He Central Bank (BCRA) released one of the most important reports for the city. It is the Market Expectations Survey (REM) prepared by 38 market participants who share their forecasts for the dollar, inflation and GDP, among other variables.

Inflation

In the month of June, those who participated in the REM estimated a monthly inflation of 5.2% (-0.3 pp with respect to the previous REM). For July they projected a monthly inflation of 4.8% and for the year of 138.1% yoy (-0.7 pp and -8.3 pp in relation to the previous survey, respectively). Those who best predicted this variable in the past (Top 10) expected a inflation of 136.6% yoy by 2024 (-6.9 pp compared to the previous REM). Regarding the Core CPI, the REM participants set their forecasts for June at 3.7% and for July at 4.1%. The Top 10 expected core inflation of 3.9% for June and July, and 114.7% yoy for 2024.

The highlight of the data is that until December, the market expects inflation to remain at a low of 4%. However, on the other hand, it also adjusted the CPI downwards for the coming months (in the previous REM, it was 5%).

Thus, for the month of June, whose number will be announced next Friday, inflation is expected to be 3.7%, July 4.1%, August 4.2% and September 4.2%. For the last part of the year, inflation would be 4% in October, 4.1% in November and a slight jump to 4.3% in December, which is the seasonally highest inflation rate.

WhatsApp Image 2024-07-04 at 7.24.10 PM.jpeg

Dollar

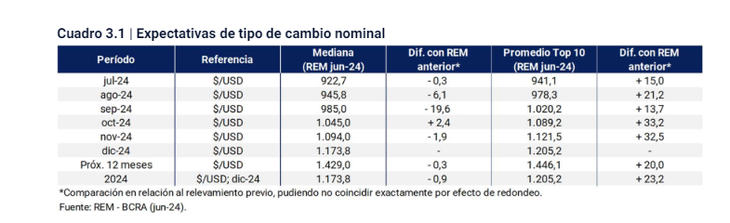

For the exchange rate, the projections were located in $922 per dollar for the July 2024 average, which implies maintaining the 2% crawling peg estimated by the Government itself. For the Top 10, the average nominal exchange rate expected for July is $941.1/USD.

The year-on-year change to Dec-24 implied by the forecasts was 83.0%, -0.1 pp lower than the previous REM.

However, by December an exchange rate of $1,173.8 is expected, above the Government’s outlook according to the budget advancewhich sees a wholesale dollar at around $1,016.

centralbank3.PNG

Economic activity

In the June survey, the REM group of analysts projected a growth of 2024 Real Gross Domestic Product (GDP) level 3.7% lower to the average for 2023, improving the outlook by 0.1 pp compared to the previous survey. Meanwhile, those who make up the Top 10 projected, on average, a reduction of 3.5% in the year. The fall would have been concentrated in the first half. According to the forecasts received, the level of activity would begin to recover in the third quarter.third quarter of the year, with a rise of 0.5% For 2025, the REM participants estimated an average growth of 3.2% a year.

Unemployment

The open unemployment rate for the second quarter of the year was estimated at 7.9% of the Economically Active Population (EAP) implying a rise of 0.3 pp compared to the previous REM. For the Top 10, the unemployment rate would be 7.7% in the same period. The group of REM participants expects an unemployment rate of 8.1% for the last quarter of 2024.

Exports

As for foreign trade in goods, analysts expect exports to grow by US$78.099 million (US$195 million more than the previous survey) and imports (CIF) fall by US$60.133 million (US$1.384 million less than the previous survey).

Financial surplus

Finally, the projection of the primary fiscal surplus of the Non-Financial National Public Sector (SPNF) made by those participating in the REM was $6.076 billion for 2024 ($1.629 billion higher than the previous REM). The average of the Top 10 forecasts a primary surplus of $6.197 billion for 2024. None of the participants expect a primary deficit for 2024.

Interest rate

As for the interest rate, those participating in the REM predicted a BADLAR rate ((which is defined as the weighted average rate by amount, corresponding to fixed-term deposits of 30 to 35 days of more than one million pesos.)for July of 33.4% The rate was expected to rise to 34.0% in December, with the rate rising slightly to 35.8% in July. This means that the Central Bank is not expected to raise or lower the rate until at least December.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.