What is not positive is the management of perceptions and data of the reality we are experiencing.

Fig 1 miscellaneous-pessimism-optimists-positive_thinking-philosophies-philosophers-bven368_low.jpg

Depending on who, and where you look, Argentina is in the worst or best of all worlds. Reality is something else.

When we face a glass filled with water that is half full, a psychologist will determine if it is half empty or half full based on the mood of the person observing it. A physical depending on the initial and final conditions. Economists gravitate between the two, without delving into the functioning of the human soul, and without the rigor of scientists.

It is then understood that there are very dissimilar positions, but within the framework that the facts impose on us. The rest is propaganda.

What worries Argentines?

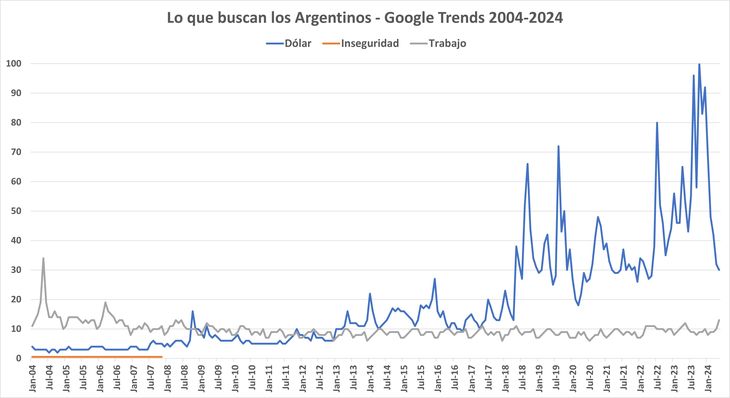

Pollsters usually put inflation, insecurity and unemployment as the main concerns of Argentines. But what obsesses us above all is something else: the dollar, or rather its price.

Fig 2 Google Trends 20 years.jpg

The dollar, an obsession of Argentines. It was not always like this, until 2013 work was able to occupy first place.

This has not always been like that. For example, between 2004 and early 2013 the search for the word “work” in the cloud surpassed “dollar”. At the beginning of 2013, due to the increase in inflation, “the bill” jumped to first place. During the first year of the Macrista administration things calmed down somewhat, but in 2018, in the face of the economic crisis, it was placed far and away in first place.

The pandemic brought relative calm, which was interrupted with last year’s electoral process (July 2022 coincides with the arrival of Sergio Massa to the Economy), when the word “dollar” became omnipresent during October.

Fig 3 Google Trends 90 days.jpg

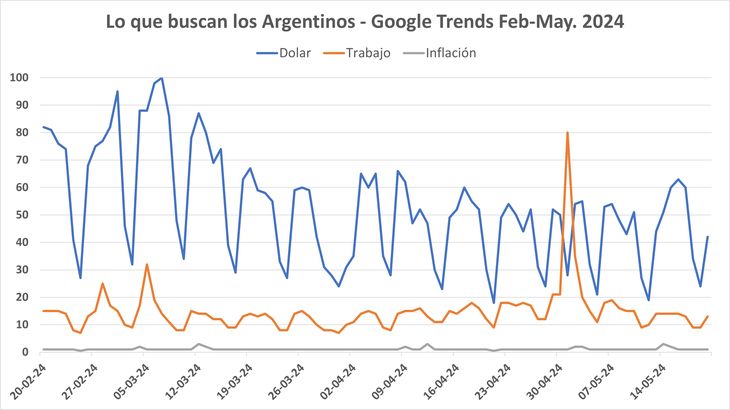

With the current Administration, the obsession with the dollar has decreased, but concern about the labor situation remains unabated.

In the last three months, interest in “the blue” has declined – in this analysis we take the ten biggest concerns identified by pollsters -, while concern about work has been advancing. Curiously – or not so much – the issue of insecurity went from a distant third place for search engines to fourth, while inflation rose this year from fourth to third.

“There is no exchange rate delay because we have a fiscal surplus”

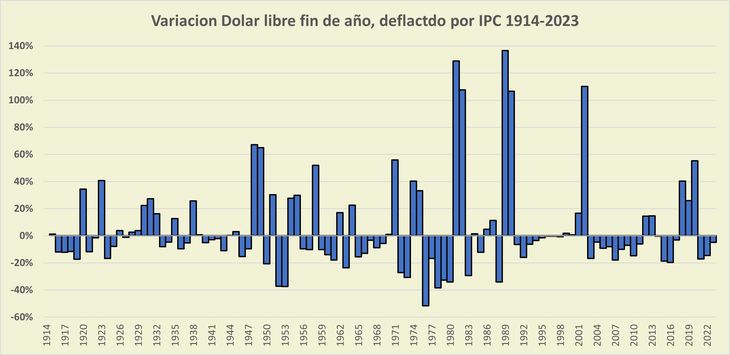

If someone had a crystal ball to predict the movement of the dollar… “it would be filled with money.” Unfortunately this does not exist. What is worse, the factors that influence the value of our currency are innumerable and although in the short or medium term it may seem from time to time that there are something like “trends”, the truth is that both daily variations and monthly, annual, or whatever you like most about the “ticket”, they display what is known as a “random walk”.

Fig 4 Monthly variation of the deflated free dollar Random Walk.jpg

The variations of the dollar against the peso are unpredictable

To put it more clearly, What has been happening with the price of green does not determine what is going to happen (This does not mean that, for lack of better references, the past is not a guide, but an imperfect guide).

Fig 5 Monthly variation of the free dollar Random Walk.jpg

The variation in the price of the dollar against the peso exhibits the behavior of a “random walk” (Durbin-Watson Tests, 2.13; Wald-Wolfovitz, Z-stat. -1.22; BRW, Z-stat -1.71) which suggests that – With some exceptions, it is not predictable.

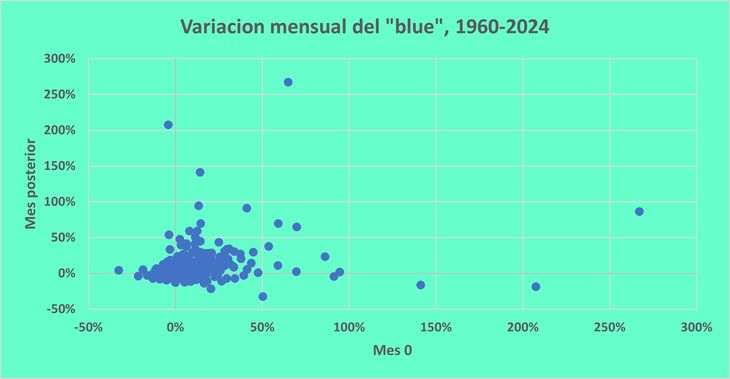

Perhaps because of this need to justify the unjustifiable, or as a result of the war over whether the dollar is behind schedule or not, In recent weeks, it has become “fashionable” among the economists closest to the ruling party to affirm that the calm on the exchange front is due to the achievement of primary and financial surpluses.

The derivative of this is – broadly speaking – that as long as the cash position remains favorable, the Central Bank will continue to increase its reserves, we will be closer to the promised elimination of the stocks and the public pressure to obtain banknotes will continue to be negative. entering a kind of virtuous circle.

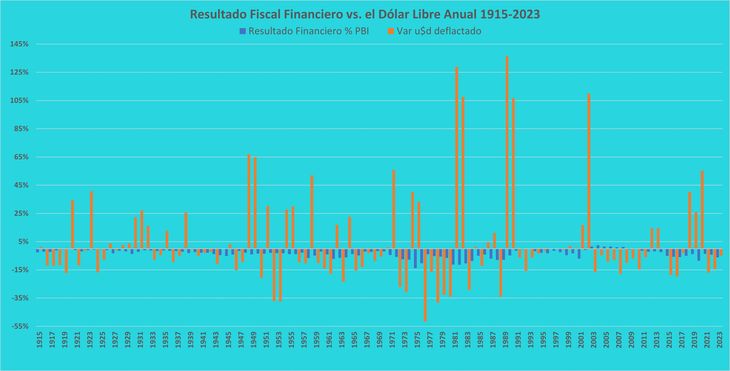

Fig 6 Deficit surplus versus dollar.jpg

In 56% of the years with a financial deficit since 1915, the price of the dollar decreased in real terms (the correlation is -25.1%)

The problem with this argument – or similar ones – is that the financial deficit or surplus are not determining factors in the behavior of the dollar on the street.

It is true that since January the country has recorded four consecutive months of surplus, and that in the interim (data at the end of April) the blue falls 39% in real terms (it rises 1.5% in nominal terms). But the reality is that the decline in the banknote started in November, before the fiscal improvement (-52% in real terms, +13% in nominal terms).

To “throw away” some idea -without any validity-, if this suggests anything it is that It is not the surplus that changed expectations regarding the “bill”, but the change of government.

What the numbers tell us is that the correlation between the monthly variations of the financial fiscal result – the comparison with the primary result does not change things – and the variations of the free dollar, is negative at 9.62% (0% against the variation of the dollar the following month).

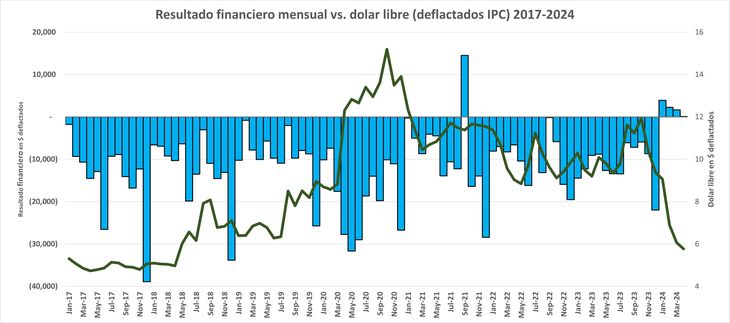

Fig 7 financial result versus monthly dollar.jpg

Statistically, there is no significant relationship between what happens to the fiscal result and the behavior of the banknote.

In fact, in the 17 months since January 2017 in which a primary surplus was recorded – in only five did we have a fiscal surplus – in real terms the dollar fell in 43.8% of cases, an average of 1%. In the other 71 months in which we had deficits, the bill fell by 54.9%, an average of 0.6%.

That is: statistically There is no significant relationship between what happens to the fiscal result and the behavior of the banknote.

In July 1915, Ethel Annakin stated: “The first victim, when war comes, is the truth” …and a war is what we have between the government and non-affiliated economists – opposition or independent -, where Unfortunately neither party seems to care much about the truth.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.