For the economist, one of those who Javier Milei listens to the most, the Government “is in no hurry” to lift the exchange rate. What do you think about the economic plan?

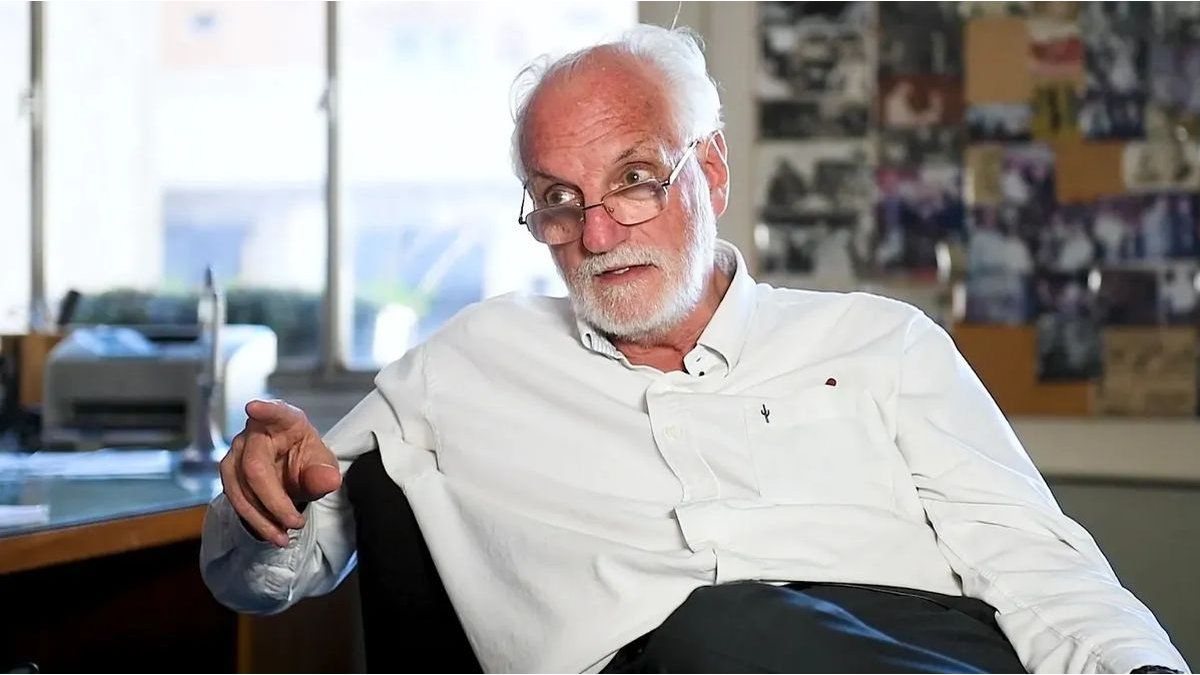

The economist Juan Carlos De Pablo, one of those that President Javier Milei listens to the most

The Economist Juan Carlos De Pabloone of those that the president listens to the most Javier Milei, expressed his opinion on the progress of the economic plan and the future of the exchange rate, in the midst of the strong rise in the Dolar bluewhich is trading at historical highs.

The content you want to access is exclusive to subscribers.

“The Government is in no hurry to take out the stocks because it has to make decisions in an uncertain scenario. The guys say ‘I’ll hurry up, arm myself and they’ll cut me’, the BCRA has to buy dollars”De Pablo said.

The economist said that “those who want to remove the stocks are those who are desperate to get the money, the multinationals that Alberto Fernández was bothering for four years, but there is no rush, they will do it when possible.”

“In light of what was achieved, the debate is that as fears ease, the ‘no money’ is increasingly difficult due to the pressures. I worry if it is here to stay. Let’s not go back to our old ways and that we throw the sacrifice of the last five months overboard,” he revealed.

Regarding economic activity, after INDEC reported that it fell more than 8% in March, De Pablo stated: “Today you have less uncertainty than 60 or 90 days ago. The industrial-level statistical data is until March; April and “May are conjectural. With the data I have from my conferences, I think they are more balanced months but they will only be known in July.”

In addition, he stated that “the rebound has to do with life itself, such as the response to mortgage loans, people are now less afraid. This is day by day, it is fluid, in 10 days we will talk about other issues “.

Regarding another of the main topics on the agenda, such as prices, the economist analyzed that the discussion on inflation “has to do with what will happen when we reach 5%. Argentina has had inflationary experience since the Second War, what we did not learn is how maintain the initial successes.

Finally, in the interview he gave to Radio Rivadavia, he gave his opinion on the Bases law: “It is important that it be approved for medium-term evolution. If it comes out with 300 articles instead of 800, those 500 difference you can go back to the fray next week”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.