Alphabet Inc. also crossed the $2 trillion mark in late April, and the surge has also pushed the market values of Nvidia Corp., Microsoft Corp. and Apple Inc. above $3 trillion.

amazon reached a market value of US$2 billion on Wednesday, becoming the fifth American company to exceed this figure. This milestone was achieved thanks to an increase in investment in technological valuesdriven by optimism about the artificial intelligence and the possibility of interest rate cuts.

The content you want to access is exclusive for subscribers.

Amazon shares rose 3.9% to $1.921, giving the e-commerce giant a market value of $2 trillion. Amazon joined an exclusive club of tech companies that have reached the milestone, alongside Microsoft Corp, Apple Inc, Nvidia Corp and Alphabet Inc.

This Thursday, Amazon shares rise 0.5% before market opensor, but in the last month it has accumulated a positive balance of 7.1% and in the last six almost 30% (+26.2%).

Alphabet Inc. crossed the $2 trillion threshold at the end of April, and this increase has also led to the market values of Nvidia Corp., Microsoft Corp. and Apple Inc. surpassing $3 trillion.

Amazon’s background

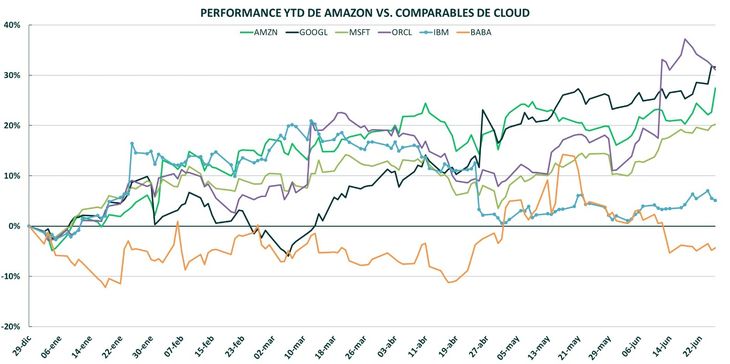

Since its first quarter earnings report, shares of Amazon have shown notable volatility. The strongest sales growth in its cloud unit in a year helped push the stock price above its all-time high set in April. The stock rose again in June, recovering from losses suffered in late May and racking up a gain of about 27% so far this year.

Prices also received support from a new report from Bank of America that set a new Price target of $220 (13% above the current value). This news adds to a number of other news from the technology sector that have occurred in recent months, but concerns are increasing regarding the possibility of presenting evaluations exaggerated in the sector that induce a future correction, points out the Inviu Research & Strategy team.

Amazon.jpeg

Comparative chart of Amazon’s performance against other cloud business competitors. Inview

The momentum in Amazon stock has been significant. Last year, the company made cost cuts and restructured its business to capitalize on the rise of artificial intelligence. Additionally, its key web services business has shown signs of revitalization in its growth, which is a major point of optimism for investors.

“Part of Amazon stock’s strong performance over the past six to nine months is due to the fact that it was oversold at the end of 2022,” explained Dan Romanoff, analyst at Morningstar Investment Service.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.