Following the latest data from inflation which exceeded market expectations (4.2%), which was more inclined to 3.9%, investors went in search of a greater dollarization of their portfolios in response to the strength of the local currency. In this context, the traditional fixed termwith an average monthly yield of 3.3%, is being eroded by price dynamics. Meanwhile, the Bopreales They are a tempting option, since rates of around 16% per year are paid in dollars, providing greater stability and profitability in the medium term.

It is essential to remember that higher returns entail higher risks. However, it cannot be ignored that today fixed-term deposits offer a negative real return compared to inflation that is around 4% per month. In contrast, Bopreales provide protection against price increases and offer attractive yields, analysts say.

Experts recommend this instrument for portfolios with “very aggressive” profiles. This is because the Central Bank faces a shortage of reserves, without sufficient dollars, and must face payments of maturities and amortizations in foreign currency, which complicates the situation, according to the City. This context explains the performance in dollars of the Bopreales, which are ideal for investors with a medium-term horizon, with one of the best strategies being to link capital to the dollar.

Bopreales: under the magnifying glass of analysts

Thus, the Bopreales They become the “favorite” instruments for moderate profile investors who avoid the rate in pesos and seek returns in dollars.

As the financial analyst recalls Leandro Monnittola, in dialogue with Scopethese bonds were issued at the beginning of the management of Javier Milei with the aim of compensating importers for the dollars that the BCRA had not delivered to them in previous years. Bopreales can be traded in both pesos and dollars, and each bond has specific characteristics, with maturities in 2025, 2026 and 2027.

What is the reason for the great interest in Bopreales? According to Monnittolathis debt was issued and matures within the current term, suggesting that the Government will give priority to paying off its own debt. For this reason, these bonds present a lower risk of refinancing:

- They were issued by the BCRA, which would have a more solid capacity to face debt.

- They are of much shorter duration than sovereigns.

The one that became the most sought after by the investor and in which Monnittola puts the most emphasis on taking a position, is the BPY26It is trading at an IRR of around 16%, pays 3% annual interest and begins to amortize the capital in the last three quarters of the bond, starting in November 2025.

Bopreales.jpeg

Bopreales. Source: Cohen.

Along the same lines, it is expressed Leo Anzalonedirector of the Center for Political and Economic Studies (CEPEC), who expresses in dialogue with this medium that the Bopreales offer a great return in hard currency, which makes them ideal for those investors with greater risk aversion.

“Not only is it a solid protection against inflation and devaluation, but it also offers very tempting interest rates in dollars,” compared to traditional fixed-term deposits in pesos, which currently pay around 3.3% per month. But he insists that it is for aggressive investors.

“He fixed termwith an average yield of 3.3% per month, is eroded by inflation, while Bopreales, such as the BPY26, which is our favorite, pay rates around 15/16% per year in dollarsproviding greater stability and profitability in the medium term,” says Anzalone.

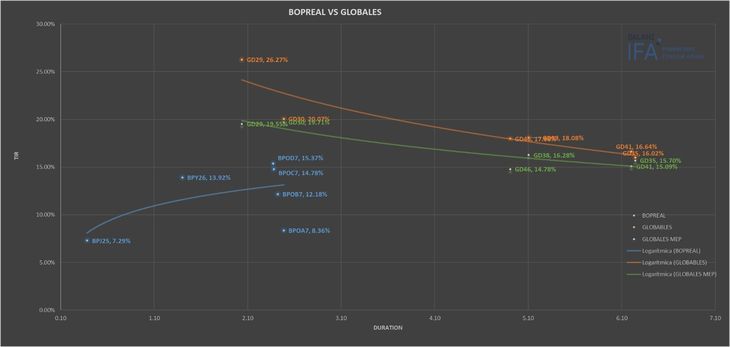

Bopreales vs Sovereigns.jpeg

Bopreales vs. Sovereigns. Source: Balanz.

The money laundering effect and the DNU on debt swap

“The whitewashing effect and a lower exposure to the risk implied by sovereign debt, resulted in the Bopreales curve accelerating the compression of rates in the last month and a half,” says Monnittola.. And he adds that the BPY26 It cut its yield from 25% to 14%, recording a gain of approximately 15% in dollars during this period.

“The BPJ25, the shortest and with a 2% IRR,” is recommended by the analyst for those conservative profiles that prioritize short-term dollarization. Meanwhile, “Series 1 with maturity in 2027 currently yields a 15% IRR, ideal for those who want to take more risk. However, we do not find it attractive to position oneself in this asset and not in the BPY26 with a shorter maturity and the same IRR.“, says the strategist.

The analyst warns that he expects the compression of rates to continue in the short term, in the same way that happened with corporate and sovereign bonds (although these lagged behind), due to the money laundering effect in particular. This happens because the money laundering regime The demand for some instruments skyrocketedwhich led to the compression of its rates, compromising the performance in dollars.

With an eye on the medium term and a possible dismantling of the cepo if macroeconomic stabilization is consolidated, Monnittola The demand for the sovereign bond curve is expected to increase. Meanwhile, Bopreales, such as the BPY26, emerge as the most attractive option for those seeking to move away from the peso rate, positioning themselves as a strategic bet at this crucial moment of transformation.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.