The Federal Reserve (Fed) cut the rate by 50 basis points last Wednesday for the first time since March 2020. This could have a positive effect on emerging markets, as the global dollar tends to weaken and commodity prices are sustained. This leads investors to seek better returns elsewhere, where China and Brazil appear to be big bets for investing through Cedears.

The relationship between the US interest rate cut and its impact on the emerging markets It is a phenomenon that affects different economic variables. Among them, the following stand out: the rotation of capital flows, the appreciation of emerging currencies and the risks inherent to these economieswhich are especially vulnerable to volatility caused by large capital movements.

The variable income Emerging market investors arrived at the Fed meeting as follows. Shares in these economies recovered after showing Strong volatility in early August and up more than 7% so far this yearDeveloped markets, however, boast a yield of 13%.

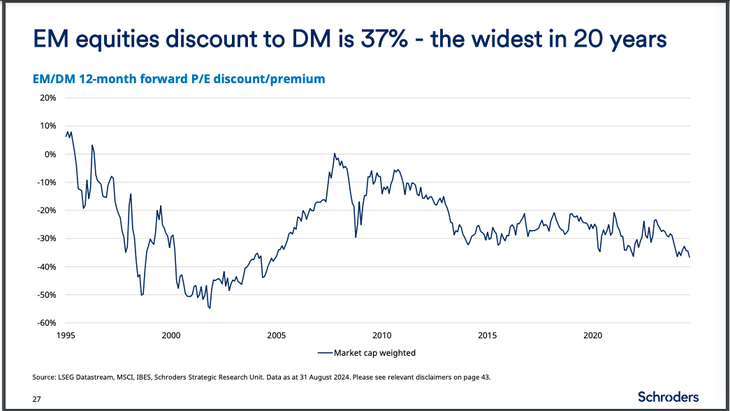

A report from the consulting firm Schroders analyzes that of the set of emerging economies, Latin America emerges as the weakest region. “Fears of US growth and the dismantling of the (global) carry trade aggravate domestic policy concerns in Latin America,” it says. But the document is conclusive: “Main valuations of emerging markets are reasonable and most of them are cheap compared to its own history, as larger markets skew aggregate valuations.”

What he is referring to is that Large economies within emerging markets (such as China or India) They have higher valuations and, when weighted in the indices, make the overall average appear more expensive than it actually is in most smaller emerging markets.

Emerging markets under the microscope of analysts

This week, Michael Burrythe renowned investor famous for having anticipated the 2008 mortgage crisis, who is a specialist in finding investment opportunities against market trends, increased his exposure to the Asian giant and bet heavily on Alibaba (BABA) and JD.com (JD). Chinese companies now account for 45% of its entire portfolio. These companies are listed on the Buenos Aires exchange through Cedears.

In that context, Juan Pablo Iacarusoequity analyst at SBS Groupanalyzes in dialogue with Scope that within emerging markets there are opportunities within Brazil and China. For the strategist, the rate hike in Brazil that was activated this week may improve the outlook within the financial sector of that country. “There we prefer Nubank (NU) whose low-cost and digitalization strategy gains ground against traditional banks”.

Emerging.png

Lacaruso indicates, on the other hand, that in China, although a slow recovery of the economy is estimated, companies such as BABA, which is a leader in the development of artificial intelligence and owner of one of the most complete cloud networks in the region, or JD.com which aims to be the main online retailer in the Asian country.are at attractive prices”.

However, the analyst is clear in warning that the bet on China entails not only macroeconomic risksbut also the result of the elections in the USA “which may be accompanied by protectionist measures such as the possibility of increased restrictions on access to chips from the Asian country.” Without a doubt, a “driver” to take into account.

Cedears: China makes things complicated, but other emerging markets have potential

Along the same lines, it is expressed Pablo RepettoHead of Research at Aurum Valueswho -in dialogue with this medium- assures that he does not see China having a very promising future performance. He indicates that this is due to the fact that the activity in that country “It’s complicated”. Europe, which could be a market that would help Chinese companies, is in the midst of a recession. Therefore, Repetto believes that high-risk investments should be taken with caution.

However, he notes that “other emerging markets, especially those that are net exporters of raw materials, could perform better than China.” This is because the Fed’s rate cut could weaken the dollar and encourage higher commodity prices. In this context, he mentions his preference by Cedears of indices such as EEM (emerging markets) and EWZ (Brazil). “Investing in more specific Cedears requires a detailed analysis of the investor’s profile and time horizon,” he concludes.

Emerging Markets.png

Finally, Ayelen Romeroanalyst at Stock Market Ravarecalls that on Thursday, after the Fed cut rates, both Wall Street and the various stock markets around the world reacted positively. In this context, he comments that the Chinese stock market was no exception. And he suggests that, although the Chinese stock market had been on a downward trend since the beginning of 2021 and reached minimum values in its quotes in February of this year, “with the adjustment in the macroeconomic numbers and the reduction in the US interest rate, China is beginning to be an opportunity”.

Romero, meanwhile, likes it the most representative ETF of the eastern country. It is about the FXI, which can be operated from Wall Street. “This instrument marks a growth of more than 13% this year 2024, but, beyond that, the expectation is great if it exceeds the price of US$27.30, since it could change the main trend and become very attractive for investors, concludes the strategist.

This new scenario, where the Fed set the pace with the first rate cut since 2020, could bring opportunities in the markets. The combination of a weak dollar, sustained commodity prices and attractive equity valuations in regions such as China and Brazil will be the driving force in the search for attractive yields going forward, at least while the cycle of interest rate reduction lasts worldwide.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.