In the first eight months of the year, the Government has achieved significant savings of around 1.5% of the Gross Domestic Product (GDP) for the primary result, and 0.4% of the GDP for the financial result. trust sustain and even enlarge this surplus to eradicate structural inflation.

Forwards, the center of the program remains a good execution of fiscal adjustmentsomething that is clearly challenging, where politics takes greater prominence ahead of the 2025 election, and with growing doubts about support for its implementation by Congress.

At this stage, to ensure the inflationary objective, the economic team also makes use of the “exchange anchor”where the stability and even real appreciation of the exchange rate contribute to supporting price increases downwards.

The flip side of this policy is an increase in uncertainty in the markets regarding the ability of the Central Bank (BCRA) to accumulate reservesand the impact that this context of exchange controls, fiscal and monetary austerity generates on the economic recovery cycle.

This is why Investors are wondering when the Government will eliminate exchange controls or “stocks”an almost exclusive condition to attract investments and to give rise to a virtuous cycle of long-term growth.

The Weight Race until the third trimester

With a new quarter closed, we resume our usual exercise of Weight Race; an evaluation of the performance of the different public fixed income assets, as a starting point to identify which are today the best investment alternatives to protect the value of portfolios in pesos and take advantage of opportunities.

As can be seen in the following table, the sovereign bonds in dollarsmeasured in pesos, continue to win the weight race so far in 2024, performing close to 100% in these nine months, followed very far by long-term bonds that adjust by CER.

These last titles, which adjust capital due to price variations, present to date a performance of between 48% and 64%well below the inflation of the period captured by the CER coefficient.

Return by type of asset, in PESOS, according to period

Returns in pesos 1.JPG

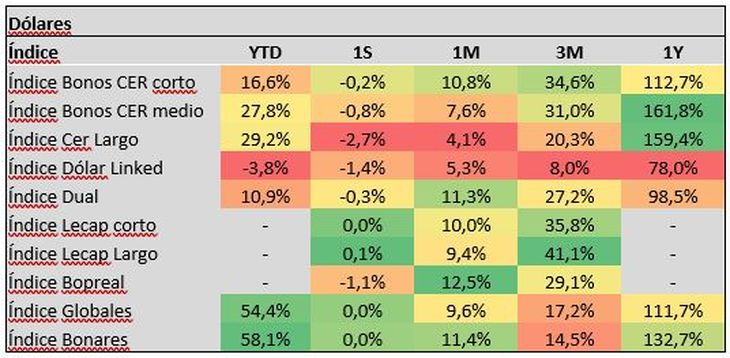

Return by asset type, in USD, by period

RETURNS IN DOLLARS.JPG

Although measured in pesos, all market instruments have lost in the face of inflation greater than 150% in 2024, the vast majority of the Argentine fixed income spectrum has generated interesting returns in dollars, considering that the variation of the MEP has been only 27% this year.

Supported by a recovery of their original value in dollars, sovereign bonds Bonares and Global They have shown notable performance in hard currency, with returns that so far exceed 50% in dollars.

The other participants of the Weight Race, Duals and dollar Linked They have had a much more modest return, given the lower expectations of future devaluation and the lower need for coverage that this implies.

The new player is consolidated in the Weight Race: the LECAPS

A little more than three months ago, a new instrument in the weight race: the Lecaps. His debut has been very outstanding, winning the return race of the period.

In the attempt to rebuild the Central Bank’s balance sheet, the Government has offered new Capitalizable Treasury Billswith strong rate incentives to attract bank participation. In recent months, these bills have gained notoriety and a complete and deep fixed rate yield curve in pesos has been formed.. Today they yield between 3.5% and 4% monthlywhich, although they are below the inflation levels of recent months, become a superior alternative to other comparable instruments such as the fixed term or surety.

What to invest in in the last quarter of 2024

To the extent that the scenario of inflation convergence towards the peso depreciation rate is consolidated, We continue to see value in weighting Lecaps over the CER curve in portfolios. The market is expressing in its quotes an inflation that will average 3.2% monthly over a horizon of up to one year. We believe that the process of lowering inflation will allow us to obtain records below market expectations and the REM survey.

In our vision, the yields of the Lecaps look attractive, assuming as a base scenario that the Government’s disinflation proposal will continue to be non-negotiable, maintaining the “exchange anchor” and incorporating a “stock” scenario for a longer time.

In any case, to protect the portfolio from an unwanted event of exit from the stocks with an exchange/inflation jump, we incorporate coverage with selective positions in the CER 2027 and 2028 section with real interest rates higher than 10% annually.

In dollars: long tranche of sovereign debt

Given the firm conviction of the Executive Branch management in maintaining fiscal discipline, ratified in Congress, along with an express commitment to honor the debt, We continue to identify value in Global bondshighlighting its favorable risk-return relationship.

When analyzing sovereign debt under different assumptions and scenarios, we continue to see opportunities in the longest part of the curve “hard dollar” law New York. Global 2035 (GD35) and Global 2041 (GD41) They are presented as the most attractive options, both in a scenario of normalization of the sovereign curve, and in the most adverse scenario, where lower parity and legal protection (GD41), act as buffers against the fall.

Conclusions

In this context, Fixed rate Lecaps should be the predominant instrument in the portfolio for those seeking to maximize the return on their working capital or liquidity weights, in a short-term horizon. For longer-term positions, in order to benefit from the improvement in the sovereign’s credit perception, we see opportunities for attractive risk/return ratios in dollar bonds maturing in 2035 and 2041.

Asset Management Director of Criteria

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.