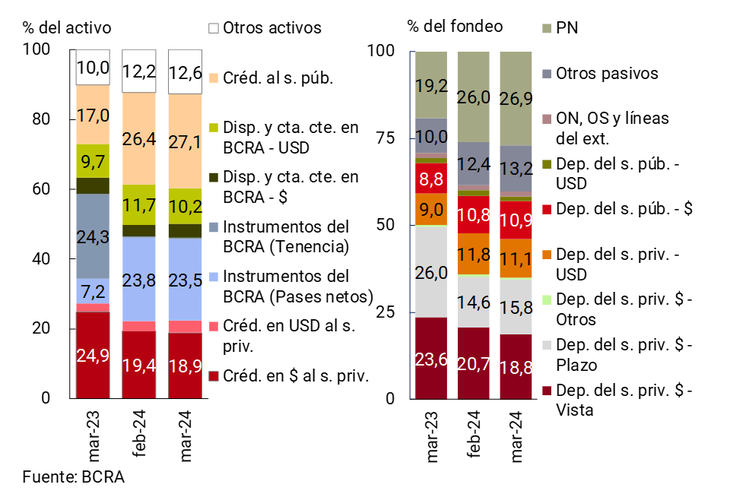

This is the official data for March. Although in recent weeks the Government accelerated the strategy of migrating banks from BCRA debt to treasury debt. Credit to the private sector falls.

In keeping with the Government’s strategy of encouraging banks to dismantle its portfolio of remunerated liabilities from the Central Bank and migrate to loan placements debt by Luis Caputo, the weight of Treasury financing in assets grew again of financial entities. In March reached 27.1%. On the other hand, credit to the private sector falls.

The content you want to access is exclusive to subscribers.

The number comes from the latest Report on Banks published this Wednesday by the BCRA. But the truth is that in recent weeks the Government accelerated its strategy of encouraging financial entities not to renew their Central securities and turn to Treasury bonds: for example, last week Caputo placed $11.7 billion that were supplied mainly with the disarmament of $11 billion of repos, whose stock fell 33% this Monday, after the monetary authority lowered the reference rate again. Thus, when the updated data is known, Treasury risk is expected to gain even more weight in banks’ assets.

Specifically, the proportion of its assets invested in public securities grew more than 10 points in a year. In March 2023, it was 17% and in the same month of this year it reached 27.1%, somewhat above the 26.4% in February.

image.png

This growth has two key flipsides. On the one hand, The weight of the BCRA’s remunerated liabilities in the banks’ assets fell from 31.5% in March of last year to 23.5% in 2024, as part of the Government’s strategy to eliminate passes (which Javier Milei considers as one of the requirements to lift the stocks).

On the other hand, the greater credit to the Treasury coincided with a fall in loans in pesos to the private sectorwhich went from representing 24.9% of assets to 18.9% in the same period.

In a context of deepening recession, the BCRA report explained: “The balance of credit in pesos to the private sector decreased 2.7% in real terms in March. The monthly drop was reflected in all credit lines and in most groups of financial entities (with the exception of public ones). In year-on-year terms, the real balance of financing in national currency to the private sector decreased 31.9%.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.