Public debt in pesos increased 98.6% during the first half of the yearaccording to a study by the Congressional Budget Office (CBO). Growth was greater than the accumulated inflation in that period (79.8%) and implied an increase in real terms of 10.45%. The main cause behind the expansion of the Treasury’s financial burden was the migration of remunerated liabilities from the Central Bank to the Treasury’s balance sheet. Instead, there was a slight decline of 3.6% in the stock of public debt in foreign currency.

The economic team’s strategy of prioritizing the cleanup of the balance sheet BCRA had as a correlate a deterioration of the financial profile of the Treasury. It is that one of the main strategies chosen was the migration of bank holdings from interest-bearing liabilities from the Central towards the debt placements of the Ministry of Financewith the aim of reducing (and eliminating from July) the endogenous issuance that involved the payment of interest on overnight passive swaps.

Thus, in the first instance, the Government encouraged banks to dismantle positions in passive transfers of the BCRA and subscribe to the fixed-rate capitalizable bills (LECAP) that the Ministry of Economy began to issue. On July 22, the process was completed with the suspension of the auctions of remunerated liabilities of the Central Bank and their replacement by the Fiscal Liquidity Bills (LEFI), issued by the Treasury but operated by the monetary authority, although this is not part of the period analyzed in the OPC report.

Debt in pesos

The study, published this Thursday, indicated that the stock of performing debt payable in pesos almost doubled during the first half of 2024 compared to the end of 2023: it increased 98.6% to reach $166.54 billion. That growth was the result of net emissions of $17.1 trillion (the excess placement over the capital maturities of the period), Capital adjustments of $64.7 billion (because the bulk of the debt is indexed) and capitalization of interest for $0.88 billion. In addition, interest was paid in pesos for $870 billion.

image.png

The most favorable data in this regard is that there was a extension of the terms of Treasury liabilities. “At the beginning of the semester, the average life of said debt was 2.14 years. 88% of the capital was due in the 2024-2025 biennium, and 32% during the first half of 2024. At the end of the first half of 2024, the average life of the debt in pesos rose to 2.92 years,” the OPC indicated.

The composition of the type of public debt instruments payable in local currency varied significantly in the first half of the year, although there was only one slight reduction in the percentage of the stock of securities with indexation clauses, which went from representing 90% of the total to 86%. The proportion of fixed-rate debt went from representing 10% in December 2023 to 14% on June 30, 2024.

Instead, there was a Significant shift in securities tied to the official exchange rate (which offer coverage against devaluation) towards inflation-indexed bonds. The former went from concentrating 46% of the stock (40% dual bonds and 6% dollar linked) to encompassing barely 7% of the total (6% dual and 1% dollar linked). In contrast, the BONCER increased their participation from 44% to 79%.

Foreign currency debt

In parallel, The stock of debt denominated in foreign currency decreased by US$9,436 million (3.6%) between December 31, 2023 and June 30, 2024, to reach the equivalent of US$255,045 million. “The variation was explained by capital cancellations for US$25,042 million, offset by loan disbursements and placements of public securities for a total equivalent to US$16,923 million and valuation adjustments that decreased the stock by US$1,316 million,” said the OPC.

image.png

What happened? First, the Government took net financing from non-transferable notes from the BCRA for US$1.878 billion: on the one hand, it renewed a note that was due in January and placed another one for an additional US$1.6 billion that was used to pay Treasury commitments in foreign currency; on the other hand, during the semester US$155 million were placed for the renewal of the interest maturities of other non-transferable notes.

The Government also received net financing from the IMF for US$1.618 billion as a result of the disbursements and amortizations of the agreed program, although a good part of this was used to return to the CAF the “bridge loan” that it had granted in December so that the country could meet an interest payment to the Fund.

Likewise, the Treasury repurchased from the BCRA US$9.726 billion in dollar bond holdings with part of the net financing obtained from the placement of debt in pesos: in February the Treasury purchased BCRA holdings of Bonar AL35 for US$7.596 billion and in May of Bonar AL35 and AL29 for US$1.329 billion and US$801 million, respectively, which were removed from the public debt records.

In addition, there were net cancellations of loans from international credit organizations (excluding the IMF) for US$1.8 billion: “disbursements were received for US$437 million and amortizations were paid for US$2.237 billion, of which the CAF short-term liquidity bridge loan received in December 2023 for US$960 million to finance the payment of debt services with the IMF stands out,” the OPC noted.

Finally, there were capital adjustments on foreign currency debt that reduced the stock by US$1,316 million.

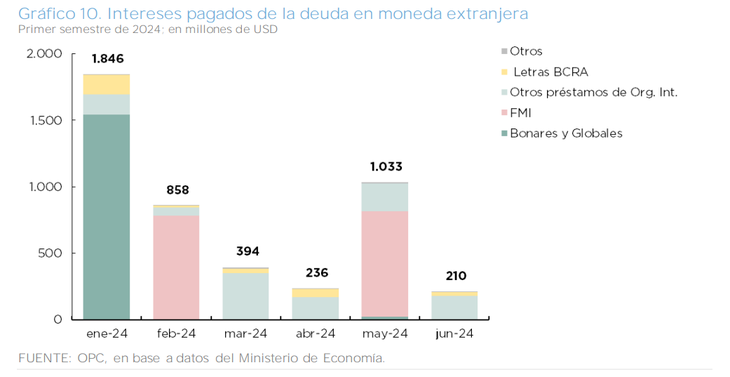

Finally, Foreign currency debt interest paid in the first half of 2024 totaled US$4,578 million. These include payments in January for US$1.541 billion to the holders of the Bonares and Globales bonds, issued in the 2020 restructuring process, and cancellations to the IMF in February and May for the equivalent of US$781 million and US$796 million, respectively.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.