The blue dollar accelerated and began an upward streak after sideways for long weeks. Thus it rose 18.3% in just seven days. What analysis emerges from this and what is the complete picture so far this year.

The blue dollar exceeds $1,200 this day and consolidates a bullish streak that has been going on for more than a week. Thus, after generating very poor returns throughout the year achieved so much in seven days increase 18.3% and more than beat the fixed term that generates less and less performance, given the decision of the Central Bank to continually lower the monetary policy rate which then impacts the offers that private banks make to their clients.

The content you want to access is exclusive to subscribers.

So, let’s first analyze the performance of the illegal bill so far this year. The blue dollar ended December at $1,005 and until May 10, before the bullish rally began, it was located at $1,040, which implies an increase of only 3.5% in 5 months. However, In the previous week, the bill advanced 7.7% and marked five consecutive increases that extended until this Monday and Tuesday, where it rose 5.4% per day, and 4.2%respectively.

Now let’s see what happened to the fixed deadlines. A week ago the Central Bank (BCRA) dropped another 10 percentage points again the reference rate, which remained at 40% annuallyin another step of its policy of liquefaction of pesos in the economy. It was the sixth rate cut in five months. It was after this decision that the banks adjusted the returns they offer to savers for the traditional fixed term and place them around 30% nominal annual.

Fixed term vs fixed rate: who won in the year

“So far this year The blue dollar (the one that rose the most) has a return of 20% which is the same as a monthly effective rate of 1.5%. The fixed term rate is approximately 2.4% and is the lowest so far this yearso it’s still below,” he told AmbitAndrés Reschini of F2 Financial Solutions on the relationship between both variables.

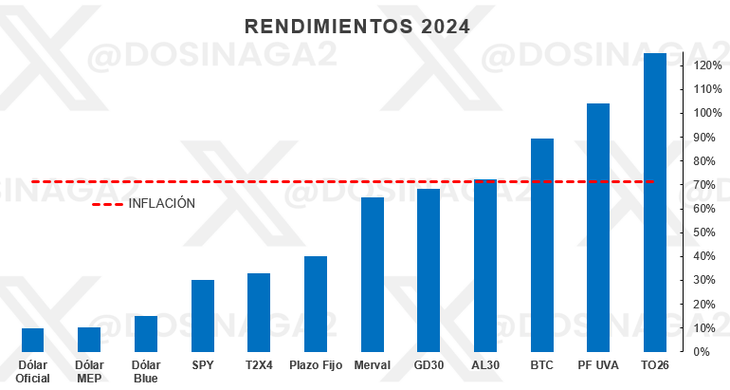

image.png

In this graph made by the analyst Daniel Osinaga It can be observed (at Monday’s values) that The blue dollar, although it was the exchange rate that rose the most in the year, is strongly lagging behind the traditional fixed term, and both lost heavily with inflation accumulated for the year.

Fixed term vs fixed rate: what to expect in the short term

“This is a temporary rise for the blue dollar, which is, for me, reasonable, taking into account the drop we had (real drop, not nominal, that is, we had double-digit inflation). The illegal ticket would be quiet until September, for me the UVA options are still the best to bet on,” Osinaga said.

For his part, for Reschini: “Although it is very difficult to know what will happen to the exchange rate, “Macro conditions do not seem to be conducive to an uncontrolled run as they were before, but we are not exempt from risks either.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.