The tense debate sweeping the United States over whether President Biden will abandon his re-election bid has already taken over Wall Street, where traders are moving money in and out of the dollar, Treasury bonds and other assets that would be affected. for the return of Donald Trump to the presidency.

The portfolio reshuffle began late last week after Biden’s disastrous debate with Trump, raising concerns that the 81-year-old Democrat is too old to serve another termMarket action was most acute in the bond market, where 10-year Treasury yields rose by as much as 20 basis points in the following days, something that also drove Argentine assets lower earlier this week.

With speculation mounting rapidly about Biden’s possible withdrawal from the race (the betting markets see less than a 50% chance that he will remain a candidate) investors are making contingency plans to react to an announcement during the July 4 holiday and the weekend afterward.

A fund manager, who spoke on condition of anonymity given the sensitivity of the issue, told Bloomberg that was biased towards the dollar and short-term debt as hedges against the increased risk it believed would be caused by Biden’s withdrawal. No president has opted not to seek a second term since Lyndon Johnson in 1968, and the election is just four months away.

Trump vs. Biden: What the market is analyzing

“Markets have already been reassessing election probabilities since the debate, so news of the The last 24 hours have only added more fuel to the fire.“said Gennadiy Goldberg, head of U.S. rates strategy at TD Securities in New York.

The consensus among traders and strategists is that a re-election of Trump, a 78-year-old Republican, would boost trades that would benefit from an inflationary mix of looser fiscal policies and greater protectionism.: a strong dollar, higher US bond yields and gains in bank, healthcare and energy stocks.

Dollar sign

The dollar (DXY) gave one of the first signals of how markets would adjust to a potential Trump victory, gaining in the hours following last week’s debate. While the dollar has received a boost this year from indications from the Federal Reserve that it intends to keep interest rates higher for longerthe currency received a clear boost in real time as Trump dominated the showdown with Biden.

Trump has proposed cutting taxes and imposing tariffs of 60% on imports from China and 10% on those from the rest of the world. Goldman Sachs Group Inc. chief economist Jan Hatzius said this week that such levies could raise inflation and force the Fed to raise rates about five times as much as it otherwise would.

“A Trump victory raises the prospect of higher inflation and a stronger dollar, given his promise of more tariffs and a tougher stance on immigration,” said JPMorgan Chase & Co. strategists led by Joyce Chang.

Potential losers from a rising dollar and Trump’s expected support for tariffs include the Mexican peso (MXN=X) and the Chinese yuan (CNY=X).

Operation on the yield curve

After the debate, money managers in the $27 trillion Treasury bond market They reacted by buying shorter-term notes and selling longer-term ones.a bet known as a steepening trade.

A number of Wall Street strategists have promoted the strategyincluding Morgan Stanley and Barclays Plc, urging clients to prepare for persistent inflation and higher long-term yields under another Trump administration.

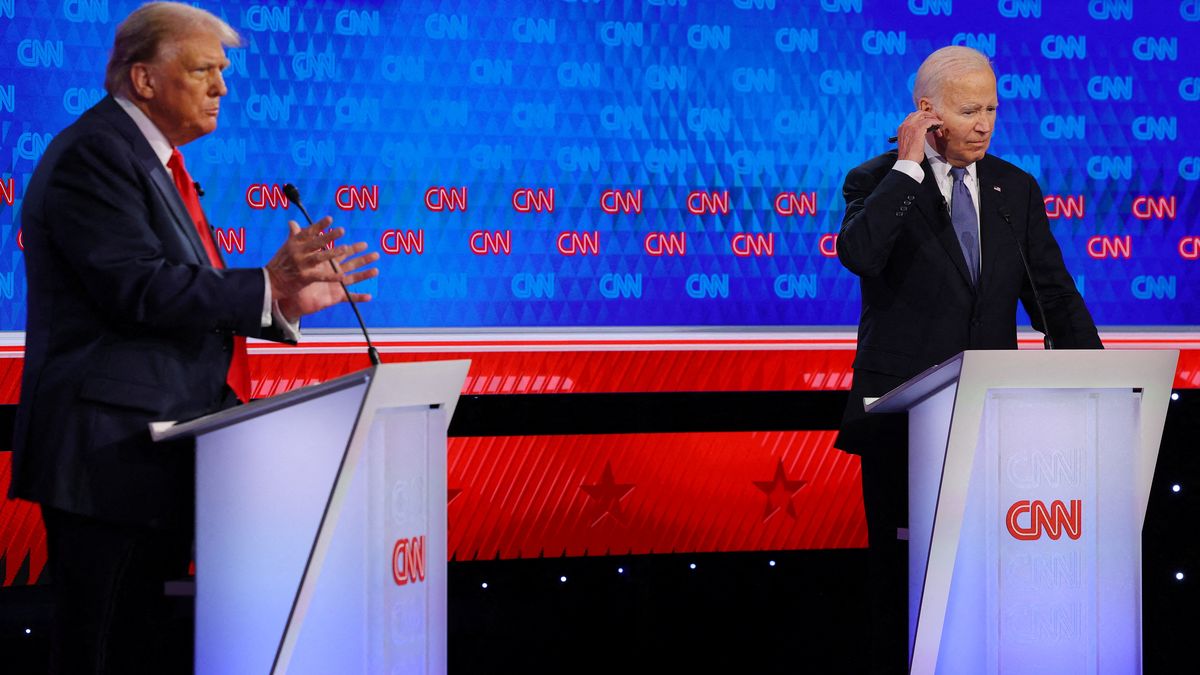

Trump and Biden.JPG

Race to the White House: Joe Biden considers dropping his candidacy after the first debate with Donald Trump.

In a two-day span starting late last week, 10-year yields rose about 13 basis points relative to 2-year rates, the steepest steepening of the curve since October.

Signs that traders are preparing for near-term volatility in the Treasury market emerged Wednesday, via a buyer of a strangle structure, which profits from an up or down move in futures through strike prices. Along with potential risk over the holiday weekend around Biden’s candidacyThe deadline also includes Friday’s U.S. jobs data and testimony next week from Fed Chairman Jerome Powell.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.