As the investment advisor points out, Gaston Lentiniin a document sent to clients on the occasion of May 25, it was very clear “that the impulse had to correct” to the stock index of the local market, the S&P MERVAL.

Lentini explains that the first objective was 1,050, the next 1,280 and it came to be worth 1,415 in an economy that tends to normalize, “although it is still missing”. The last friday, the S&P MERVAL measured in CCL corrected to the 50-day average at 1,084 points, close to 38.2% of the Fibonacci retracement.

“If the declines continue, the next important support is at the 200-day average, coinciding with the 61.8% of the series at $930, which coincidentally coincides with the 50-week average“, Explain. Simply put, if the market does not bottom here, could continue to drop another 10% as a natural part of its correction, and that will be the time to buy strong stocks again, since this May was led by the banks to the detriment of the energy sector that pulled in 2023 and early 2024.

So, to put it more easily, the strategist maintains, “sIf you are investing in Argentina, don’t be scared, this cycle has a lot to give, but otherwise, if it is low it makes you nervous, consider not adding more argy positions and look for or add Cedears”. Finally, he recommends, if the investor prefers to be more conservative, he should opt for dollarized fixed income.

Cedears: which ones the city has in its sights

Emilse Córdobadirector of Bell Stock Market, He maintains in statements to Ámbito that, from that broker they are cautious, but like Lentini, they bet “strong for Argentina in the medium and long term”.

The strategist states that she is confident that, even with more changes, the Law Bases will end up being approved and in the meantime, “It is a good possibility to incorporate Cedears into the portfolios, being an alternative to dollarizing them.””.

“For those who can take a little risk, they can opt for conservative assets such as Coca-Cola or McDonalds. Also more aggressive ones like Globant, Nvidia, Microsoft for greater volatility if the investor profile tolerates it”, holds.

While, Flavio CastroAsset Management Analyst Criteriamaintains in statements to this medium that, the current one, is a context where the boom in Artificial intelligence (AI) is driving a strong push by technology companies within the large-cap and growth sector, which is supported by improvements in labor productivity.

Cedears Criteria Portfolio.JPG

Furthermore, Castro maintains that he sees value in this segment of the American market, due to short-term catalysts, where expectations move in step with the decisions and signals of the Federal Reserve, while inflation and economic activity data arrive. The analyst indicates thata decrease in the risk-free rate would boost the valuations of those stocks whose cash flows are expected to be largely distant in timethis being the case of these growth and large capitalization technology companies such as Microsoft and shares the Cedears portfolio that Criteria recommends.

Cedears: the recommended wallets

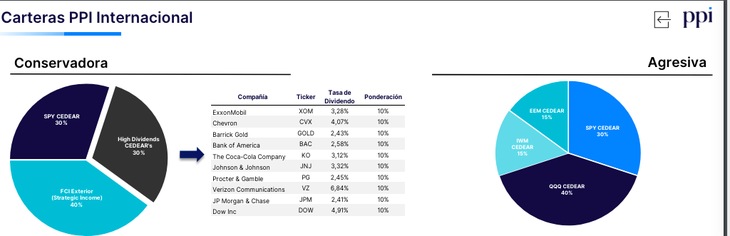

Lastly, since Personal Investment Portfolio (PPI), maintain that, facing the end of May, they maintain exposure to the North American economy, which remains resilient, “but with the labor market partially softening.” In turn, PPI continues to bet on FCI Strategic Income for its holding of long bonds in the face of an eventual rate cut by the Federal Reserve.

On the other hand, for stock selection, PPI continues to bet on its high dividend portfolio, made up of leading companies in their respective industries, with low beta and that have solid financial and credit fundamentals, while paying juicy dividends.

Screenshot 2024-05-27 at 09.15.02.png

Cedears portfolio recommended by PPI.

“The latest US employment data, which showed that the labor market could begin to give way, generated optimism in the market. Again, they are priced two potential rate cutswhich excited equity investors,” they say from the brokerage house.

In this sense, and added to the fact that the conflict in the Middle East seems to have taken a backseat, PPI recommends leaving XLE (-20pp) and rotating towards QQQ (+20pp). “We consider that the technology sector, which is also the most linked to services, is the one that could best capitalize on this drop in rates due to the weight that the future flows of its components have on their valuations,” very in tune with Criteria.

At the same time, they consider that the improvement in international mood could benefit emerging economies “which is why we maintain our position in EEM.” Finally, PPI continues betting to re-coupling between IWM and SPYwhich since March 2023 have taken different paths.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.