Embarking on his attempt to break the resistance of the inflation down, the Government swears that it is not urgent to speed up the recovery of the Central Bank’s coffers or to regain access to international markets. And it assures that it will be able to face the very large external debt maturities next year without refinancing them. But In the city this does not clear up the uncertainty.

The main market players continue to keep an eye on the dynamics and prospects of the Reservations. An increase in the deficit of the BCRA’s net international holdings is foreseen in the coming months and consider that the Target agreed with the International Monetary Fund (IMF) for the third quarter was at risk.

The week that passed was a calm one for the parallel dollars. But the analysts who advise the big firms scrutinize the official strategy, evaluate the variables that will have an impact in the last part of the year and make their calculations. consultant 1816who has a lot of influence on the tables of the City, estimated that Net reserves today are negative at US$5.25 billion (net of BOPREAL payments for the next twelve months), a level at which they have stabilized since one month. Is that negative balance on track to double?

Based on the expected flows, 1816 considered that it is not expected that net reserves will be recovered between now and January, when the next maturity of capital and interest on foreign currency bonds is scheduled for a total of US$4,367 million. In fact, the pressures are downwards. On the one hand, between now and then, there will be payments of government bonds and to the IMF (net of disbursements) for US$1.1 billionthe consultancy firm calculated in its latest report for its clients. On the other hand, in the same period, the official exchange market “should be moderately in deficit” due to the balance of import payments and the seasonality of export settlements.

image.png

As for the demand from importers, there will be something that Ámbito has already anticipated: between September and Novemberthere will be an overlap of the new import payment scheme in two installments with the old four-installment schedule, which will result in the demand for the equivalent to almost an extra month of accrued importsAnd it remains to be seen how much more will be added due to the deferral of operations in August while awaiting the reduction of the PAIS tax that began to apply this month.

A report from BAVSA He noted these factors: “The BCRA began September by buying US$144 million in the MULC (the official market), driven by a solid settlement of agricultural products at US$80 million per day. However, reserves will be under pressure this month due to higher import payments due to changes in payment terms from 120 days to 30-60 days. The reduction of the PAIS Tax will affect reservations from Octobersince September imports will be paid later.”

Due to this set of factors, 1816 warned that “net reserves could go to the zone of US$-10,000 million in the second week of next year” (the Bonares and Globales expire on January 9), practically double the current redin the event that there is no external financing for the payment of these maturities.

Regarding the latter, in recent days Bull Market Brokersthe family stockbroking company Ramiro Marraagain mentioned versions about the arrival of foreign currency from abroad. In this case, He spoke of a Repo-type loan from international banks for US$4,000 million or US$4,500 million. to cover the next capital maturities with the bondholders. Luis Caputo has already spoken of the intention to arrange a financing of this type, although there is no official clarification on the matter.

Anyway, Marra (presidential advisor and Buenos Aires legislator for La Libertad Avanza) He was quick to clarify that the opinions expressed in the Bull Market reports “They are purely analysis and speculation from different independent analysts who have no relationship with the economic team of Javier Milei’s government.”

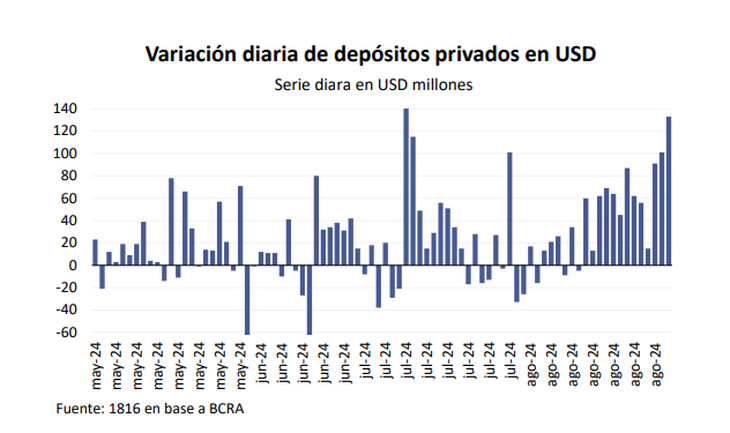

Reservations and money laundering

The Government meanwhile is looking for a currency bridge in money laundering, which has already begun to show a relevant impact on the so-called argendólares. A report from the Economic Studies Department of the Provincial Bank He stressed that between August 15 (the day of the regulation of the asset regularization regime) and September 4 Private dollar deposits rose by US$1.05 billion from US$18.7 billion to US$19.75 billion. However, due to other minimum cash operations, this increase has not even had an impact on gross reserves, which fell by US$70 million in the same period, the report noted.

image.png

However, it is to be expected that in the short term it will help to shore up the gross holdings of the BCRA via reserve requirements. But will not help reverse the red in net reserves. “As the fine alone contributes to net reserves and the CERAs are so attractive (the same economic team insists that the regularization of assets does not have a fiscal objective), even a successful money laundering could contribute little to the net stock of the BCRA,” said 1816.

If the whitewashing ended with a important acceptancewould give him some oxygen on the side of the gross reserves (due to the availability of foreign currency from the reserves), but we have to see how far the rope of the keep-go-go can be stretched in terms of exchange. By 1816, this “would give Greater flexibility for the Central Bank to move towards more negative net reserves if the economic policy objectives demand it, although it is imaginable that There is a level of net reserves below which the market (and/or the local holder of argendólares) would be uncomfortable and “an unstable dynamic could be unleashed”. That number is impossible to know in advance, he clarified in his report.

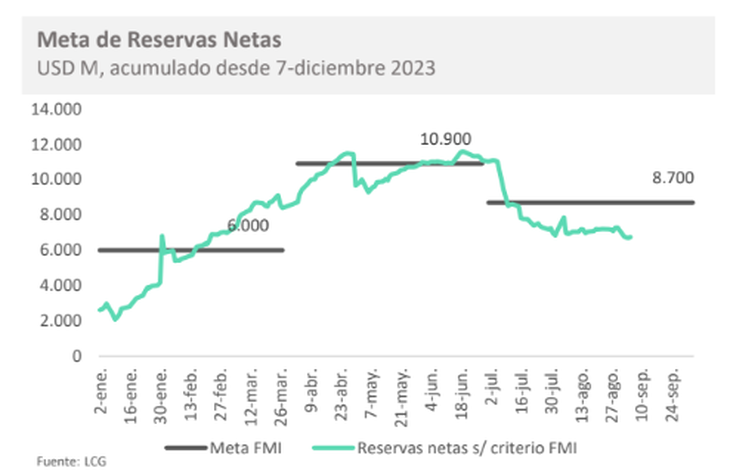

Reserves: a goal at risk

In this context, it seems to have entered into jeopardizes compliance with the reserve accumulation target agreed with the IMF, which audits the Argentine economy on a quarterly basis since Mauricio Macri took out the US$45 billion loan. The next post will be the numbers from the end of September and “The Central Bank would not be achieving the accumulation objective for now of Net Reserves for the third quarter,” the report highlighted Bapro.

image.png

A report by LCG He also highlighted the pattern of accumulation of US$8.7 billion of net reserves between December 10 and September 30 today “it seems difficult to fulfill”. According to the consultancy’s estimates, the BCRA has so far accumulated US$6.7 billion using the IMF methodology, so It would need to add around US$2 billion by the end of the month in an adverse context.

According to calculations by economists at Banco Provincia, more than US$4.6 billion in net reserves have been lost in the third quarter, due to debt payments and other factors. Thus, it was estimated that US$2.2 billion would need to be added to reach the goal.

One of the symptoms of a strategy that ignores the accumulation of reserves as a priority objective and stretches the opening of the exchange rate is evident in the country risk stagnation around 1,500 basis points. On Friday it closed at 1,483 units, while Luis Caputo now insists that he does not consider it urgent to lower it.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.