According to SEC records, the Oracle of Omaha’s company sold 13.968 billion shares of a major bank.

Berkshire Hathawaythe company of Warren Buffet, got rid of in recent days of around 14 million Bank of America shares for a total of US$550.6 million (498 million euros), the entity reported.

The content you want to access is exclusive for subscribers.

The Securities and Exchange Commission (SEC) records show that the “Oracle of Omaha” company divested itself of 13.968 billion Bank of America shares in three transactions between August 15 and 19.

Specifically, On August 15, the entity sold 5.18 million shares of the bank at an average price of $39.3088.while a day later it placed another 3.75 million shares at an average price of $39.2719, and this Monday it sold 5.03 million shares at an average price of $39.6454.

After the confirmed sales, Berkshire Hathaway still controls a package of 928.46 million shares in Bank of America, whose value would be around US$36 billion (32.565 billion euros).

Strategic moves in the portfolio

In the second quarter of this yearBerkshire Hathaway focused on diversifying and consolidate their positions in key sectors. Notable investments include significant gains in shares of technology and financial companies, two sectors that have shown solid performance despite market volatility.

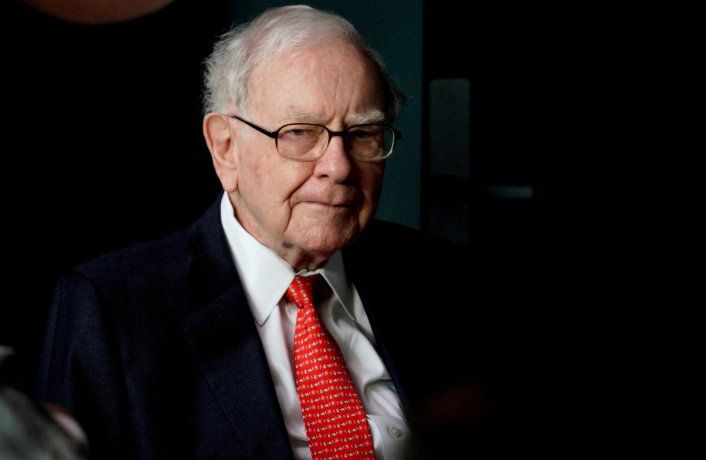

Warren Buffet

Berkshire Hathaway focused on diversifying

REUTERS

Technology and finance: the favourite sectors

One of the most talked about movements was Berkshire’s increased stake in Appleone of his most successful investments to date. Apple remains a cornerstone of Buffett’s portfolio, and the decision to increase his stake underscores the conglomerate’s confidence in the tech giant’s continued growth.

Besides, Berkshire Hathaway also strengthened its positions in the financial sector, with additional purchases of stock in companies such as Bank of America and American Express. These moves reflect Buffett’s view that the financial sector will remain central to the global economy, especially in a rising interest rate environment.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.