True to form, during an interview with CNBC in April, Warren Buffet –the Old Sly- said that selling “a little bit of Apple“It would benefit Berkshire shareholders if the income tax was increased (ie if Joe Biden won; today Kamala Harris). With this he justified that during the last quarter of 2023 the company had divested itself of 1% of its holding in the apple company.

Ironically, by then Berkshire Hathaway (BRK), its flagship, had already sold 115 million shares or 13% of the stock holdings in the apple company. A little bit… nothing.

In May, during the BRK meeting, when asked about Apple, he said that “it is an even better business” than American Express and Coca Cola, its third and fourth largest holdings, which together with Chevron and Bank of America make up 72% of the firm’s shareholdings.

Berkshire announced Saturday that it had divested an additional 390 million shares in the second quarter, reducing its holdings in the company founded by Steve Jobs & Co. by 55.8% in the first six months of this year.

Apple’s problems

It’s easy to make the case that Apple’s earnings (the world’s largest publicly traded company with a market cap of $3.5 trillion) aren’t growing like they used to, its share price is – by almost any measure – far from rock bottom, a “strong” dollar isn’t doing it any good, its phones stopped being the world’s best-selling phones for over a year (Samsung displaced them), it has just fallen to sixth place in the key market that tends to set trends: China (behind VIVO, Oppo, Honor, Huawei and Xiaomi) and Apple Intelligence, the app on which the firm has placed all its hopes, is presenting too many intricacies (they already had to delay its launch due to problems), etc.

But none of this should affect someone who has always claimed to be a long-term investor, especially when that investor was the third largest shareholder in the company, controlling 5.92% of the capital and remains so now (his position was reduced to US$84.2 billion or 5.15% of Apple’s capital), with an excellent relationship with the two largest shareholders (Vanguard Group and Black Rock) and enough power to influence the board of directors.

Buffet wants more money

While BRK’s net income fell 15% from $35.91 billion a year ago to $3.34 billion at the end of this semester, operating profit was a record, growing 15% to $11.6 billion – practically half generated by the insurance business – compared to $10.04 billion in June 2023. It is clear then that Berkshire does not need money.

What’s more, it has nowhere to invest it (its share buybacks, $2.6 billion in the first three months, have shrunk to $345 billion in the past three; the company hasn’t paid a dividend since 1967). In May, Buffett declared: “We’d love to spend that money[referring to BRK’s cash reserves]but we’re not going to do it unless we think we’re doing something very low-risk and can make us a lot of money,” hinting that the mountain of cash he began to build up in 2017 “could” grow to $200 billion by June.

BRK cash per quarter.jpg

Buffett’s bet on going cash speaks more about waiting for a crash than anything else

With the $75 billion they just pocketed from Apple shares, the former textile company’s cash pile climbed much higher than expected and, if you want, more prudent, US$276.94 billion, which is about 30% of the group’s total holdings.

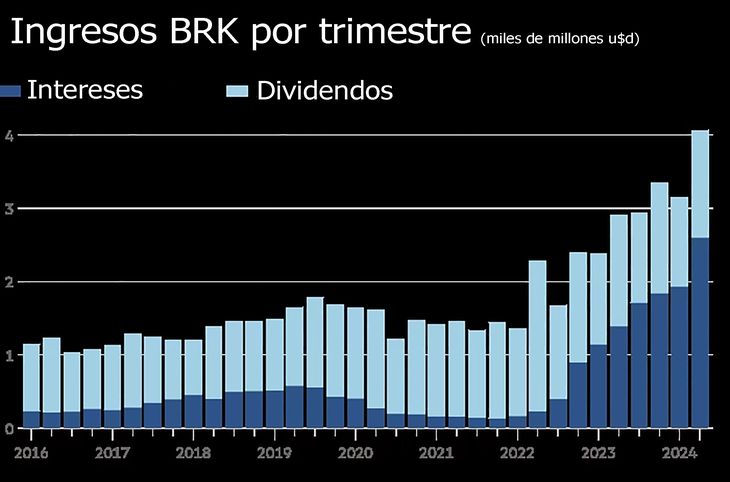

It is true that in the last two years the rate hikes by the Federal Reserve and the secular decline in dividends resulted in Berkshire, thanks to its “dollarization” strategy, earning $8 billion in interest versus $5.4 billion in dividends (this last quarter was $2.6 billion and $1.5 billion).

income brk.jpg

Cash positioning, despite generating some dollars than stocks, has been a losing strategy for Berkshire Hathaway

But this is just a drop in the bucket, and it does nothing to offset the $116/182 billion that would have been gained by being 100% in the S&P 500. What’s more, the Fed Funds rate, currently at 5.25%/5.5% per year, is projected to fall to 3.9%/4.4% next year and 2.9%/3.6% in 2015, virtually eliminating the interest rate differential.

The reality is that Buffet They have no consistent excuse to explain the magnitude, let alone the speed at which their cash position is increasing. (Whoever is able to sell $75,000 worth of paper without significantly affecting its price should be able to buy it), that is, beyond what he expects… (call it whatever you want).

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.