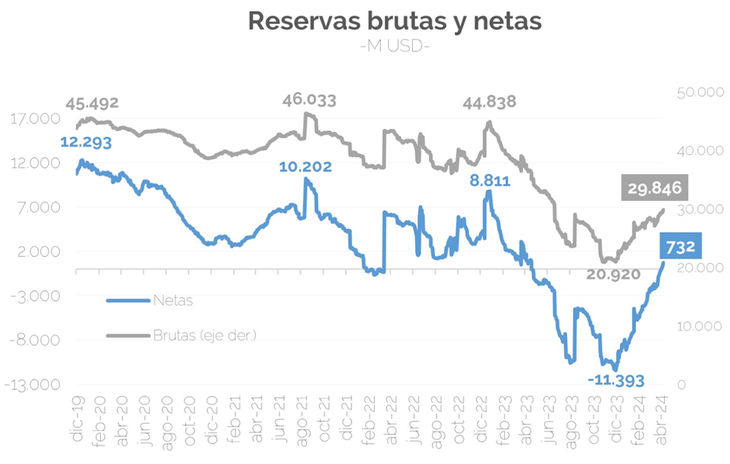

The Central Bank has purchased more than USD 15,000M of reserves, and has only had net sales in four days of its government.

image.png

Source: Invecq Consulting

After the previous government left a deficit of USD 11,000M in net reserves, in just 5 months Milei has moved into positive territory.

Downward inflation

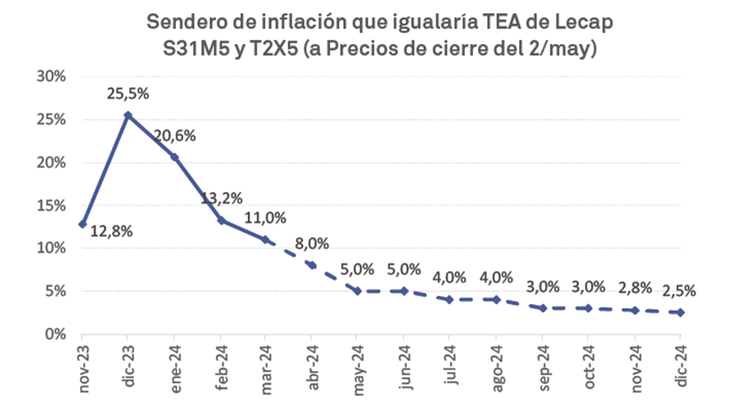

Inflation in December 2023 was 25.5%; in January 20.6%; in February it gave 13.2%; and in March 11%. For April it is expected to be in the single digits, which means a great advance, taking into account the relative price distortion that had been received.

image.png

There has even been 1% deflation in food and beverages in the last week of April.

And the market, which votes with its pocketbook, also expects downward inflation:

image.png

Beyond the technicality, what matters is that the market expects monthly inflation of around 3% for the last four months of the year.

Risk country

The country risk has dropped from 2000 points to the 1200 area, in line with a more favorable climate for investors, after the pro-market measures that were implemented. It is worth noting that Argentina’s country risk fell three times as much as in the rest of the emerging markets.

This led to a large bullish rally in bond prices. The AL30 bond, the highest reference, rose more than 120% from pre-runoff levels.

image.png

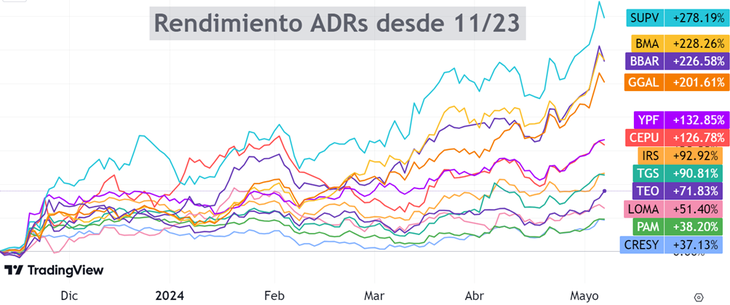

Stocks, for their part, also had large upward movements:

image.png

The strongest sector has been the banking sector, with accumulated increases of more than 200%. In total, Argentine companies added USD 20,000M in market capitalization.

In conclusion, in his first five months at the head of the Executive, Javier Milei has faced a disastrous economic legacy and has taken bold measures to stabilize public accounts. Were all the measurements perfect? Clearly not due to the restrictions already in place.

But if one analyzes the trajectory of the measures, the direction is correct. It is only enough to analyze the fiscal course, which is what guarantees a solid foundation to be able to grow sustainably without ending up in crisis repeatedly. Is there much left to do? Without a doubt. Is the chosen path the correct one? Also.

Finally, I believe that there could be enormous progress if the Base Law and the fiscal package are approved. In particular, with the money laundering proposed by Milei we could see a faster recovery and many flows going towards Argentine investments. For this reason, I want to invite you to download a free report that we prepared with the Investor Club team where we tell you everything you need to know about the money laundering that is coming. You can download it here: https://informes.cartafinanciera.com/.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.