We Argentines are like that. One week we are all talking about what the price of the dollar is behind and a few days later, the topic becomes the exchange rate run. In the meantime, the Government, self-perceived as the most liberal in the history of the country, denies both situations, trying to instill in the people the idea that it has absolutely control over the economy… we Argentines are like that.

The problem with currency runs is that – as with their relatives, speculative bubbles – we can only determine them ex-post (after the events have happened). If it ever started, the current run did so on May 14, when the price of the dollar on the street jumped 2.39%, the largest daily increase since January 17.

Regarding the fight in the Senate, since the beginning of the month it was clear that things were not going well with the “Bases Law” and we saw how as the days went by the situation became more and more “angry”, so there was no disagreement here either. surprise that caught investors off guard. Despite this – perhaps seeking to “put pressure on the Representatives” – the Government sought to link the rise in the ticket with the Legislative discussion.

eurnekian-milei.webp

Eduardo Eurnekián at the CICyP: “Let him get his act together and lead the country.”

An interesting point in this story, beyond the friendly crossover of his former employer Eduardo Eurnekian, was the fiery speech that President Milei made on Wednesday the 15th at the CICyP meeting, where he began by harshly lambasting those who spoke of the dollar’s exchange rate backwardness despite that the evidence, even the “ordinary” evidence – as Matías Surt points out – points in another direction.

Although the banknote experienced the biggest rise in 17 weeks, with the country’s risk rate giving up 0.71% between Friday the 13th and the 17th, no one seemed too worried (the exception may have been the “hyper-opposition” economist, Horacio Rovelli , who himself 14 had warned that “There are serious risks of a currency run”) and what prevailed were measured voices like that of Juan Luis Bour (fortunately the people of FIEL left politicking aside), pointing out that “The reaction in the exchange rate is reasonable in a context where Argentina lacks dollars,” but without failing to recognize that “If the dollar were free today, the price would be higher.”

The fact is that, instead of calming down – since “the bad ones” were all specific events, whose adjustment in the market should have been “rapid/instant” – the situation continued to get cloudy.

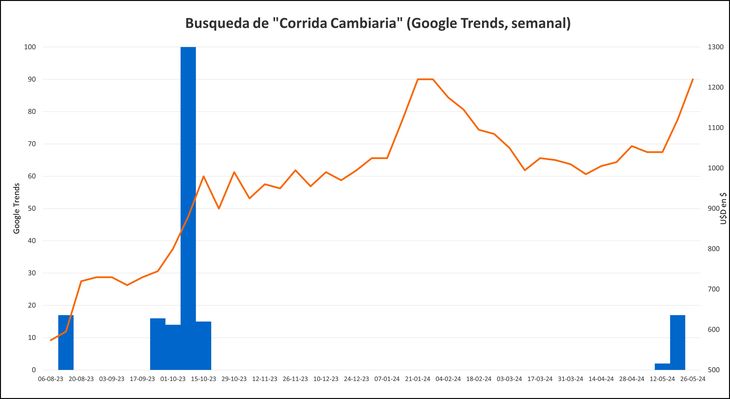

Gogole trends.jpg

Traditionally, every time we have a currency run, Argentines want to know more about the subject. For some reason this did not happen during the January bullfight.

With the 5.36% that the blue “flew” on Monday the 20th (the largest daily jump since January 9 and the third largest of the current Administration) the first comments began to be heard about an exchange rate run, which grew until Thursday the 23rd. , when they practically disappeared from the media, to remain refugees in the “networks”. Although this Friday the bill collapsed 4.69%, to $1,220 (the largest daily drop since March 6 – at the beginning it was traded at $1,300), it ended with a rise of 8.9%, the largest and identical to that of the week of January 15 to 19.

In the government they swear and swear that in the last round they did not intervene in any way to stop the rise of the “bill” but, despite the fact that few dare to raise their voices or if they do it is in an elliptical manner and even by mouth to reassuring outside -perhaps not wanting to antagonize the Lion-, the truth is that there seem to be more who do not believe him.

In this sense, the rise in the country risk rate, 14.3% in the week, the highest since March 20, 2020 and the maximum since March 22, and Minister Caputo’s 180-degree turn do not help too much.

Something that we cannot leave aside here is the rise of the “blue” between January 3 and 23, when it “flew” 26% in 14 wheels (this time it was 23% in 9 wheels), a process in which, Unlike now, the idea of a bullfight was practically absent.

Beyond the political moment and perceptions, the difference may have had with the definition of what an “exchange run” is.

What is an Exchange Run?

A tour of the main economic and financial dictionaries – Palgrave’s Dictionary of Economics, Barron’s Dictionary of Finance and Investment Terms; Oxford Dictionary of Finance and Banking, The Penguin Dictionary of Economics, The Herold Financial Dictionary and on the WWW, Investopedia’s Financial Dictionary – did not give us any answer to what a “currency run” is. Not even the BCRA financial dictionary talks about it.

Searching the “literature”, there is not much we find and in general it is in references to exchange crises, bank runs or the “Tequila Crisis” and its effect on Argentina.

Chat GTP carridacambioria.jpg

There is no definition of what a currency run is, however, all Argentines know it. ChatGTP gives us one of the best answers.

We had a little more luck asking the three main AI machines, ChatGTP 4.0; Grok and Bing’s Copilot. Possibly the best response was that of ChatGTP (in English it did not change.

Clearly there is no single and exhaustive definition for the economic or financial profession – in fact, there is no definition – of what constitutes an exchange run; …and yet any Argentinian over 13 years old who has ever seen a dollar knows by heart that it is an exchange rate run.

Who in gladio occiderit, gladio peribit,

“He who kills with iron, dies with iron” (Gospel according to Saint Matthew 26:52). We saw the last indisputable event of a currency run between November 26 and October 23 of last year, when the free dollar “flew” 42.9% in 18 wheels.

Faced with this type of phenomenon, governments usually take one of two paths. First, ignore them publicly – while putting pressure on the largest players in the market and taking advantage of the most sympathetic voices -, in the style of what the current administration has done. Second, look for and point to some culprit – But these are not exclusive paths, but rather they often end up joining together as things get more difficult, in the style of what the current administration is doing.

The irony behind all this is that, despite his denials in that October bullfight, the current president of the Nation was considered and accused as one of the main factotums.

the-remembered-press-conference-of-28-d.webp

The conference of December 28, the entire economic cabinet leaves Federico Sturzenegger alone

Of course, Javier Milei is not the only one linked to foreign exchange bullfights. The Minister of Economy, Luis Caputo, knew how to take over as president of the BCRA in June 2018 after Federico Sturzenneger was “filed” to resign in the middle of an exchange rate run, a run that he could not stop and that led him to suddenly slam the door. three months later and that left us with the year with the largest increase in the ticket since the end of convertibility.

The astute reader will surely have noticed that in this note I did not talk about the causes, nor the effects, nor how long it can last or if it is already over or if the process of the last two weeks is an exchange rate run or not.

The point is that probably What we are experiencing these days is the first of many similar episodes that we will have in the future. -in which the government “wins” or “loes”- to the extent that there is no single exchange rate, the value of the “bill” is repressed (in whatever variant it may be) or it does not achieve a sufficient level of confidence in the society.

The rest is for another note.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.