Stability until November will largely depend on the effectiveness of the strategies implemented and the market’s confidence in the government’s ability to balance monetary and exchange rate policy, experts warn.

In the last weeks, The economic team intensified its efforts to tighten monetary policy in order to address the growing mismatch in the exchange rate gap and a lower than expected flow of foreign currency. An example of this is what was announced on Tuesday night regarding the easing of restrictions.

The content you want to access is exclusive for subscribers.

Added to this is a negative projection from the Central Bank for the third quarter, which adds uncertainty about the Government’s ability to meet debt maturitiesas reported Ambit“The big question is whether the recent changes will be able to ensure economic stability until the start of the liquidation of the fine harvest in November,” states a report by Analytica Consultora.

In the last month, “the exchange rate gap against the CCL reached an average of 45%, which represents a significant increase compared to the 30% recorded in May,” the document states. In addition, the Central Bank’s purchasing balance in the MULC turned negative, with a difference of $47 millionIn response, Phase II of the economic policy was launched on June 28, eliminating the Central Bank’s passive repurchase agreements and replacing them with Treasury Liquidity Fiscal Letters (Lefis).This measure caused a fall in the peso debt market, increasing the exchange rate gap to 56% on July 2 and maintaining it at an average of 53% in the following days,” to which is added the partial dismantling of the cepo.

Analytica.jpeg

This measure caused a fall in the peso debt market, increasing the exchange rate gap to 56% on July 2 and maintaining it at an average of 53% in the following days.

Faced with the weak market reaction to these measures, Economy Minister Luis Caputo announced that the Central Bank would stop issuing money to acquire dollars in the MULC. As of July 16, this issuance had increased the monetary base by $12.4 billion, compared to a total growth of $11.1 billion, Analytica maintains. The Treasury surplus allowed the monetary base to be reduced by $28.6 billion during 2024. With the current official wholesale dollar and the CCL, 70% of the foreign currency generated by the MULC will be destined for the CCL market, with a progressive increase as the exchange rate gap decreases.

Historically, the Central Bank has intervened by selling dollars to control the foreign exchange market. Now, it plans to sell approximately two-thirds of these currencies in the CCL market to reduce money supply and increase the supply of foreign currency, which should put downward pressure on the exchange rate gap. However, this strategy also involves a lower accumulation of international reserves. Currently, the exchange rate gap stands at around 42% against the CCL.

The divergence between the stocks and flows of pesos and dollars continues to be a challenge for economic policy. To assess the short-term viability of the government’s exchange rate strategy, various key indicators are analyzed to determine whether the second half of 2024 and the first quarter of 2025 can be adequately managed, until an agreement with the IMF and a possible restructuring of the debt with private bondholders is reached.

Analytica Consulting.jpeg

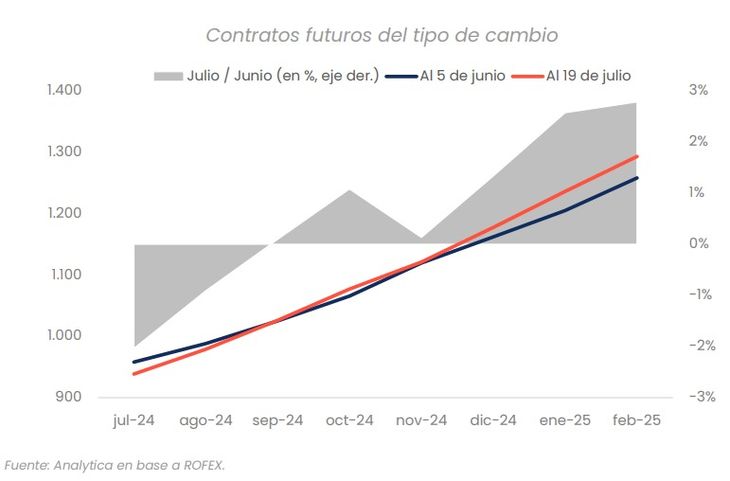

The dollar futures curve has not shown any significant changes, which is considered a positive sign. In addition, the percentage of sales in the MULC also shows encouraging signs.

The indicators analyzed present a mix of signals

- Positives: The dollar futures curve has not shown any significant changes, which is considered a positive sign. In addition, the percentage of sales in the MULC also shows encouraging signs.

- Mixed: Inventory build-up and aggregate competitiveness show mixed signals, with concerns about inventory build-up.

- Negative: Exports have grown in value due to increased quantities, but prices have decreased. The decline in the volume settled by the oilseed and cereal sectortogether with low international prices, negatively affects the exchange market. The gap between the official dollar and The soybean dollar remains a challenge for the sustainability of the exchange rate regime.

The recent implementation of LeFi shows a preference for “heterodox” intervention mechanisms rather than raising the interest rate. The Central Bank’s intervention in the debt marketreflected in a significant increase in the volume traded, suggests an effort to control the exchange rate gap through the use of reservesThe sustainability of this strategy will depend on market confidence, the stability of dollar exchange rates and the government’s ability to manage the economy in the coming months.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.