The data comes from a report on the matter Schroders, which maintains that the $300 billion of frozen Russian reserve assets says out loud, what the “militarization” of the US dollar can really mean -the hegemony of the dollar, if you will-.

“The vast issuance of US Treasury bonds to finance endless deficits also triggers rumors about long-term debt sustainability,” the document warns. Which adds that, central banks –China, Singapore and Polandthe largest in 2023 – have been executing record purchases so far and that have brought gold reserves as a percentage of the total holdings of the 13% at the end of 2021 to 15.3% at the end of 2023.

“Looking at the long term, central bank purchases reflect well the evolution of global geopolitical and monetary/fiscal dynamics. Between 1989 and 2007, Western central banks sold all the gold they practically could, limitated after 1999 by central banks’ gold deals to keep sales orderly“, admits the document.

In that post-Berlin Wall, post-Soviet world, with the rise of American-led liberal democracy, “the acceleration of globalization and America’s debt metrics frankly quaint compared to today,” demonetizing “gold as a reserve asset seemed totally logical.”

The 2008 financial crisis, the introduction of quantitative easing and emerging geopolitical stress were enough to put an end to Western sales and bring emerging market central banks to an average of 400 tons per year between 2009 and 2021. Large numbers (>10% of annual demand) but not seismic.

gold

Depositphotos

The 1,000t of gold (20% of global demand) purchased by central banks in 2022 and 2023, a pace that was sustained in the first quarter of 2024, They are potentially seismic. “It seems entirely plausible that the current tense dynamic of rising power and power, combined with the fiscal fragility that looms not only over the US-issuing reserve currency, but over the entire advanced economic bloc, could trigger a sustained move toward gold“.

Put bluntly, “the gold market is not big enough to absorb such a sustained move without much higher prices, especially if other global players also try to enter at around the same time.

Growing demand from Chinese investors

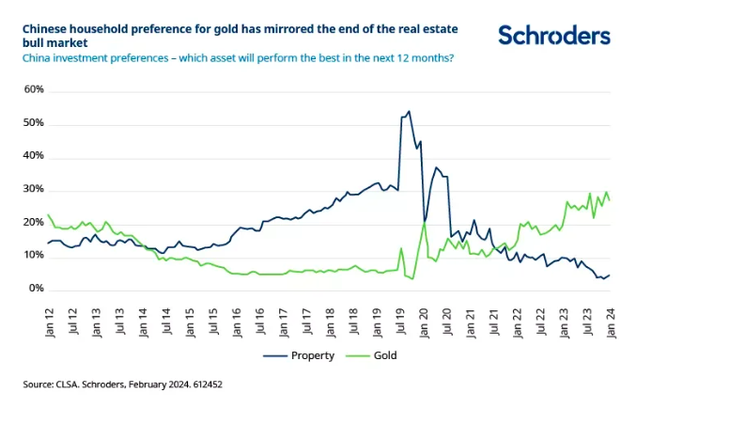

According to, Schroders, lChinese households, which have added trillions (in dollars) to an already record savings glut during 2022 and 2023, are one such actor. The end of the thirty-year real estate bull market has been key in triggering a major shift in attitudes toward gold.

“The increase in investor preference for gold has reflected the decline in the real estate sector. We doubt that the increase in household demand for gold is a temporary phenomenon,” maintains the global investment benchmark.

Screenshot 2024-06-17 at 14.44.02.png

Gold’s strength reflects a shift towards a more multipolar world – Schroders report.

Western investors, whose selling has not been enough to stop gold’s record prices, are another key participant who could well switch from seller to buyer in the coming quarters. The buying (and selling) of Western investments has reliably followed the inflections of monetary policy.

“Cyclical easing remains likely this year and a tax-dominated future suggests that Federal Reserve intervention will be necessary to maintain Treasury market solvency/liquidity,” he maintains. Schroders.

Thus, the investment giant concludes that, gold will remain a relevant hedge against central banks and broader sovereign fiscal credibility that Western investors will use.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.