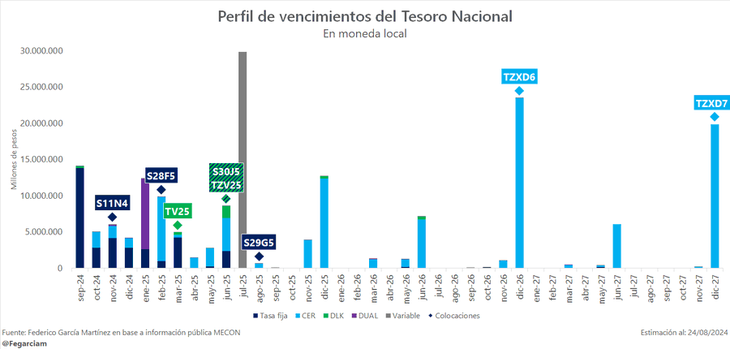

This Friday, the day the tender will be settled, the Government will face the maturities of a fixed-rate bill (the LECAP S30G4) for $2.26 billion and a dual bond (the TDG24, which adjusts for the dollar or inflation) for $1.45 billion, according to data from the Congressional Budget Office. These are the commitments that the Congressional team has made. Luis Caputo will seek to refinance through this Wednesday’s auction.

“We believe that there should be no problem regarding rollover, but that The Treasury will evaluate offers to see how much net financing it can attract, given that September maturities rise substantially “regarding August,” he told Juan Manuel Franco areachief economist at Grupo SBS. Thus, one of the issues that the market will monitor is whether the Ministry of Finance decides to take on a considerable amount of additional debt, with the aim of increasing the liquidity cushion that the Government currently has deposited at zero interest in its account at the Central Bank ($16.7 billion).

Debt, menu and signs

Specifically, the secretariat headed by Pablo Quirno included eight debt instruments in pesos in its call for bids. There will be four LECAPs: The one maturing in February 2025 will be reopened (to be auctioned at a price) and four new bills will be issued (to be auctioned at a rate) on November 11, 2024, June 30, 2025, and August 29, 2029.

image.png

On the other hand, there will be four indexed bonds. Two of them with exchange rate adjustment: the banks will be reopened Dollar linked to March and June 2025. The rest, tied to inflation (CER), will be long term: the BONCER TZXD6, in December 2026, and the TZXD7, in December 2027.

The operators read several signs on the menu chosen by the Government for this operation, as indicated by various sources. On the one hand, it shows The Ministry of Economy wants to test, through a one-year fixed-rate bond, whether the market buys the idea of a lasting slowdown in inflation, a possibility that eventually “matches” with a scenario with continuity of the cepo until next year’s legislative elections and without devaluation at least until that moment.

In this regard, the offering of two dollar-linked bonds maturing during the first half of 2025 It seems like an attempt to reinforce the premise of the exchange rate going on and on.. An idea that Caputo himself reaffirmed this Monday during a meeting with executives of insurance companies, in which he again ruled out a devaluation jump and said that he aims for the gap to close from top to bottom, that is, for the parallel dollars to converge to the value of the official one. In the last few days, The operators detected an active intervention of the BCRA on the MEP and CCL dollar with sale of reserves to bridge the gap.

Meanwhile, in the City, there are divided forecasts regarding the future of the exchange rate, between those who believe that the Government will maintain its roadmap and those who predict a devaluation with the lifting of the currency controls during the summer.

On the other hand, the inclusion of a short LECAP, with a duration of less than two and a half months, could imply a window for banks (heavily loaded with long-term securities) to also renew their holdings for shorter periods.

“Both dollar linked bonds that are offered have due in March and June 2025. This supports the view that gained strength in recent weeks that there would be no exchange rate unification until after the midterm elections. If so, the Government would be betting on the disinflationary process observed in recent months, which would favor the demand for fixed-rate instruments above CER. In this sense, Finance would also seek to extend the duration of the LECAP curve, through two new alternatives that exceed the last current maturity (June 18, 2025),” he analyzed. Personal Investment Portfolio (PPI) in a report for their clients.

image.png

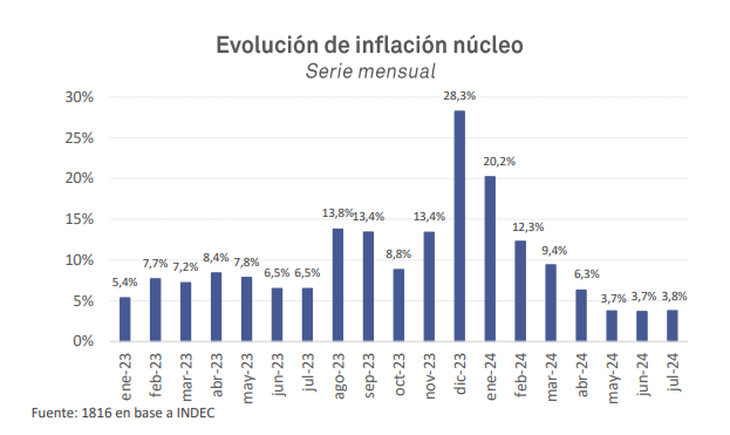

For his part, Franco considered: “The Government continues to stretch the duration of the LECAP, in a context in which inflation expectations continued to decline according to the latest REM (Market Expectations Survey) of the BCRA. Nevertheless, it should be noted that the high-frequency data for the first three weeks of August show that Disinflation is losing strength and that even the core could have accelerated marginally, although we are waiting for the official data.”

Along these lines, an operator consulted by Ámbito highlighted that in recent weeks inflation-indexed bonds found a floor and The long end of the CER curve experienced a rebound relatively important. The trader, who preferred to remain “off the record”, pointed out that this movement could be linked to the growing idea that the cepo has a “long life” and to the stagnation of the core CPI itself, which in July was 3.8% after having remained at 3.7% during May and June. Although This Tuesday there was a lot of demand for the longer fixed rate bills available on the secondary market.

image.png

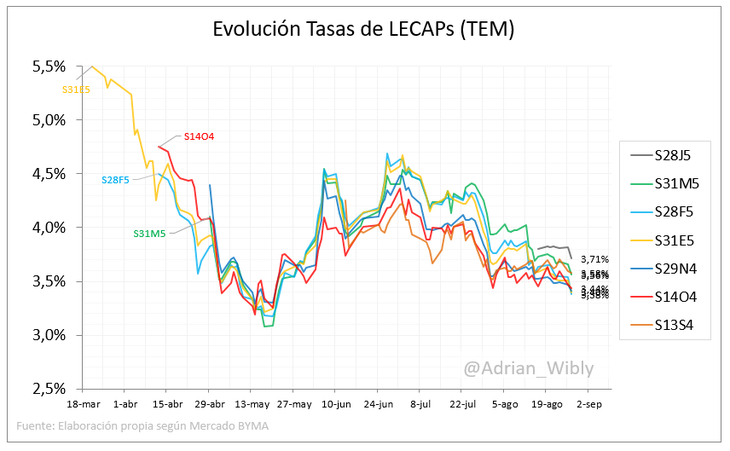

LECAPs, without a minimum rate

The chief economist of Grupo SBS told this media that “The novelty this time is that they do not announce a minimum TEM (monthly effective rate) for the LECAPssomething that did happen in the previous auction, in which they reduced the minimum TEM compared to previous occasions.” In the first auction in August, Finance had set a minimum effective monthly rate of 3.95% for a LECAP as of June 18, 2025, below the 4.5% it had set as the minimum yield in the previous placement for a LECAP as of March of next year.

“By not offering a minimum rate on this occasion, the result will serve as a thermometer for market expectations,” PPI said. What can be expected for rates then? According to the firm, the TEM of the new LECAP on June 30 should not stray far from the level it has in the secondary market the bill that matures on June 18just a few days before. Yesterday, it closed just above 3.7% TEM.

Precisely this Tuesday, after the Treasury’s call for tenders, that bill had many buyers. “A high demand for secondary education was observed in the longest LECAPswith S18J5 and S31M5 rising 1.1% and 0.8% respectively, with a market validating increasingly lower medium-term rates in line with a downward inflationary expectation, which can give us a proxy that there may be demand to lock in long-term fixed rates” at the auction this Wednesday, he told Ámbito Damian Palaisfrom Cocos Capital. An investor hypothesis that is in line with Caputo’s idea of continuing the currency exchange rate.

image.png

Palais added that, From the Government’s point of view, the best scenario would be to first concentrate placements in the LECAP by August 2025 “First, because it would allow it to extend the duration of its liabilities and second, because, of the months that are being tendered, it is the one with the fewest maturities.” That month, for now, debt payments total $1.6 trillion have been accumulated, while in November 2024, $7.1 trillion will expire; in February 2025, $10.9 trillion; and in June 2025, $9.6 trillion.

From the market perspective, Nicolas Rivasfrom BAVSA, considered that The appetite will surely “be concentrated on the long LECAPs”in dialogue with this medium. While Nicholas Cappellafrom IEB, agreed that “the bulk of the flow” will go to fixed-rate bills in June and August. He added that “in the CER curve there may be demand for TZXD6”, although “we have to see if the Treasury decides to validate positive real rates until 2026 or prioritize the LECAPs”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.