On this occasion, it will tender three LECAPs (short-term fixed rate bills). The longest, until September, will have a minimum effective monthly rate of 4.25%.

The Ministry of Economy will carry out a new placement of debt in pesos this Wednesday. The tender, the first of June, will be held on a hot day: that day the basic bills and package of fiscal measures, which the Government is trying to float, will be discussed in the Senate. The team of Luis Caputo will go out in search of $5.4 billion.

The content you want to access is exclusive to subscribers.

In this tender, the Ministry of Economy will face the first important expiration of the LECAP, the short-term fixed rate bills that it issued in large quantities during the last month to channel the banks’ pesos from the disarmament of BCRA repos. In this case, The payment to be renewed is for around $5.2 billionplus some other smaller commitments.

Debt: the details of the tender

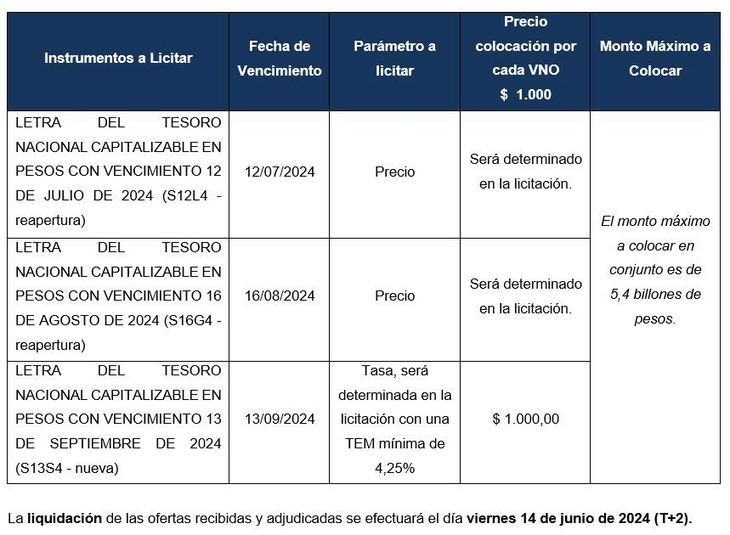

In this opportunity, will tender three LECAP. It will reopen bills maturing on July 12 and August 16. In both cases, they will leave without a minimum rate. The performance will be defined in the auction itself based on a price comparison.

In addition, it will offer a new LECAP that will expire on September 13. In this case it will have a minimum effective monthly rate of 4.25%. This is a change in the strategy since in the last placement it had been the shortest letter that had a predetermined minimum yield.

image.png

The reception of offers for all instruments will begin at 10 a.m. and will end at 3 p.m. this Wednesday, reported the Treasury Palace. The settlement of the operation will take place this Friday.

In this case, the maximum amount defined for this placement reflects that the objective of the economic team is limited to the renewal of maturities, which are of a similar magnitude. This opens the door to a pause in the migration strategy from Central Bank repos to Treasury debt. A strategy that had been deployed strongly during May and had increased the treasury’s short-term maturities.

The decision comes after a complicated week financially for the Government, which included a sharp drop in Argentine assets. Debt securities in Treasury pesos did not escape this dynamic. Despite the rebound registered this Monday (especially in stocks and bonds in dollars), the Government decided to open the umbrella for the next tender, which will have as its framework the beginning of the debate in the Senate of the basic and package bills. fiscal.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.