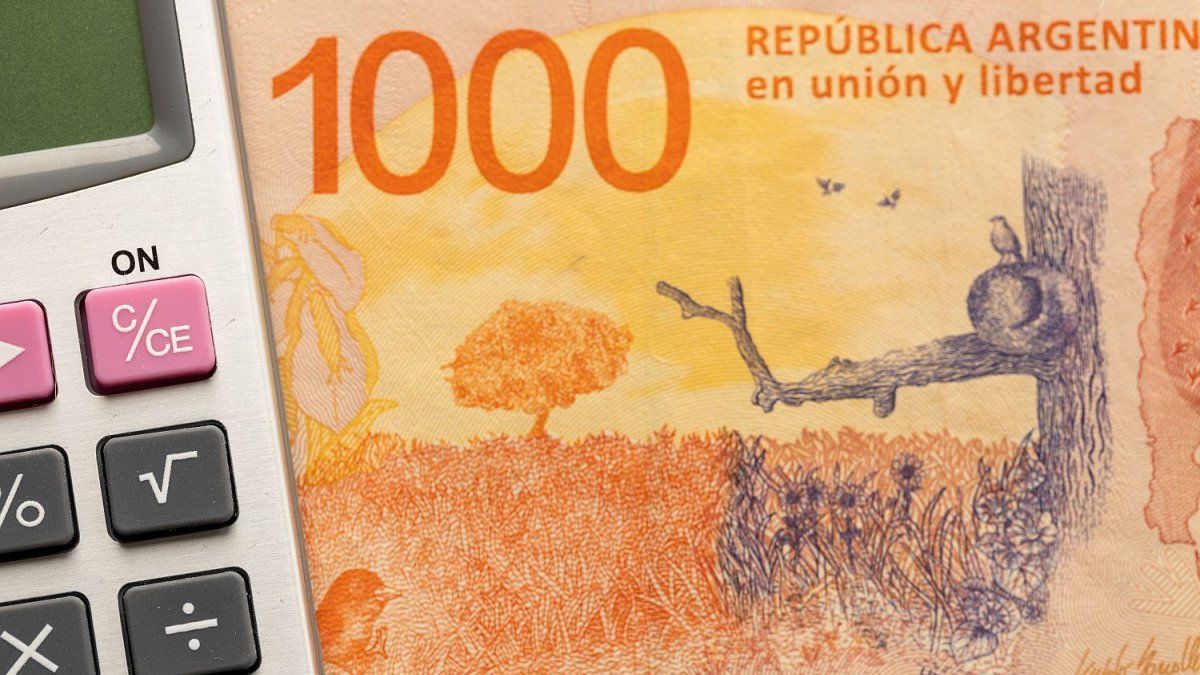

In recent days, in order to attract more clients, some banks have decided to slightly increase rates for 30-day peso deposits.

This week some banks slightly raised the rate they pay for fixed terms of savers. The performance of this popular instrument In some cases it approached 3% per monthstill below the estimated inflation.

The content you want to access is exclusive for subscribers.

It is worth remembering that the Central Bank of the Argentine Republic (BCRA) deregulated minimum interest rates of the fixed-term deposits offered by banks. For this reason, the entities continually modify the Annual Nominal Rate (TNA) that they pay.

The reference for the TNA that each bank sets is the monetary policy rate that the BCRA pays for one-day Passive Repos, which today is located at 40%. Within this framework, banks set their average rate between 30 and 35.5%.

As part of the strategy to transfer debt from the Central Bank to the Treasury, the Government began to issue the Liquidity Tax Letter (LEFI) for a nominal value in pesos of $20 billion.

These instruments have a one-year term, a rate equivalent to the monetary policy rate, and full amortization upon maturity. The objective, according to the document, is “the sanitation of the BCRA balance sheetby recovering the level of international reserves and a solution to the dynamics of its remunerated liabilities.”

Fixed terms: which banks raised the rate and how much each one pays

- Meridian Bank: 35.5% (up 1 point)

- Uala/Uilo: 35% APR

- Banco Comafi: 35% (up 1 point)

- Bank of Chubut: 34.5%

- Macro Bank: 34%

- Mortgage Bank: 34%

- Banco Credicoop: 34% (up 1 point)

- National Bank: 33%

- Provincial Bank: 33%

- Bank of Corrientes: 33% (up 1 point)

- Bank of Cordoba: 33%

- Santander Bank: 32%

- BBVA Bank: 31.5%

- HSBC Bank: 31.5%

- ICBC: 31%

- City Bank: 31%

- Galicia Bank: 30%

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.