“This is certainly one of the strongest investments Berkshire has made in the last decade,” said James Shanahan, an analyst who follows Berkshire for the Edward Jones brokerage. Berkshire’s stake in Apple now represents more than 40% of its equity portfolio, according to InsiderScore.com calculations.

The conglomerate is Apple’s largest shareholder, outside of index and exchange-traded fund (ETF) providers. The billionaire investor has called Apple “Berkshire Hathaway’s third most important company,” after its interests in insurance and railroads.

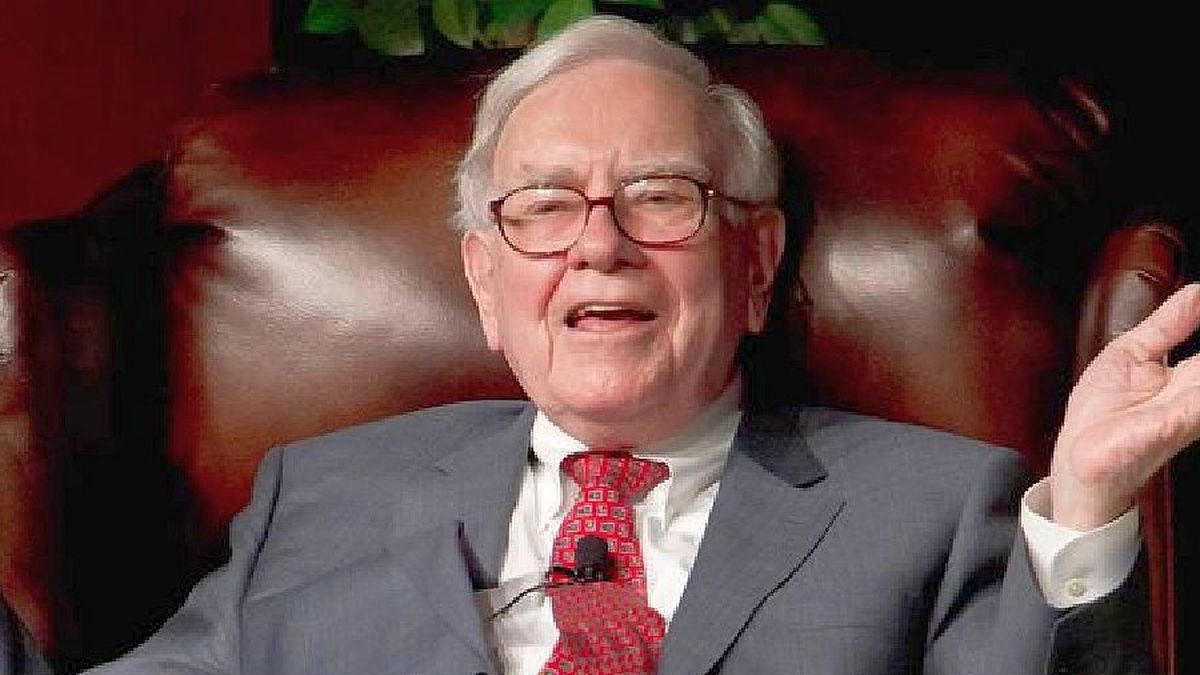

“It’s perhaps the best business in the world,” Buffett said in an interview with CNBC in February 2020. “I don’t think of Apple as a stock. I consider it our third business.”

Investors view Apple shares as a safe haven. In 2021, assets were up more than 30%, after an 80% increase in 2020. By comparison, the S&P 500 is up 25% in the same period. The company reached $ 1 trillion in market capitalization in 2018 and it took two years to double that valuation. LInvestment in the tech giant played a crucial role in helping the conglomerate weather the Covid-19 crisis in 2020, as other pillars of its business, including insurance and energy, were hit hard.

Source From: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.