Warren Buffett.jpg

Inc.

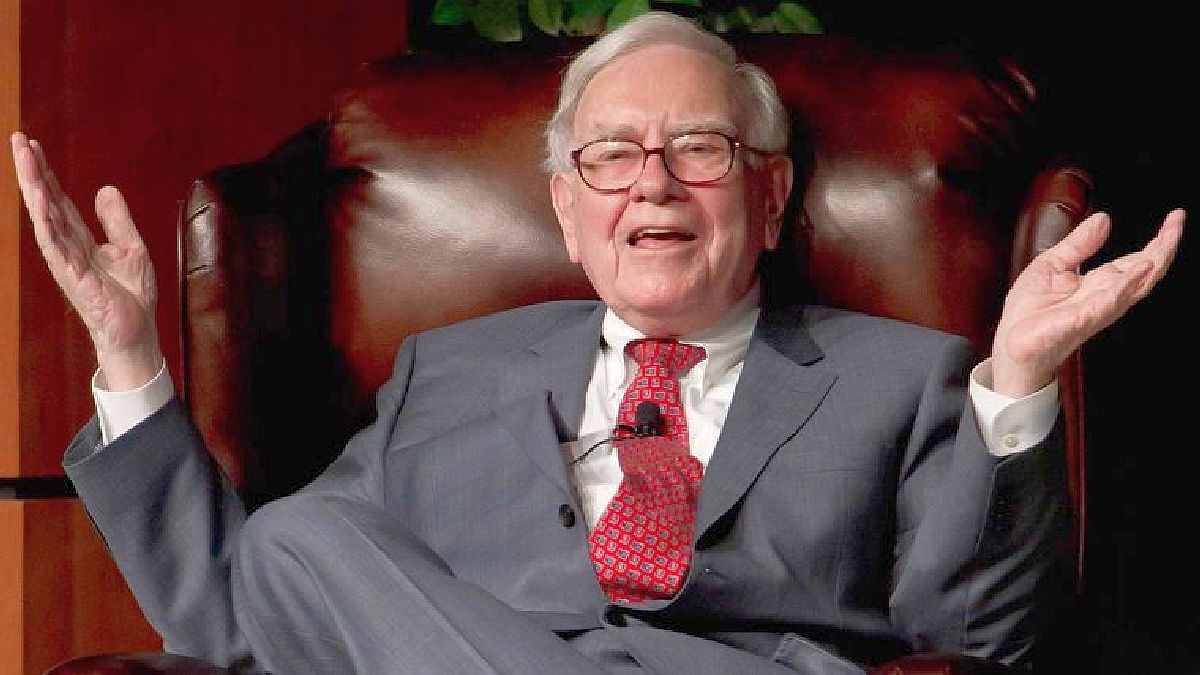

What were the mistakes and successes of Warren Buffett during 2021

Apple’s bet

Buffett’s greatest success could be his investment in Apple of u $ s36,000 million. The shares have uploaded about a third this year, pushing the value of Berkshire’s stake to more than $ 150 billion in mid-December.

apple.jpg

The letter to the shareholders

Buffett published his annual letter to shareholders in February. The investor admitted that overpaid when you acquired Precision Castparts In 2016, he praised a slew of Berkshire affiliates and contrasted their long-term shareholders with speculators who flock to hot assets such as meme shares and cryptocurrencies.

PAG4-WARREN BUFFETT-REUTERS.jpg

Chevron y Verizon

Buffett started the year in style and his fourth-quarter portfolio update in February. Revealed a $ 4.1 billion stake in Chevron and a $ 8.6 billion position in Verizon, answering the question of what mysterious stocks he had been buying in recent months.

Berkshire also cut its largest portfolio position, Apple, by 6%. In addition, he halved his holdings in Wells Fargo and left JPMorgan, PNC and M&T after cutting their positions in those banks in 2020.

chevron.jpg

Reuters

The annual meeting

Buffett warned novice traders that don’t be haughty, lamented the lack of bargains in the market, made sound the inflation alarm and admitted to buying “mediocre” stocks during Berkshire’s annual meeting of shareholders.

The investor also complained about the increase in people who treat the stock market like a casino. In addition, he acknowledged that cutting his stake in Apple and selling Costco were likely a bad decision, and suggested that prevented the rescue of the “big four” US airlines upon exiting their positions in them in April 2020.

Warren Buffett.

The tax crisis

Buffett came under fire after ProPublica obtained the tax returns of some of the wealthiest Americans and reported that the investor only paid. $ 25 million in federal taxes between 2014 and 2018.

The Berkshire boss defended himself, noting that he has pledged to give more than 99% of their net worth to philanthropic causes, and has already donated about half of its Berkshire “A” shares since 2006.

Warren Buffett.

The Gates Foundation

Buffett resigned in June as administrator of the Bill and Melinda Gates Foundation. The investor explained that barely participated in the work of the foundation and that he had already left all the boards of directors of the companies, except his own. He also highlighted his annual donation of u $ s4,100 million in total to five charities, including the Gates Foundation itself.

wife gates.jpg

Friendship with Charlie Munger

Buffett and his business partner, Charlie Munger, discussed their decades-long friendship in a CNBC interview that aired in June. The couple harshly criticized Robinhood and also Munger asked more stringent regulations for derivatives trading after the collapse of Archegos Capital. Buffett, for his part, underscored the immense contribution Munger has made to his life.

Charlie Munger Warren Buffet.jpg

Warren Buffett junto a Charlie Munger.

Buybacks, cash and stock sales

Berkshire’s third-quarter earnings underscored how tough it has been for Buffett find stocks and businesses at a bargain price. A situation that has led to hoard cash and to increase share buybacks.

The conglomerate sold a net $ 7 billion in shares through September 30.. Meanwhile, it revealed that it was on track to buy back a record $ 25 billion in stock this year, increasing its cash pile to an unprecedented figure of $ 25 billion. u $ s149,000 million.

Source From: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.