The market remains expectant this week as expected adjustments in the economic direction after last week’s exchange rate turbulence that affected assets. This week, the Government faces the payment of US$2.55 billion for the partial amortization of bonds, while details are awaited of a new Monetary Regulation Letter (‘Leremo’) by which remunerated liabilities will be transferred from the central bank (BCRA) to the Treasury.

Financial business will resume on Monday after Milei’s trip to Brazil to meet with businessmen and in view of the national holiday on Tuesday for ‘Independence Day’.

“We are preparing for the amortization of the ‘Bonar 2030’ and other bonds for more than 2.5 billion dollars, guaranteed by the Government and the one that speculates with a High level of reinvestment due to the future opportunities expressed by Argentine fixed incomea,” commented a financial advisor from a Buenos Aires brokerage firm.

The exit from the cepo takes center stage

“Beyond the fashionable alternatives regarding the cepo (exchange control), the debts of the central bank (BCRA) and the Treasury and changes in figures, we consider that the first requirement to begin to reverse this decline is achieve a positive currency flow and recurrent as a medium-term strategy, given the high deterioration of the local economy and finances,” reported the consulting firm VaTnet Financial Research.

“The government is issuing pesos to buy dollars due to exchange rate controls and because the BCRA has begun to pay off its debts,” said economist Roberto Cachanovsky, amid the discussion on monetary issuance.

“For the Government, the challenge in the next 12 months is to consolidate disinflation below 50% year-on-year and to be able to accelerate the recovery through the Relaxation of foreign exchange restrictions and the implementation of RIGI (large investments)”, explained the consultancy Delphos Investment.

“The economic team aims to achieve the Zero emission by eliminating passive transfers from the BCRA, achieved through a new instrument: the Letters of Monetary Regulation (Leremo). They will have a rate determined by the BCRA, although the interest burden will fall on the Treasury of the Nation,” recalled the consulting firm Grupo IEB.

“However, doubts regarding the BCRA’s assets persistn: the exchange rate policy remains unchanged“and the restrictions will not be removed until the BCRA’s balance sheet is cleaned up,” he added.

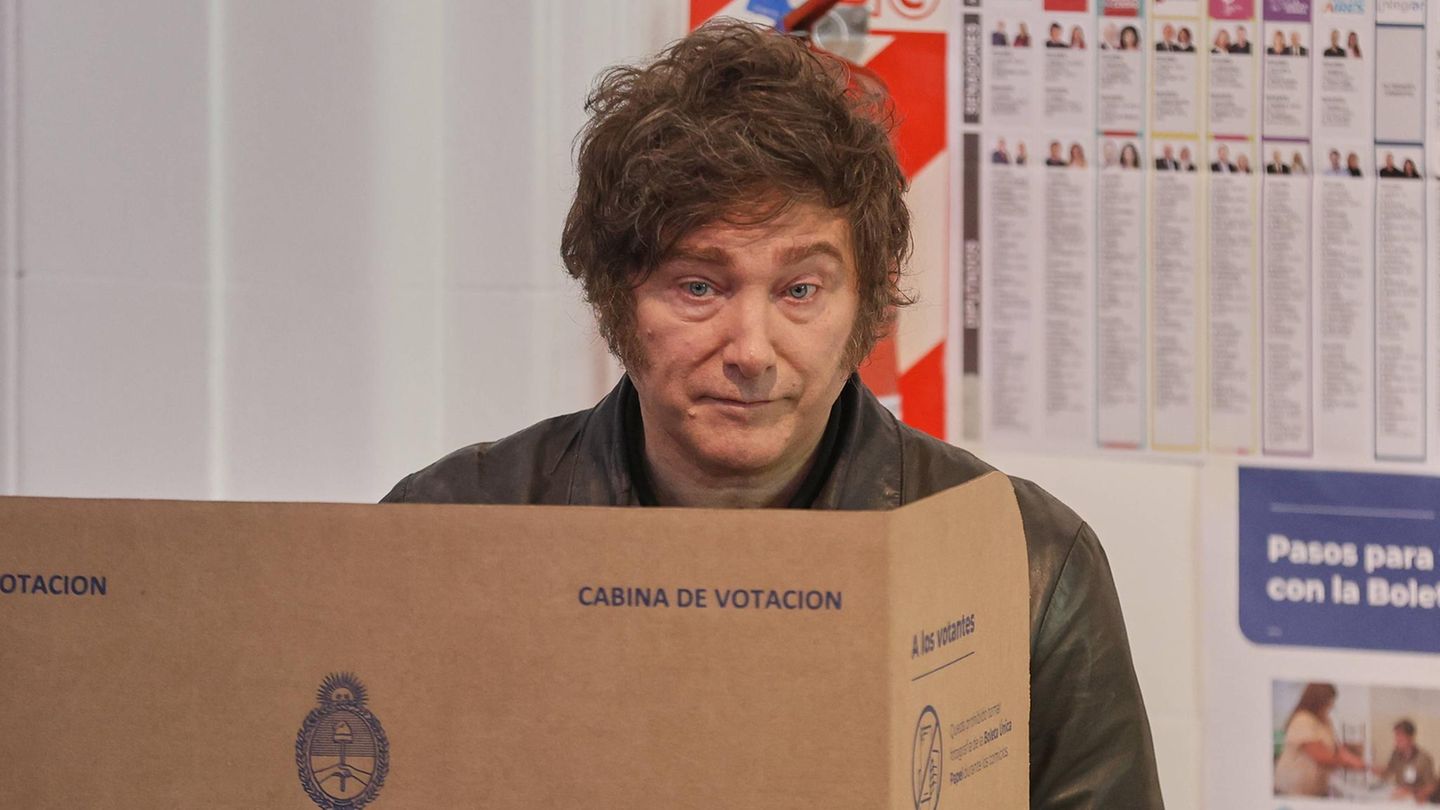

Dollar Exchange Rate Cepo.jpg

The market expects a progressive relaxation of exchange restrictions but warns about the accumulation of reserves

A key tender for the Economy this Wednesday

“In the (Treasury bills) auction on Wednesday, the government will be able to take another step in the dismantling of remunerated liabilities of the BCRA. If successful, the Monetary Regulation Letters will be able to debut The Government will have greater room to raise rates, in exchange now for a higher fiscal cost,” said economist Roberto Geretto of Fundcorp.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.