A consulting firm conducted an analysis of the first half of the year and classified an investment as the best strategy. But it also pointed out what will happen in the coming months.

The first half of 2024, mediated by high inflation, was quite difficult for the investors. Returns were unable to keep up with the acceleration of prices quickly enough while the dollar was no longer an alternative. But there was an investment in pesos that generated returns of 60% in dollars for those who “if they saw her” in December 2023.

The content you want to access is exclusive for subscribers.

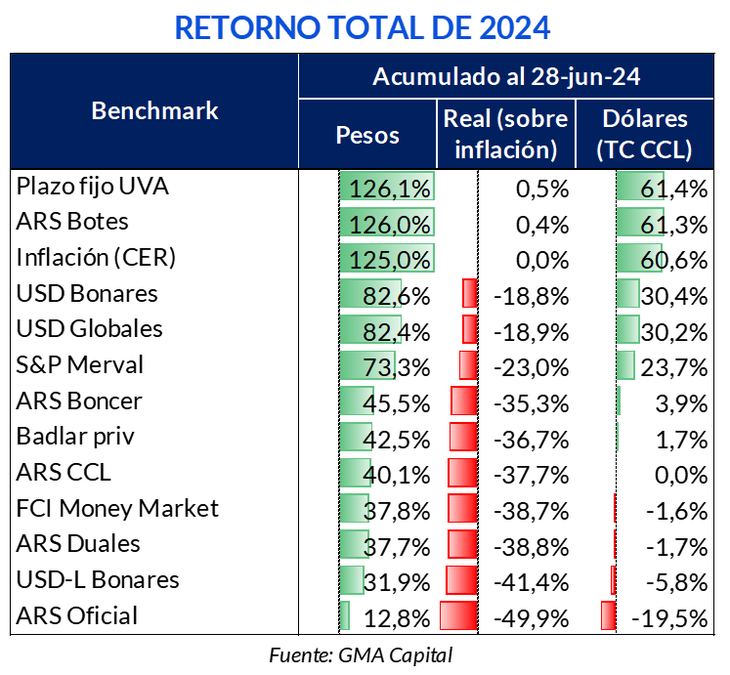

A report prepared by Nery Persichini, Head of Research & Strategy at GMA Capital, reported that in the first quarter of 2024, the PF UVA (inflation) was unbeatable. It yielded 126% in pesos and 61% in dollars. Meanwhile, he said that “taking out the TO26 rally, the performance of sovereign bonds in dollars (+30% in USD) and stocks (+24% in USD) stood out.” The dollar? The favorite investment of Argentines did not yield anything: the financial (CCL) advanced only 40% and the official 13%.

GRa76t_bMAAZM6E.png

The change in investments in June

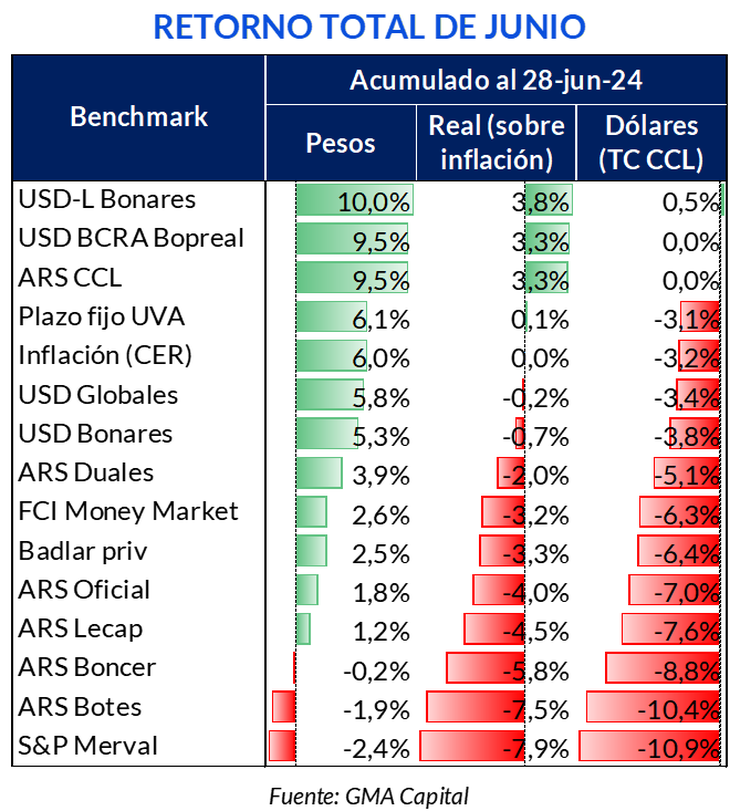

In June, however, the analyst says there was a 180-degree turnaround. “Demand for hedging returned. Dollar-linked bonds were the best performing asset (+10%), closely followed by Bopreal (+9.5%). The CCL woke up. It climbed 9.5% in the month, and made the gap climb from 38% to 48%.”

That month alone, Only the Bonares in dollars, the Bopreal and the CCL managed to beat inflation. While in dollars, only 0.5% was seen in the Bonares.

GRa_ADgXIAEVQ_M.png

Investments for currency hedging: what is the expectation?

According to a report this week by GMA, with a market concentrated on exchange rate dynamics“assets with poor performance in the first half appear as attractive alternative“. There they point out the Dollar Linked Fundswhere the return will depend on the evolution of the official exchange rate in the coming months, so the elimination of exchange controls is a “crucial event”. “The market considers that an end to the exchange controls would imply an exchange rate higher than the current official one, but lower than the financial one.”

On the other hand, they claim that a wide gap favors positions in these assets over the hard dollar. This is because in the event of a unification of the exchange rate, the linked dollar will have a greater upside, as it follows the path of the official exchange rate.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.