The announcements made by the National Government over the weekend in terms of foreign exchange had their counterpart this week: although parallel exchange rates suffered a sharp decline, the country risk rose sharply. What does this imply?

He risk country played on this day the 1,600 basis pointsand marked a four-month high. It went against the price of Parallel exchange rates: both the blue and MEP and CCL had strong declinesespecially on Monday.

The content you want to access is exclusive for subscribers.

This was the result of the announcements on monetary and exchange matters made by the National Government over the weekend, where it was reported that If the BCRA buys dollars in the Single and Free Exchange Market (MULC), the issuance of pesos generated by that operation would be sterilized with the sale of equivalent dollars in the Cash Settlement Market (CCL), in order to reduce the gap.

“The dollar continued to retreat, as did the Globals which extended the cuts”they explained on this day from PPI and they added: “The announcement of measures by the economic team filled the local market with negativity. However, it fulfills its purpose given that the gap continued to narrow”. Along these lines, the CCL fell again from $1,320 to $1,290, and in just two days it has accumulated a drop of 9.5%. The gap closed at 39.7%, from 54.6% on Friday, close to a maximum in the Milei era.

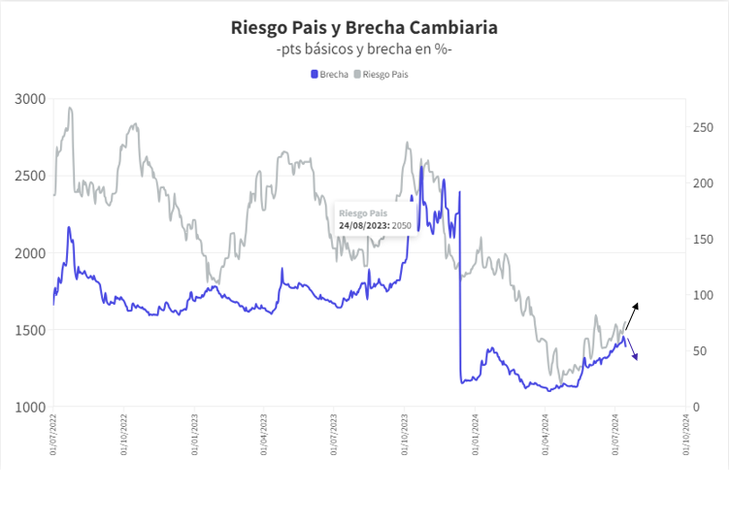

Country risk and its relationship with the gap

The Economist Amilcar Collante He asked from his account on X: “Is a “divorce” between the gap and country risk coming? And to illustrate this question he provided two key data. While The country risk reached 1,600 points on this day, and the gap between the settled dollar and the official dollar fell to 36%. The following graph shows that The relationship between both indicators is now inversely proportional.

image.png

“We have to understand that the measure that the Government announced on Saturday, Greater intervention in the MEP and cash settlementmeans a lower accumulation of reserves“, he told Ambit the financial analyst Christian Buteler and expanded: “Dollars fall as Central Bank threatens to sell up to $1.2 billion in CCL, But bonds are also falling and country risk is rising.”

In this regard, he explained that this dynamic is due to the fact that “the bondholders They think that next year The Government has to pay a fortune of overdue debts, but how does not have access to the voluntary credit marketthey are going to spend dollars on the intervention. Therefore, they are going to have fewer dollars to pay their commitments, and that is why it was seen a strong sale of bonds and an increase in country risk“.

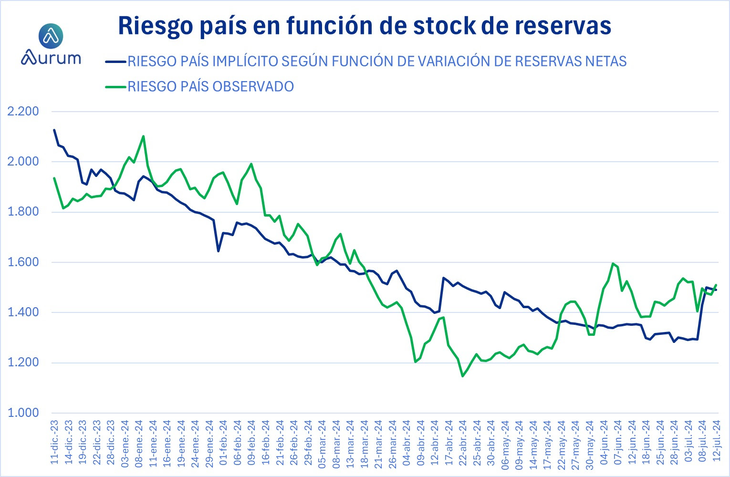

Country risk and its relationship with reserves

From Aurum, They believed that the Government decided to “take a very controversial measure using currencies to intervene in parallel markets, even though The BCRA has not managed to accumulate dollars enough to bring net reserves into positive territory“They also specified that the measure goes against what the IMF had pointed out in the Staff Report a few weeks ago. “We find this worrying beyond any temporary positive effect that may be obtained in terms of gaps”they expanded.

image.png

“We see the decision as negative in terms of country risk. (decrease in bond value) since Milei took office The correlation between changes in net reserves and changes in country risk has been very close.. To the extent that the State (BCRA and/or Treasury) uses these funds for foreign exchange intervention, the risk of deterioration of financial assets will remain very present,” they concluded from Aurum.

This Tuesday, BCRA’s gross reserves fell by US$559 million and fell below US$28 billion after payment to the International Monetary Fund. According to official sources confirmed to Ambitduring this day US$642 million left the monetary authority to meet debt obligations that the country has with the main international credit organization.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.