The weight of Treasury debt in banks’ assets rose another notch in June. As a result of the continuation of the process of migration of remunerated liabilities of the Central Bank to public securities promoted by the Government, at the end of the first semester the ratio was on the verge of reaching 37%There was also an increase in the share of credit to the private sector, which stood at 22.1%.

The data comes from the Report on Banks June, published by the Central Bank on Wednesday. The figures reflect an increase in the so-called “Treasury risk” and “private risk” as the counterpart to the “BCRA risk”, which fell to 10.1%.

The movements are a logical consequence of the policy of dismantling of the stock of passive passes that the monetary authority placed with financial institutions to sterilize the excess liquidity of the economy, which It was replaced by debt issued by the TreasuryThis was accompanied by an incipient recovery in local currency loans to the private sector, still at levels that represent a historic low.

The Minister of Economy, Luis Caputoand the president of the BCRA, Santiago Bausilipromoted a debt migration strategy from the monetary authority to the treasury in order to end the endogenous issuance that generated the payment of interest on remunerated liabilities. A process that, on the one hand, decompressed the balance sheet of the Central Bank but burdened the Treasury with more commitments and, on the other, increased the banks’ exposure to a debtor (the Government) usually seen as riskier than the BCRA.

Specifically, the official report shows that in June The weight of public securities in the assets of financial institutions reached 36.9%almost one point above the 36.1% of May. This is the penultimate step in this sequence towards the elimination of the Central’s remunerated liabilities. To put it in perspective, In April 2023, Treasury debt represented 16.4% of total bank assets; more than 20 points below the level with which it closed the first half of 2024.

image.png

On the other hand, financial institutions went from having a third of their assets concentrated in BCRA instruments in April 2023 (at that time Leliq + Pases) to 12.6% in May 2024 and 10.1% in June of this year.

The final step of this monetary strategy was already carried out on July 22, when the Central Bank suspended the placement of one-day passive repos and the liquidity of the economy began to be managed through a letter issued by the Treasury, the LEFI. Thus, last month the handrail was put in place. That is why, when the BCRA publishes its next Report on Banks, The weight of public securities in the assets of financial institutions is expected to comfortably exceed 40%.

Banks: incipient recovery in credit to the private sector

At the same time, a incipient recovery in credit to the private sector. In this way, the participation of loans in pesos to that sector reached 22.1% of the banks’ assets in June, above the 20.6% in May and the 18.7% low it had reached last April. However, starting from a historically very low low, it is still far from the 25.3% (also low) it represented in April 2023.

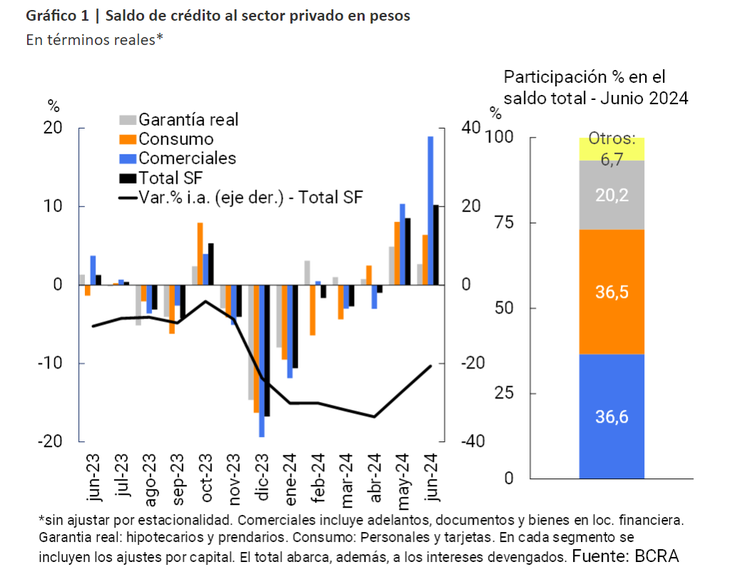

“In June, the balance of credit to the private sector in national currency grew 10.2% in real terms (+15.3% nominal). The monthly increase was widespread across all financial institution groups and was mainly explained by commercial lines and consumer loans (with increases of 18.9% in real terms and 6.4% in real terms, respectively),” the BCRA report noted.

Likewise, the balance of financing to the private sector in foreign currency increased by 2.5% compared to May, mainly explained by national private banks and public banks.

image.png

“In this scenario, the total real balance of credit (in national and foreign currency) to the private sector accumulated an increase of 8.5% in the month (+13.4% nominal). It was driven by loans to companies, which grew 10.5% in real terms (+15.6% nominal), especially those destined to service companies and primary activities. Financing to families advanced 5.3% in real terms in the month (+10.2% nominal), mainly explained by the performance of personal loans.

The monthly improvement, however, It has not yet managed to compensate for the decline of the previous months. So, In the year-on-year comparison, the total balance of credit to the private sector decreased by 14.1% in real terms.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.