Over the past 50 years, the financial deficit accumulated was equivalent to a Gross Domestic Product (GDP)of production, according to an analysis of the IERAL (Mediterranean Foundation) prepared by its vice president, the economist Marcelo Capello. This red is due to the high inflation rate, which was in average of 192% per yearwith hyperinflation in between, and the weight of the public debt. In addition to the increase in the imbalance in the State accounts, there is also the fact that export development has not been promoted, which is why in that period there was also a low growth with per capita production increasing by only 0.7% per year.

However, for the first time in 15 years, the National Public Sector (NPS) showed fiscal surpluswith an improvement in the financial result of 5.6 points of GDP in one year. This is the “most important since 1960” and is explained by the “reduction of fiscal expenditure”according to the study. Meanwhile, the second largest improvement in the fiscal result was the Austral Plan in 1985when the accounts improved by 4.6 points of GDP that year, although this was thanks to the liquefaction of income, since expenditures increased in terms of the Product.

Changes in financial results.jpg

Despite this, Capello stressed that currently although “It cannot be said with complete certainty that this time high levels of competitiveness and consequent export-oriented industrial development will be achieved”although there are still some doubts about the exchange rate policy and the recovery of the BCRA reserves, a notable progress can be observed regarding the situation of the public accounts.”

In the last 62 years, between 1961 and 2022, there was only a fiscal surplus in 9 years: in 1991 with Plan Austral; in 1992 and 1993 with the reform of the State and the privatizations of Convertibility of Carlos Menem and Sunday Cavallo; and between 2002 and 2008, by liquefaction and non-payment of interest on the debt during the mandates of Eduardo Duhalde, Nestor Kirchner and the first period of Cristina Fernandez. The other years, the numbers were in the red, according to a report by the Argentine Institute of Fiscal Analysis (Iaraf).

Public spending: the chainsaw, the key

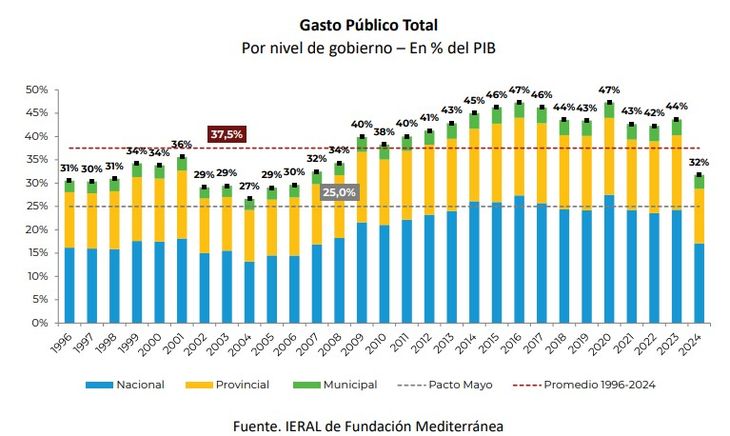

Within the study, Capello highlights that The key to fiscal adjustment in 2024 lies in cutting public spendingat all levels of government. “If the rest of 2024 expenditures are executed as in the first months of the year, consolidated spending could fall to 32% of GDP,” he emphasizes and clarifies that consolidated public spending, at the three levels of government, went from 27% of GDP in 2004 to 47% in 2016, although between that year and 2022 it was cut by about 5 points. “Thus, in one year, the increase in expenditure observed between 2004 and 2023 will have been reduced by 70%”the report summarizes.

The fiscal adjustment so far in 2024 occurred mainly due to the liquefaction of spending on salaries, pensions and transfers to provinces and companiesin addition to the sharp drop in public investment, to eliminate in one year a financial deficit of nearly 6% of GDPaccording to Capello.

He added that this measure was “inevitable”in his opinion, since between 2004 and 2023, “Three quarters of the increase in spending by the Nation plus Provinces is due to spending on Personnel (+3.4% of GDP), Retirements and Pensions (+2.9%) and Subsidies on tariffs (2.1%)”.

The adjustment in the provinces and municipalities

In addition to the fiscal adjustment at the national level, cuts are also observed in local governments. Provincial revenues fell by 17% in real terms in the first quarter of the year, their expenditures by 24%, with a 55% reduction in capital expenditure and 21% in personnel expenditure. Of the 24 provinces, only two show a “small financial deficit”, which are Misiones and Entre Ríos. In this way, “the total reduction in the weight of expenditure in GDP, so far in 2024, is explained by 61% adjustment in national expenditure, 36% by adjustments in provincial expenditure and 3% in municipalities, similar to the shares that these levels of government had in GDP in previous years,” says Capello.

public spending.jpg

“Once fiscal balance has been achieved, the important thing is not to lose it, guaranteeing a zero deficit going forward, so that any proposal for increased spending must be accompanied by the source of resources to finance it.“as required by the Financial Administration Act (with less spending on other items, tax increases or eliminating some tax exemptions)”, Capello stressed.

“It is time for Argentina to have a fiscal rule to ensure long-term state balance and solvency, which prevents unsustainable debt or the generation of strong inflationary processes. In the meantime, We must work to improve the quality of the adjustment, with less liquefaction and more state reform, eliminating highly distorting taxes. Now that balance has been achieved, it is the right time to agree on a zero-deficit fiscal rule as a state policy, which should be adopted by the main political forces,” concluded the vice president of the Fundación Mediterránea.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.