This week the market’s attention is focused on the meeting of the world’s leading central bankers which will take place next Thursday and Friday in Jackson Holethe valley located in the Rocky Mountains of Wyoming, USA. The expectation is high, as the host is expected to be Jerome Powellchairman of the Federal Reserve, will give some indication of what his decision on interest rates will be in view of the September meeting, which will undoubtedly have its counterpart in American stocks, and therefore in Cedears.

The next few days look hectic for the market, as in addition to Powell’s speech next Friday, investors will also be keeping an eye on the minutes of the July Fed meetingwhich will be published on Wednesday afternoon, as well as preliminary data on applications weekly unemployment benefit which will be announced on Thursday morning.

Analysts largely expect Powell to set the tone for a rate cut in September. However, if the speech takes a different direction, could jeopardize the recent stock market rally. These are the scenarios.

Jackson Hole: What the historical data says

Available data indicate that U.S. stocks historically tend to rise around the annual Jackson Hole symposium. The S&P 500 has rallied in the two weeks leading up to and following the Fed conference, with further gains following the Fed chairman’s speech. For example, if the S&P 500 extends its green on Tuesday, would achieve its ninth consecutive day of gainswhich would be its longest winning streak since 2004, according to Factset.

Powell is scheduled to speak about the economic outlook on Friday morning. And while Jackson Hole is not typically a place where Fed presidents deliberately go on about future interest rate decisions, the chairman’s speech has the market on edge.

One thing to note is that over the past 20 years, the S&P 500 has averaged a 0.4% return during the conference, according to Dow Jones Market Data. The index posted an average gain of 0.1% in the month following the conference and an average return of 1.8% in the three months following the event.

S&P 500.jpeg

However, Fed presidents have occasionally made comments that have provoked a disproportionate reaction. For example, the S&P 500 fell 3.4% on August 26, 2022, after Powell dashed investors’ hopes for a quick conclusion to the rate-hiking campaign.

Among the most optimistic options on the market, Powell is expected to highlight that inflation is moving in the right direction, giving the Fed more confidence that it will reach its 2% target. This could indicate that the slowdown in inflation It allows the central bank to combine its efforts with its other tasks.which is to maximize employment.

However, there are also negative scenarios, and some believe that investors may have set their expectations too high for Powell’s speech. Therefore, the question that arises is: What if Powell simply says he might want to adjust interest rates a little lower, but we don’t need to cut them dramatically?

That would be negative for the market, as traders are pricing in Fed rate cuts at each of its three remaining meetings this year, according to the CME FedWatch tool. In any case, Powell’s speech could threaten the stock market’s rebound from the plunge earlier this month. And with recession fears intensifying, the market is now at a stage where bad news is taken very seriously.

Jackson Hole under the microscope of analysts

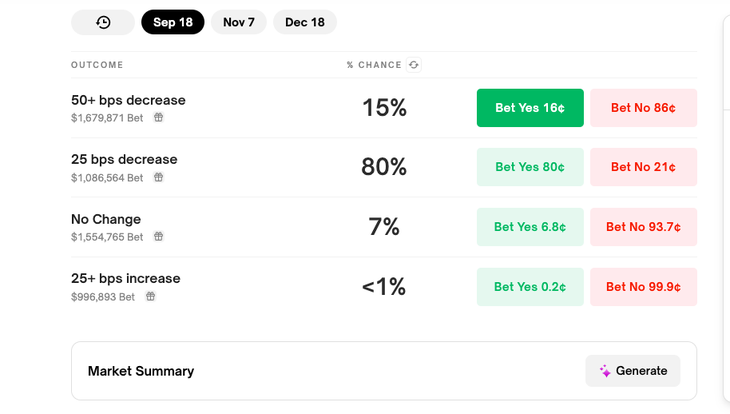

In dialogue with Scope, Pedro Moreyra, director of Guardian Capitalexplains that markets are pricing in a 100% probability of a 25 basis point rate cut at the Federal Open Market Committee (FOMC) meeting on September 17-18 and a 24% probability of a 50 basis point cut at that same meeting. “In short, there is consensus that there will be cuts, but the uncertainty lies in the magnitude of the cuts,” he says.

Regarding the annual symposium in Jackson Hole, Moreyra maintains that it will be the key event of the week, in a context where the markets have just recorded their best week of 2024. “In our opinion, the optimal scenario would be for the first signs of confirmation of the expected cuts to be given in September,” he says. However, it is most likely that a constructive message will be issued that “emphasizes the long-term objective, which, although it would be a less direct comment, would still be positive,” Moreyra analyzes.

For its part, Juan Manuel Francochief economist of SBS Groupassures that the international market will closely follow the news that arise from the traditional symposium, where the most anticipated thing will be Powell’s speech.

Fed rate Polymarket.png

Specifically, Franco says, “investors will be attentive to what Powell has to say regarding the future of monetary policy, especially the path of interest rates.” According to his analysis, this is supported by the fact that the labor market and some activity indicators no longer show the robustness of a few months ago and “this suggests a possible exhaustion in the upward dynamics of the economy.”

“Regarding market expectations, it is implicit in Fed Funds Rates futures that there will be cuts of at least 25 bps in the reference rate in the three remaining FOMC meetings this year, although the probability that any of them will be 50 bps is located at 75% for December,” concludes Franco.

Finally, and according to data from the Blockchain-based market prediction platform, Polymarketinvestors see a 15% chance that the Fed will cut rates by 50 bps in September; 80% are betting on a 25 bp cut and 7% are betting on there being no changes at that meeting.

Cedears: what to bet on based on Powell’s words

Ignacio SniechowskiHead of Equity of IEB Groupsaid in statements to this media that today it seems that after Black Monday, the market is factoring in or anticipating a soft landing for the US economy (soft landing, in English). In this context, he analyzes that the investor should look for companies that generate a lot of cash and that benefit from this scenario. “But given the quotes of the technology companies, I would put together a portfolio that is well diversified via ETFs. I would especially do S&P 500 (SPY) and Nasdaq (QQQ).”Especially if you buy Cedears, since they have a lot of liquidity.“, he says.

The strategist indicates that, if the scenario that emerges from Jackson Hole, “which is not ruled out, but which would seem to be not the one that the market sees today,” that is, a negative one in which no light is provided on rates, “perhaps the investor should be a little calmer and the portfolio should be built with stocks with low volatility and good dividends: such as Coca-Cola (KO), Berkshire Hathaway (BRKB) and Johnson & Johnson (JNJ). “Then also diversify with some of the Dow Jones ETF (DIA) and a small portion of SPY,” he concludes.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.