In its weekly report, the consulting firm 1816 put numbers to this statement: the monetary base (BM) is currently around $22.6 trillion and the broad monetary base (which, according to its analysis, includes the BM, the Government’s deposits in the BCRA and the stock of LEFI held by banks) is at $47.7 trillion, in line with the maximum margin of monetary expansion set by the Central Bank. “If so, it seems that there is a long way to go,” said 1816..

image.png

Cepo: the scenarios that the market is evaluating

The report by the consultancy firm led by Adrián Rozanski, Mariano Skladnik and Martín Defilippo takes for granted that The opening of the currency controls will imply a devaluation jump of the official exchange rate and poses two scenarios Regarding the timing that the Government could choose to remove the exchange restrictions. The first is that the exit will take place in the remainder of 2024 and the second, to be postponed until after the 2025 legislative elections.

Each of the alternatives brings with it an associated cost. “The risk of releasing now is that another devaluation would accelerate inflation again”noted 1816. Instead, The reason for maintaining the restriction for a long time is that, as long as there is a gap, the BCRA will not accumulate foreign currency. and clarified that at the beginning of 2024 it could have done so but “due to a very high exchange rate, the collapse of activity and, fundamentally, the scheduling of imports.” And without the recovery of reserves, “it will be difficult to significantly reduce the country risk,” the consultancy firm considered.

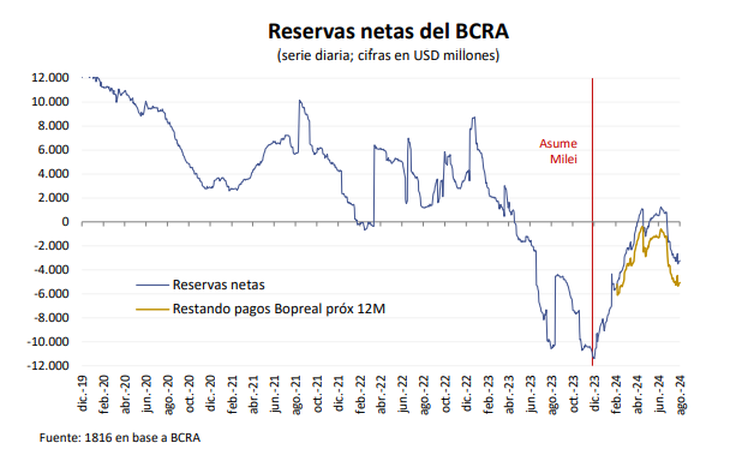

The red of the net reserves It is one of the points that generates the most alerts from analysts, economic agents and investors. According to 1816, today they are negative by US$5.1 billion (minus the BOPREAL payments scheduled for the next twelve months) and from now until January there are debt maturities in foreign currency for US$4.5 billion corresponding to sovereign bonds, IMF and provincial commitments that will add additional pressure on the Central Bank’s coffers. A report by BAVSA placed net reserves at around Negative US$5.8 billion.

image.png

But the Government is willing to give up reserves in order to calm an inflationary inertia that makes the deceleration difficult (the Core CPI was 3.7% in May and June, and 3.8% in July). The decision to intervene on financial dollars was a first sign. In September, the reversal of the PAIS tax rate on imports will go in the same direction if it complies with its idea of not compensating it with an equivalent devaluation. By 1816, The signals from the economic team are consistent with “scenario 2”, that is, that the restrictions continue for a long time..

Does the market see the clampdown for a long time?

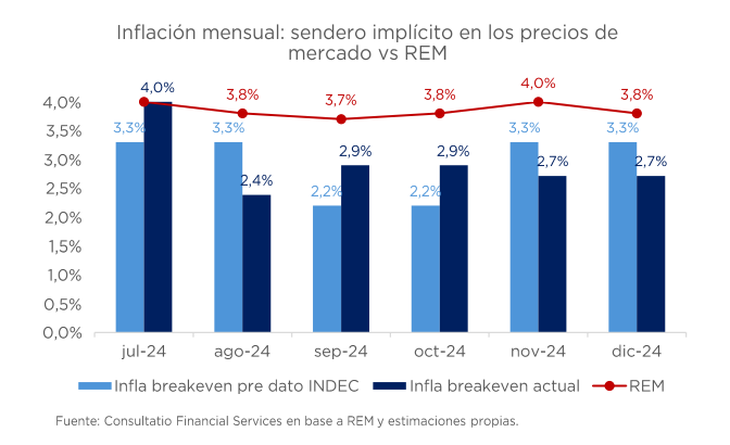

The latest financial movements also seem aligned with the second scenario and not only because of the compression of the devaluation expectations implicit in future dollar contracts. A report by Consultation He stated that the market “believes there is room for disinflation to continue.”

In his report, he said that this was reflected in the result of the Treasury’s peso-denominated debt auction this week, in which the Ministry of the Economy placed $1.59 trillion in a LECAP with a fixed effective monthly rate of 3.95% and maturity in June 2025. He also pointed out that this was also observed in the prices of public securities in the secondary market, which in recent days incorporated a monthly inflation path of 2.7% average from now until the end of the year, a number that he considered “optimistic.” For now, economists already have serious doubts about the possibility that the general CPI slowdown will continue in August.

image.png

For its part, 1816 stated that the City “was incorporating in the prices of LECAP and CER bonds an increasing probability that the Government will opt for scenario 2, that is, aiming all its artillery at lowering inflation now, postponing the release of the currency controls”. He added that the figures for the future dollar in September at Rofex reflect that “the market does not anticipate a relevant probability that the 10 percentage point reduction in the PAIS tax will be compensated with an increase in the A3500 (official wholesale dollar).”

Cepo and IMF: what would be the requirements?

However, the Government is not alone at the decision-making table. Sitting on the chair that represents the $45 billion debt that Mauricio Macri took, appears the IMF The IMF is ready to put forward its traditional recipe book. Even more so considering that Milei and Caputo aim to obtain new debt from the organization to support their program. Although the negotiation is in its infancy and the government is betting its chips on an electoral victory by Donald Trump in the United States that would unlock a new program with fresh dollars, there are already those who are beginning to analyze the possible conditionalities that the Fund will propose.

This is the case of the consulting firm PxQof Emmanuel Alvarez Agiswhich in a recent report assessed the possible demands of the IMF to enable these currencies in the face of an opening of the cepo. He did so in light of two recent agreements the agency signed with Egypt and EthiopiaPxQ pointed out that, although the economies of these countries differ from Argentina’s, in both cases the Fund followed certain patterns that serve to think about what could happen in a negotiation with Milei’s government.

The two agreements included the lifting of current exchange controls and currency unification. What did the IMF ask for? PxQ listed four patterns that are not too far from its usual recipe:

- Contractive monetary policy with a rate at the level of current inflation.

- Devaluation of the official exchange rate to the level of the “free” exchange rate.

- Relaxation of controls on the trade account and the capital account.

- Authorization to intervene in the foreign exchange market based on clear rules.

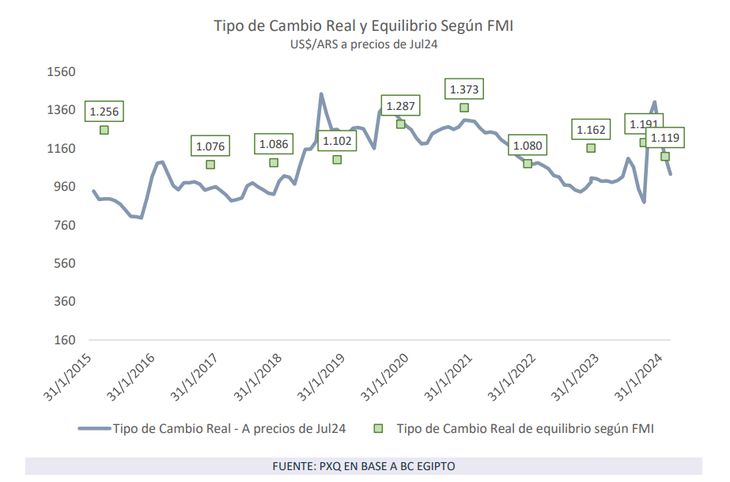

In addition, the consultancy founded by the former Vice Minister of Economy pointed out that in any eventual negotiation with the IMF regarding a currency unification, “a discussion on the real equilibrium exchange rate will be inevitable.”

image.png

PxQ recalled that, according to its latest External Sector Report, The Fund believes that the dollar was in equilibrium at the end of March 2024. And he stated that, since then, “the official exchange rate appreciated given that the “crawling-peg” ran below inflation” and In July it was 17% below from the equilibrium level set by the agency ($1,118 at today’s prices). “The longer the lifting of the cepo is delayedwith a “crawling-peg” that travels below inflation, The greater the leap needed to reach the real exchange rate requested by the IMF”the consultancy concluded.

Getting out of the trap, but how

Although the President said this week that it is not necessary to lift the restrictions in order to grow, contrary to what he himself has always said, there is a widespread view among economists that, in order for strategic investments to arrive, it is necessary to ease the exchange restrictions. What is not so much in the debate is the how.

The consulting firm got involved in that discussion South American Vision and the “think tank” FoundThey did so through a document entitled “Neither a restriction nor complete liberalisation: towards prudent regulation of capital flows”which bears the signatures of the former Minister of Economy, Martin Guzman; his second deputy minister, Fernando Morra; his undersecretary for financing, Ramiro Tosi; and the members of the study center, Guido Zack and Pablo de la Vega.

The central argument of the work is that Argentina oscillated between “extreme positions”, which involved strict controls or almost total liberalizations, and that going forward The country should aim for a middle path “that encourages the inflow of capital for medium- and long-term investments and discourages short-term speculative flows.” In other words, the future opening of the currency controls (when it occurs) should not repeat the experience of Macri’s government, in which the economy was exposed to financial shocks, as reflected in the massive capital outflow during 2018 and 2019.

The document argues that restrictions need to be relaxed, but that “prudential regulations should be maintained, not as a transitional scheme, but as a permanent regime,” which would contribute to economic stability. “The scheme we propose works as a set of ‘valves’ that allow liquidity flows to be regulated in the event of disruptive events in the exchange market, but that do not affect normal activity in times of stability,” the authors state.

What does the proposal consist of? First, establishing conditions of macroeconomic stability to strengthen the currency and the local capital market, which include “a fiscal order, within a framework of growth, that eliminates dependence on monetary financing and short-term external capital.” Then, moving forward with a regulation that prevents disruptive exchange rate events and establish “limits that, although not restrictive under normal conditions, serve as a containment against such events.”

Among the regulations, they include the Establishment of reserve requirements or taxes according to the period of permanence of the capital (from 30% for those less than 30 days to 0% for those over a year), mandatory liquidation of exports “with terms and amounts that do not affect normal business operations,” access to the exchange market with prior approval from a high limit (converging to values above US$3 million per month, but starting with lower values) and rules for public debt (national, provincial and municipal) in foreign currency and legislation.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.