Immediate and QR transfers doubled in quantity as well as amounts while the BCRA encouraged the use of electronic payment methods.

In the month of March there was a sharp increase in the number of immediate transfers (IT) and of the Payments with Transfer (PCT) through interoperable QR codes. According to a recent report by Central Bank (BCRA) The increase was 324%, which consolidates electronic payment methods as the way to carry out transactions when paying for goods and services in the country.

The content you want to access is exclusive to subscribers.

The growth in the use of electronic payment methods in all their versions goes hand in hand with the recent measure of the BCRAin which it advanced with the interoperability of QR codes for payment with credit cards, the new modality of immediate pull transfers for funding between own accounts and the new electronic fixed term.

payments with qr.jpg

Pexels.

Electronic means of payment: how much immediate transfers increased

The innovations occur with “the objective of benefiting financial users, reducing the existing frictions in the ecosystem of electronic payment methods,” the entity stated. The implementation will be gradual until all processes are operational.

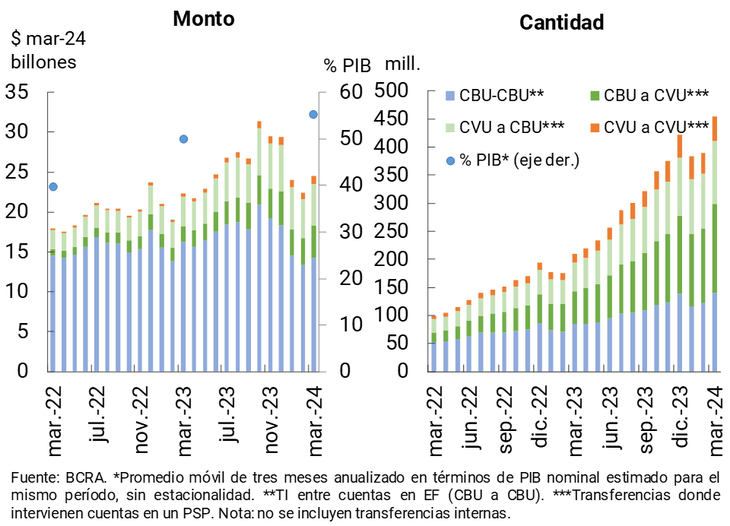

In March, immediate transfers (IT) increased both in quantities (+16.8%) and in real amounts (+9.1%), a performance that was achieved for the different components. In interannual terms, IT more than doubled in quantity (+116.7%) and increased 9.3% in real terms in amounts, dynamism mainly explained by transactions that involve the interaction between accounts in financial entities (EF) and in payment service providers (PSP), as well as the exclusively PSP account segment.

It is estimated that the amount operated in the aggregate set of IT in the last three months (annualized) represented approximately 55.2% of GDP, 5.2 pp more than compared to the same month of the previous year.

Payment methods: how much QR transfers grew

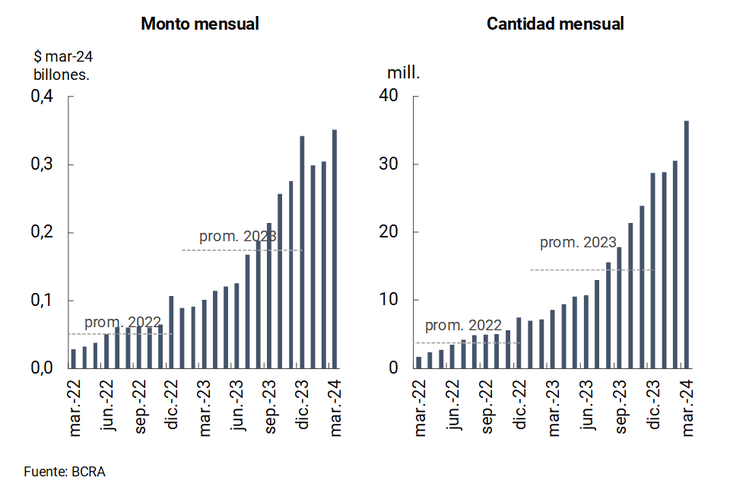

In March the Payments with Transfer (PCT) through QR codes interoperable grew 19.2% in quantities and 15.2% in real amounts. In year-on-year terms, these operations increased 324% in quantities and 245% in real amounts, reflecting the effect of the measures timely implemented by the BCRA that promote the acceptance of payments with any digital wallet21.

In interannual terms, IT more than doubled in quantity (+116.7%) and increased 9.3% in real terms in amounts, dynamism mainly explained by transactions that involve the interaction between accounts in financial entities (EF) and in payment service providers (PSP), as well as the exclusively accounts segment in PSP19 20. It is estimated that the amount operated in the aggregate set of IT in the last three months (annualized) It represented approximately 55.2% of GDP, 5.2 pp more than compared to the same month of the previous year.

Graphic14.png

In year-on-year terms, IT more than doubled in quantity (+116.7%)

Graphic15.png

Payments with transfer (PCT) through interoperable QR

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.