Last week, the Senate generally approved the Base Law and the Fiscal Package. In the particular vote, it only rejected the chapters of Income Tax, Personal Assets and Social Monotribute. Now the dossier returns to the Chamber of Deputies, where they must validate the changes made by the Senate and where they have the possibility of reincorporating the original versions of the chapters rejected by the Upper House. Three additional good pieces of information were added to this news:

- The renewal of the Swap with China,

- The approval of the 8th revision of the Program with the IMF.

- An inflation figure below expectations (4.2%).

In that context, the question is what arises, what comes next now and what position to take when assembling portfolios. Let’s see what the city gurus in its most recent reports.

However, and as in any economic program, the one that the Government is implementing has different milestones marked on its agenda that function as turning points. They are necessary facts to close a stage and be able to move on to the next.. For this reason, the approval of the Bases law and the Fiscal package had become in recent months a factor that blocked potential advances in many areas of the economic program.

Although still final approval was not achieved, the market positively valued the progress achieved. The Senate was the main challenge due to the low degree of representation of the ruling party in that Chamber.

Strategy: is the investment compass recalibrated?

From the Consultant 1816 recommend the following strategy, since the approval of the Bases law and the fiscal package “It is positive news for debt“, not only because of the content of the regulations, but also because of the political signal of having managed to pass (not without some modifications) the emblematic project of the Milei administration in the Chamber whose composition was the most adverse for the Government.

1816.png

In any case, the ups and downs of the legislative agenda in these 6 months confirmed that, at least until next December, it will not be easy for the Government to work with the Legislative Branch. That said, and while recognizing the political fragility and pending issues, 1816 maintains the “pay-per-view” stance on hard dollar bonds, as long as a pro-market government that faces fundamental reforms while carrying out a severe fiscal adjustment and relative prices continues to retain popular support.

“Taking everything into account, we ratify the idea of being long” in Global 2035 and 2041which because they have lower parities (see figure) provide somewhat more coverage than the 2030s in bad scenarios, while at the same time Their longer duration retains more upside if “everything goes well” and the sovereign yield curve normalizes.

Screenshot 2024-06-17 at 13.45.33.png

From Consulting 1816 they recommend the following strategy.

And he adds, “For now, Within the Lecap segment we continue to prioritize short instruments and we continue to prefer CER over long Lecap, given breakeven inflation, at 4.1/4.2% for Jun-Dec,” concludes the consultancy.

Some ONs appear on the radar

From the IEB Group prefer positions in the short section of the curve (GD30) betting on a normalization of the curve as the government improves its liquidity position.

On the other hand, for the most conservative investors, IEB considers it convenient diversify the portfolio by incorporating hard dollar Negotiable Obligations such as: Telecom 2026 (TLC1O) and Tecpterol 2026 (TTC7O). Low duration bopreals can also be incorporated where we lean towards BPA7C.

RIGI and Argentine equity

Local equity continues to show great potential in the future, even more so with what was stated in the previous section, a context that will fundamentally favor those companies related toin the Oil & Gas sectorgiven the great potential for growth and development.

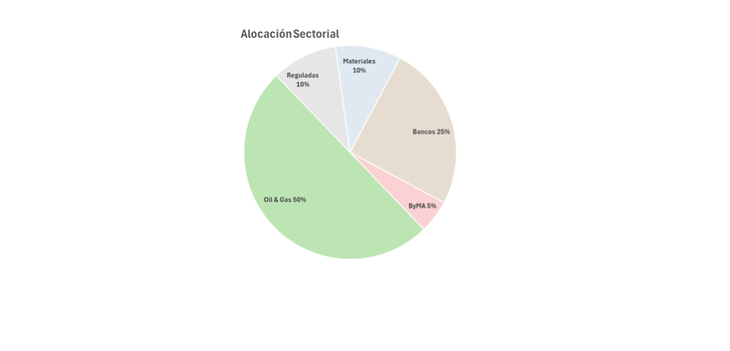

Projects like those involved in Vaca Muerta, Palermo Aike, Argerich, among others, They will directly benefit from RIGI. From IEB they indicate that this is why they believe it is convenient to continue with a strategy that mainly weights the Oil & Gas sector, within which pWe refer companies such as YPF (YPFD), Pampa Energía (PAMP), Transportadora de Gas del Sur (TGSU2) and Vista Energy (VIST).

Screenshot 2024-06-17 at 14.12.48.png

IEB Group sector allocation.

Likewise, IEB sees growth potential for companies whose business is highly influenced by regulations, where projects such as the second stage of the NK Gasduct, the reversal of the Northern Gasduct, new high voltage transmission lines, among other infrastructure works, will be able to provide great value for these companies after the approval of the RIGI. “To this end, we consider it attractive to maintain positions in companies such as Central Puerto (CEPU) and Transportadora de Gas del Norte (TGNO4).”they assure.

On the other hand, in the face of a transition from the current banking business in Argentina towards traditional banking, IEB finds it interesting to have a portfolio position in the banking sector through Banco Macro (BMA) and Grupo Supervielle (SUPV). Mwhile for the materials sector we like Ternium Argentina (TXAR) and Loma Negra (LOMA), given the possibility of facing an increase in demand without the need for heavy investmentssince they have a low utilization of installed capacity, while at the same time they have attractive long-term valuations.

Finally, the group continues with the “positive” view on the actions of Argentine Stock Exchanges and Markets (BYMA) given the defensiveness it incorporates into our portfolio, while at the same time allowing us to capture the growth potential of the Argentine capital market.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.